TL;DR: The January JOLTS data included decent news about the labor market, but this is outdated due to recent policy news which will likely depress hiring going forward.

In this writeup I’ll cover:

The Big Picture

The Data

Revisions to Historical Data

More below chart.

1. The Big Picture

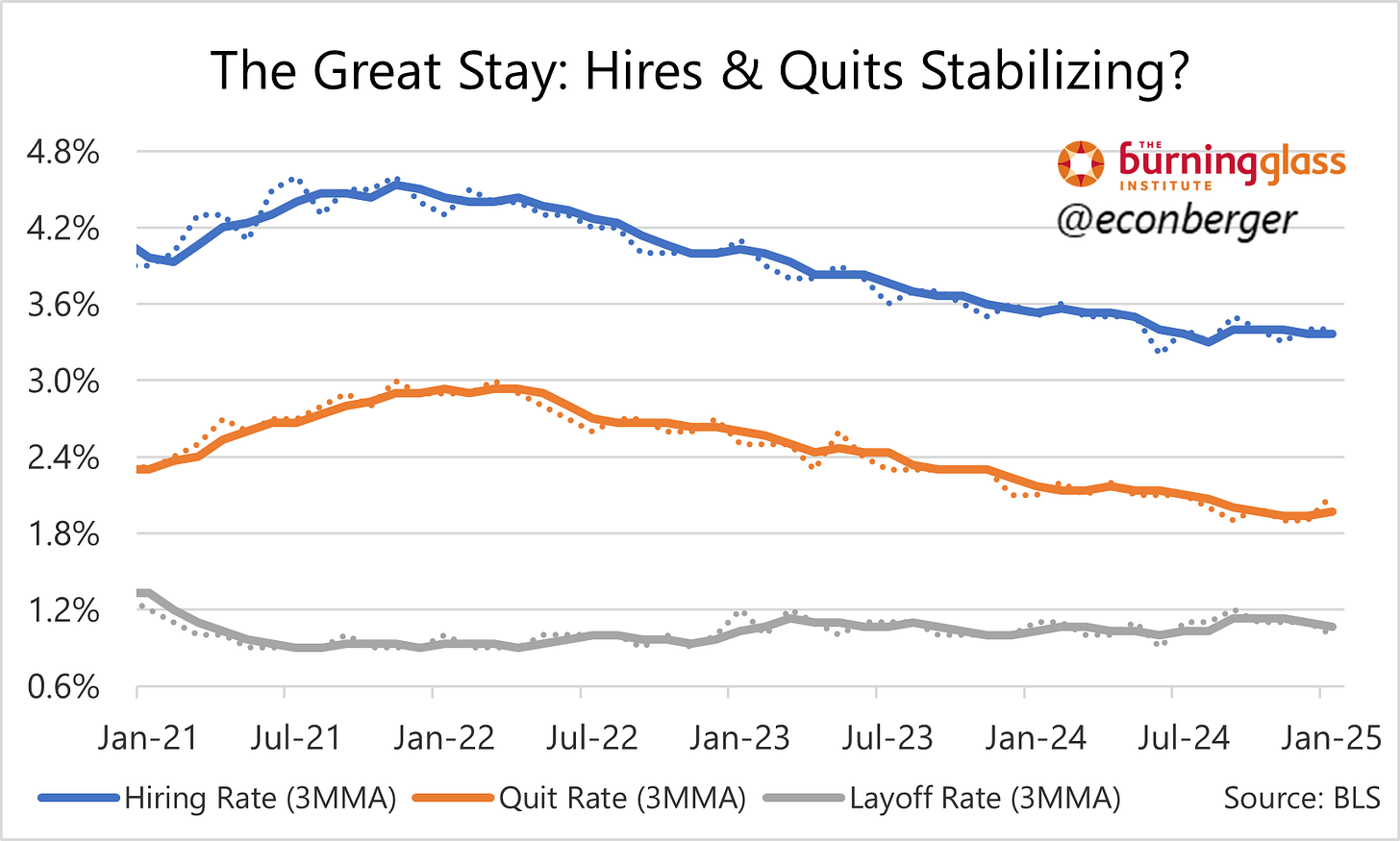

In my recap of the January jobs report, I concluded that the job market was showing strong signs of stabilizing - and this was apparent in the January JOLTS data too.1 Hires have been basically flat since last summer, and quits may have been leveling out too.

However, we know a lot has happened since the end of January and I’m pessimistic about this stabilization holding. We’re probably headed toward lower hiring, and possibly higher layoffs. Employers and hiring managers need to regain confidence about the economic outlook in order to make bets on workforce expansion.

