TL;DR: The January BLS jobs report was much stronger than expected, with big gains (and upward revisions) to employment. Wage and hours data was probably distorted by bad weather.

Key data points:

Unemployment rate: unchanged at 3.7% (ok)

Prime working age employment population ratio: rose to 80.6% from 80.4% (good)

Nonfarm payroll employment: rose by 353K (GREAT)

Wage growth: 5.1-5.4% annualized over the past 3 months (too high for the Fed, but probably distorted by bad weather)

Below I’ll discuss:

The big picture

Wages and hours

Miscellaneous thoughts

1. The Big Picture

Over the past few months I’ve been ping-ponging between “the job market is stabilizing” and “the job market may still be cooling”. In today’s report, the pendulum swung in a big way back toward “stabilizing”.

Let’s start with the establishment survey. Job gains were tremendous in January, at 353,000. But there were also large upward revisions to prior numbers - 10K per month for all of 2023, and 42K per month for the post-benchmark period.1

Nonfarm payroll employment has been one of the more upbeat data series over recent months - showing either stabilization or a near-stabilization over the 2nd half of 2023 - but there was a loose expectation that this might not survive today’s revision. Not so! If anything, there seems to be a near-term reacceleration.

For what it’s worth, on Wednesday I was surprised at how confident Chair Powell and the FOMC were about the strength of the job market in their statement and press conference. They did not have today’s data in hand, but their confidence has clearly been vindicated (at least for the time being).

The household survey was not quite as impressive as the establishment survey, but on balance healthier than last month. The unemployment rate, for instance, was unchanged at 3.7% and has not increased since August.

We also saw an uptick in the share of prime working age Americans who have a job, from 80.4% to 80.6%. It’s still a little below the peak of 80.9% last summer, which I hope we will exceed again this year.

And despite the flood of stories about layoffs (mostly at tech and media companies), the share of unemployed who have been “permanently laid off” has not budged (yet). It’s higher than it was 15-18 months ago, but stable.

