TL;DR: November’s jobs tally showed the anticipated rebound from hurricanes and the Boeing strike, but was otherwise disappointing, with modest underlying job gains, rising unemployment, and falling employment.

Key Data Points:

Unemployment rate: rose from 4.145% to 4.246% (bad)

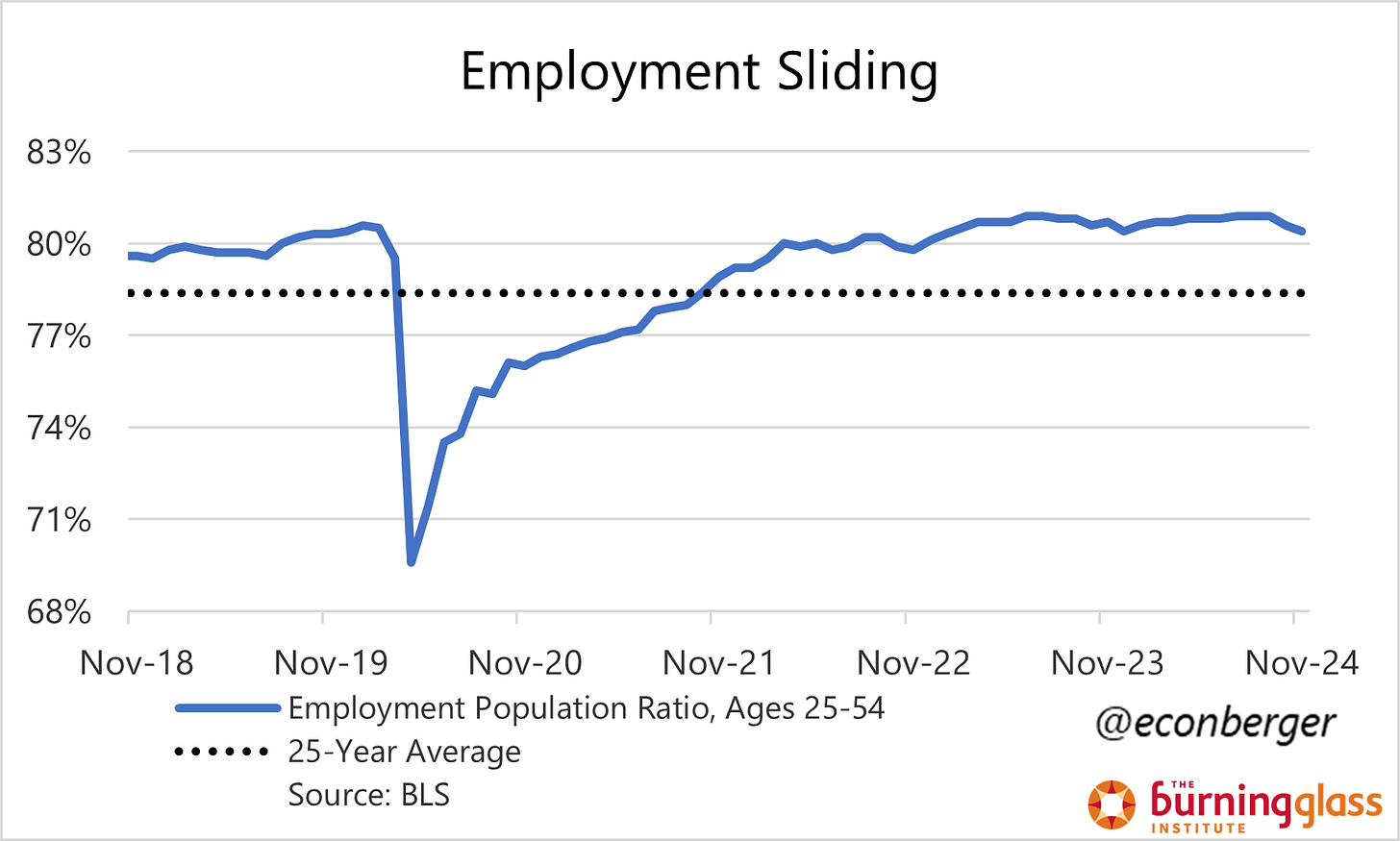

Prime working age employment population ratio: fell to 80.4% (bad)

Nonfarm payroll employment: rose by 227K (good, but less impressive after accounting for a rebound from strikes and hurricanes)

The rest of this recap is split into 2 sections:

The Big Picture

Strong Job Growth: Less Than Meets the Eye

More below chart.

1. The Big Picture

I used a lot of space in my preview for this jobs report talking about how I thought there was potential for labor market reheating, but it certainly didn’t materialize in November’s jobs report. Instead, we’re stuck in the same process of slow, gradual labor market cooling that we’ve experienced over the past 2.5-3 years. I still think a turning point is coming, but probably not until next year.

That cooling process is apparent across a wide range of indicators. You can see it in the unemployment rate (above chart), which has risen by 0.04 percentage points a month over the past year.

You can also see it in the “mix” of unemployment, which is getting worse. Layoffs are very low (as we know from this week’s JOLTS report), but weak hiring means that folks who are unfortunate enough to lose their jobs can’t find new ones - the “permanent layoff” unemployment rate rose to a 3-year high in November. Moreover, the rise in re-entrants probably isn’t a sign of strength - instead, it probably comes from the pool of people who previously lost their jobs and temporarily exited the labor market.

The duration of unemployment is getting longer - unemployment of more than 27 weeks as a share of the labor force is at its highest level since early 2022; unemployment of 15-26 weeks as a share of the labor force is at its highest level since the summer of 2021. This is a lagging indicator, not a leading one, but it nevertheless measures a labor market that’s slowly getting sicker rather than healthier.

And it’s not just unemployment that’s getting worse; employment is getting worse, too. The prime working age employment population ratio fell to 80.4%, its lowest level of the year and a little lower than it was a year ago.

None of this is catastrophic. It’s gradual cooling, and there’s little sign of it accelerating into recession. Moreover, there are good reasons to think that various forces will push the pendulum back into reheating mode next year. But if you were hoping that reheating had already started, it’s a clear disappointment.

2. Strong Job Growth: Less Than Meets the Eye

I was joking with someone that this is the least excited I’ve been about a monthly jobs gain of >200K. How come?

Let’s start with the good news: 227K is a hefty increase, and there were also solid revisions to the 2 prior months (+56K).

But there were several special factors that are unlikely to repeat in future months. The Boeing and Textron strike endings added 38K in jobs this month; without them, we would have added 189K in jobs. There’s also the bounceback from Hurricanes Helene & Milton; this is harder to quantify. But my guess is that the 5-6 month average of employment growth is probably giving us a decent read on the underlying run rate, i.e. 140K-150K. This isn’t bad, but it’s not great.

And there’s more potentially bad news. Data from the Quarterly Census of Employment and Wages indicates substantial downward revisions to employment growth through March 2024 are coming (albeit somewhat smaller than previously believed), and moreover, there’s evidence from the Q2 QCEW data that the overcount continued past March.1 At the very least I would consider the possibility that the 140K-150K run rate mentioned above is an overcount.

Anyway, regardless of whether there’s an ongoing overcount or not - recent employment growth is failing to keep up with labor supply, leading to an increase in the unemployment rate and a fall in prime working age employment. This is not good!

Onward to next month. I hope within 6 months I get to start telling a more upbeat story about labor market health.

The QCEW is extremely noisy on a monthly basis, so I’m hesitant to draw strong conclusions from just one (or even two) quarters of data. There’s a reason the BLS benchmarks the CES on an annual basis! Nevertheless, I think a modest amount of worry is warranted.