2. The Data

The bad news about hiring is that it’s down, a lot, and is now comparable to where it was in 2013-14 when the unemployment rate was above 7%. It’s a hard time to find a new job. The good news about hiring is it probably stabilized in the 2nd half of 2024, and into January. And the bad news (again) about hiring is that it’s likely headed for further declines, as I discussed in the previous section.

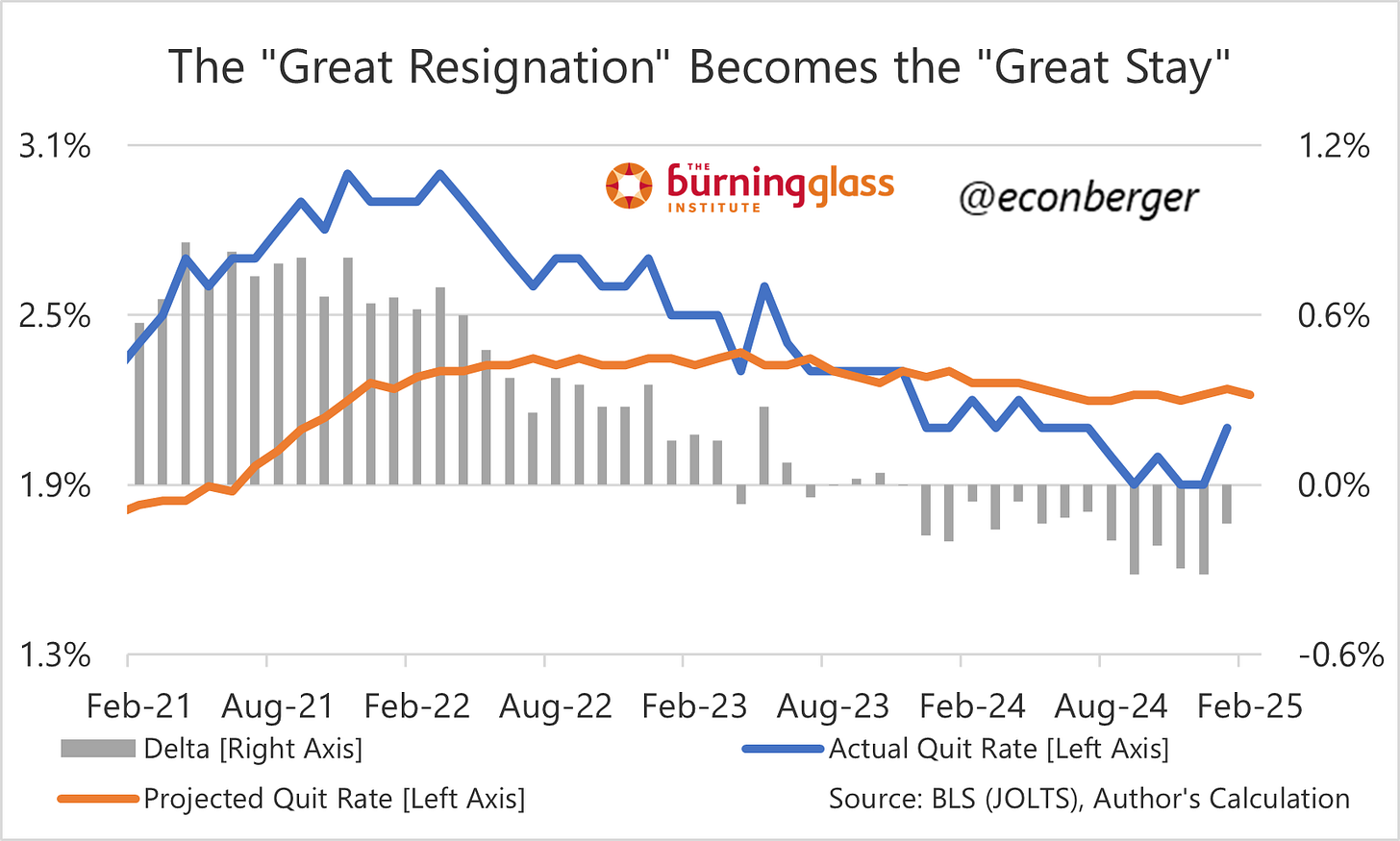

The quits data was the most upbeat we’ve had for some time. At 2.1%, the quits rate is where it was in late 2016 and early 2017, when the unemployment rate was around 4.7%. That’s not so out of whack with its current value; maybe this is noise, or maybe jobseekers had a small surge of optimism about job availability heading into 2025. Either way, I’m skeptical it will last.