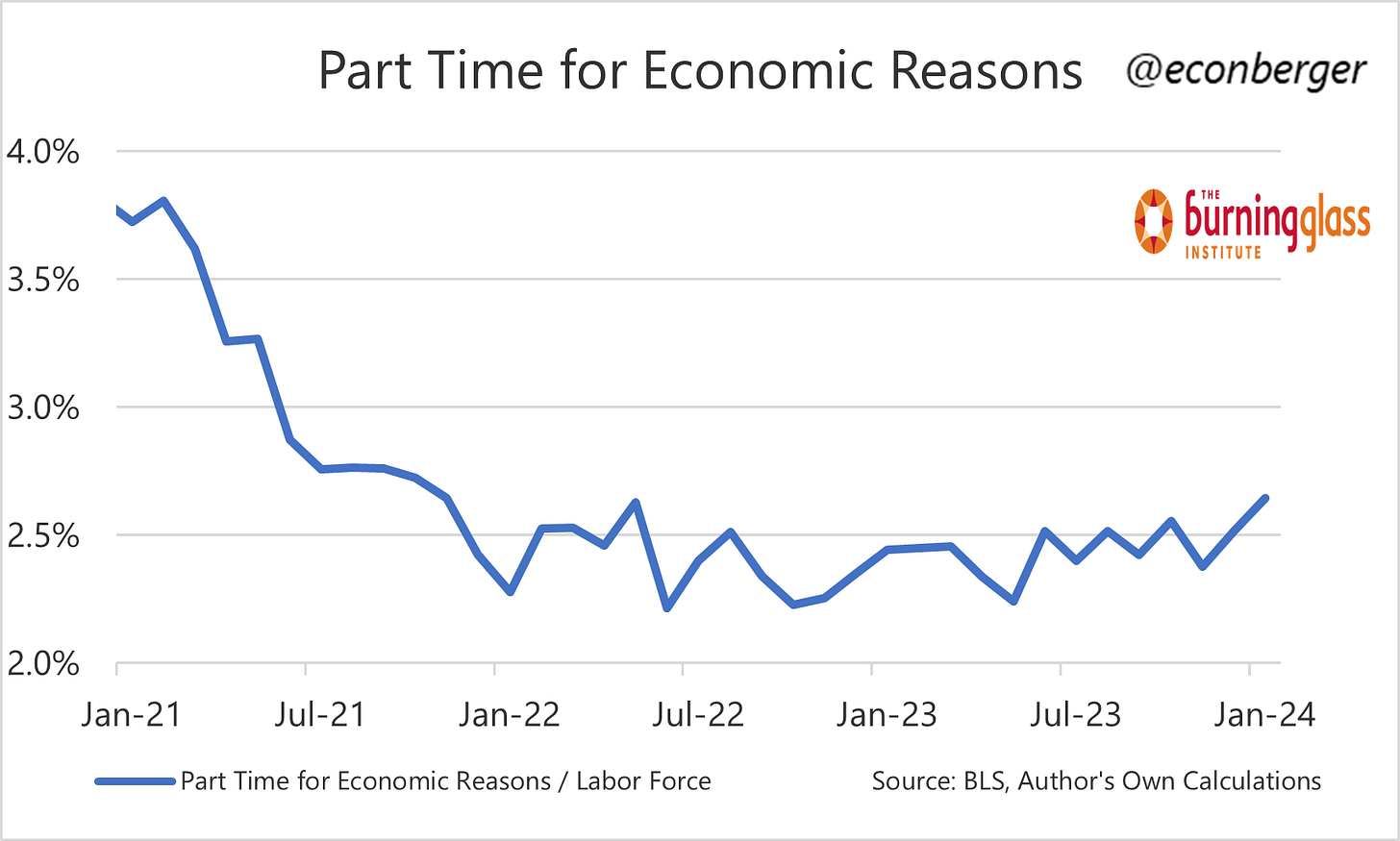

One bit of the report that was clearly on the softer side, and that would normally worry me, was a slight uptick in the share of folks working part-time hours for economic reasons - it rose to its highest level since 2021. But it’s possible that this was downstream of the weather distortion in the data (next section).

So to wrap up: you should update your assessment of the health of the labor market to be more positive on this report (unless you were a total Pangloss/Polyanna, in which case you saw this coming). I think some caution is warranted about extrapolating strength forward, as my “ping-ponging sentiment” comment earlier suggests - maybe we’ll be back to rending our clothes and gnashing our teeth next month. Fortunately, our margin for recessionary error is wider than we thought.

2. Wages and Hours

Mid-January was a period of cold and snowstorms east of the Rockies. West-Coasters and non-Americans may be wondering, doesn’t this happen every year? And the answer, as far as the labor market is concerned, is “no, not every year.”

The number of people who have a job but were totally absent from work spiked in January to well above the historical average for that month.

There was also an elevated number of people who have a full-time job but were only able to work part-time hours.

This probably played at least a partial role in the sharp decline in the average workweek experienced during January:

And that brings us to wages. Some folks get paid hourly, but many others are salaried. When a salaried worker is absent or works less-than-typical hours, their average hourly pay increases. And that may be at least a partial explanation for the spike in wage growth we saw in January.

I don’t want to bet too heavily on this thesis (especially since I also predicted wage growth would moderate this month). But feel free to hold me accountable.

One other comment. Setting aside the causes of recent hot wage growth data. Maybe wage growth is running too hot for sustained 2% PCE inflation. Alternatively, maybe the economy can sustain a faster pace of inflation-adjusted wage growth than it did during the late 2010s due to higher productivity. This is really speculative, but we already know disinflation to 2% happened with “elevated” nominal wage growth. I recommend against strongly-held beliefs regarding what pace of wage growth is inflationary.

3. Miscellaneous Thoughts

i. JOLTS

With today’s report, the most concerning labor market data points become the soft hiring (and to a lesser degree quits) data from the November and December JOLTS report. But the historical JOLTS data will be impacted by the same annual revisions as the establishment survey:

I’m not an expert on the JOLTS annual revision process, but it’s possible that the historical time series could look materially different a month from now.

ii. The “White Collar Recession”

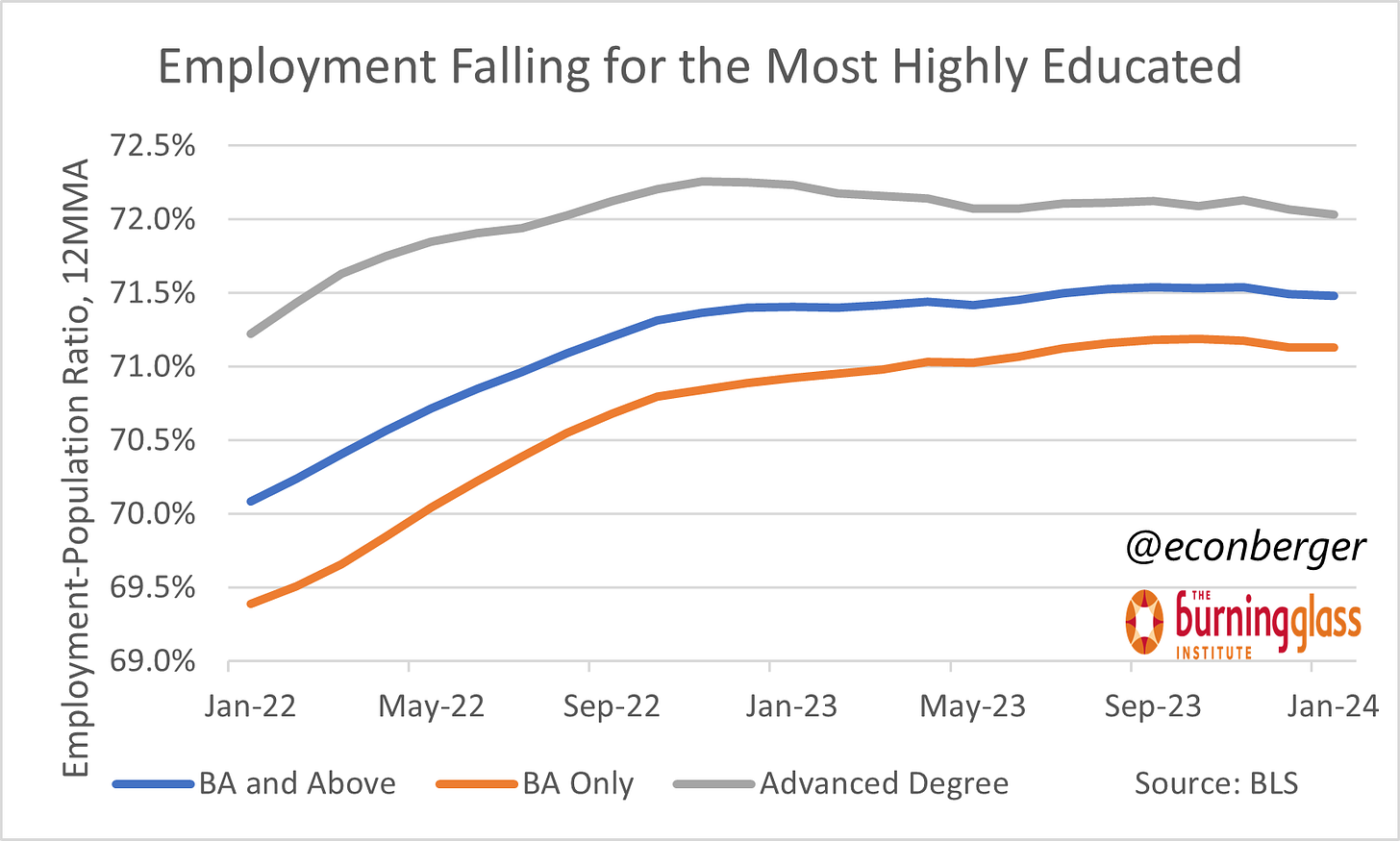

I’ve generally been skeptical of the “white collar recession” narrative - that while the economy and labor market are doing fine overall, white collar workers are experiencing genuinely recessionary conditions.

After reviewing the data on educational attainment, my opposition to this thesis has softened somewhat (though I wouldn’t necessarily say I endorse it). The advantages that the most-highly-educated have relative to other folks in terms of pay and employmetn are narrowing.

What seems to be happening is that folks with only a BA are doing reasonably well. But folks with an advanced degree really are experiencing rising unemployment.

The share of folks with an advanced degree with a job has also fallen over the past 12-18. Data only goes back to the mid-2010s, but the “employment gap” between advanced degrees and “BA only” is the narrowest on record.

And finally, data from the quarterly CPS release on median wages show the pay premium for advanced degrees on top of BAs and high school diplomas narrowing. The premium for a BA relative to a HS diploma is unchanged.

I think it’s interesting to think of a lot of the stories we consume in light of this data. Are higher profile layoff stories more likely to reflect these highly educated professionals and ignore the fact that BA-only folks (not to mention HS-diploma and no-diploma folks) are doing pretty well? What about the Vibecession discourse? Anyway, I’ll be looking at this closely in the months ahead.

The March 2023 level of nonfarm payroll employment experienced a benchmark revision of -266K. But the numbers after March 2023 were revised upward by a lot - by enough, in fact, to more than fully offsetthe benchmark revision.

The advantages that the most-highly-educated have relative to other folks in terms of pay and employment are narrowing. // proxy for consequences of recent ageism culls?

Good post Guy