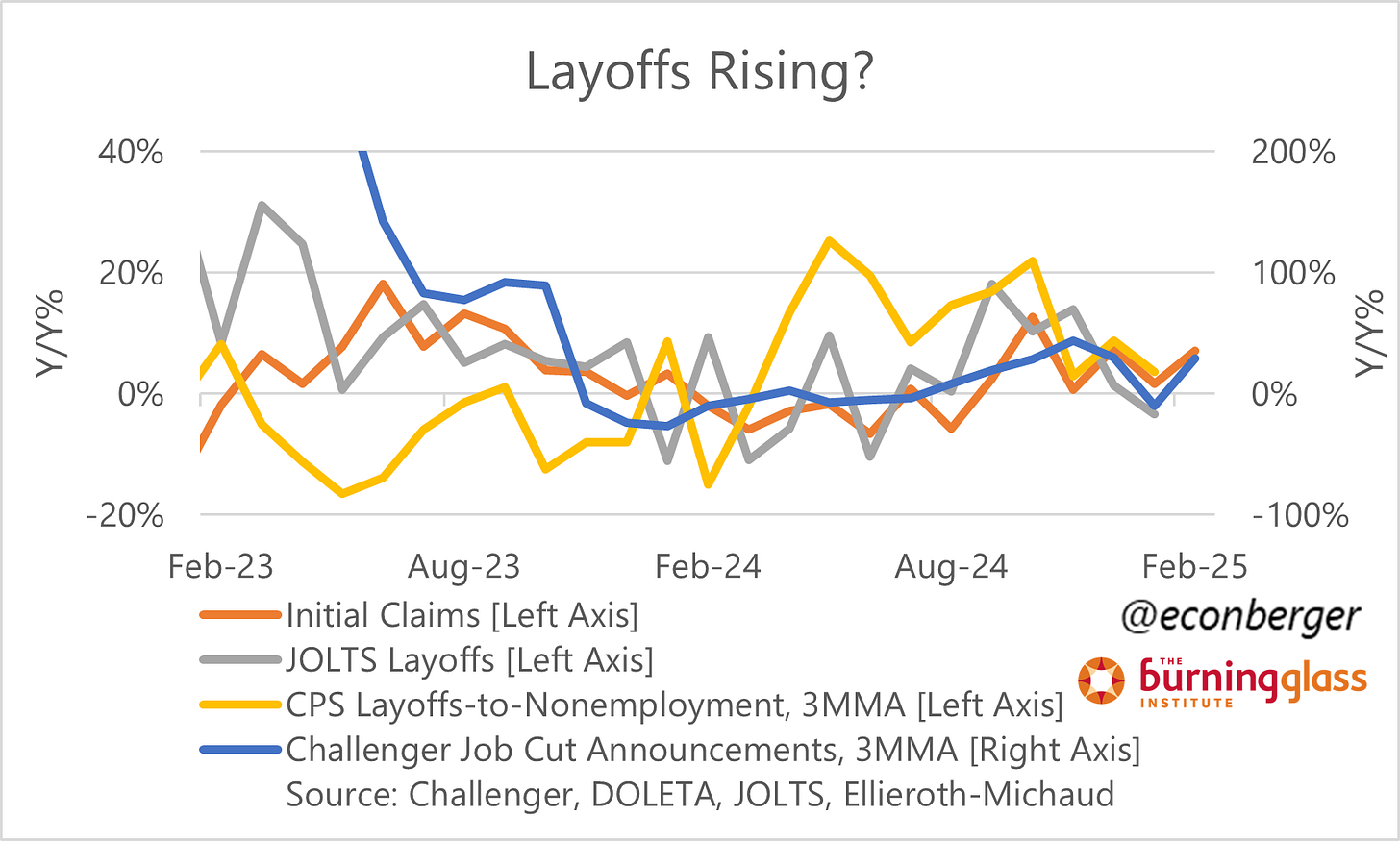

Finally, layoffs were extremely low in January. However, data that we have from February (initial claims and Challenge job cut announcements) suggests that the upward creep in layoffs is ongoing. The increases we're seeing are small (so far) and have mostly occurred during a period when other indicators (hiring, unemployment) have shown stabilization. But it's a noteworthy change from a year ago.

3. Revisions to Historical Data

We got the annual historical revisions to the JOLTS data. JOLTS is an establishment survey, just like the Current Employment Statistics (CES) from which nonfarm payroll employment is generated; given the downward revision to NFP gains, there were good reasons (both substantive and methodological) to expect changes in JOLTS too - but we didn’t know whether it would come through lower hires or higher layoffs.

After today, the answer is quite clear: hires were somewhat weaker than previously believed in both 2023 and 2024. This weakness was partly offset by softer quits in both years. Revisions to layoffs were tiny in absolute terms. So if anything, the “Great Stay” / labor hoarding stories of the US labor market have gained increased credence.

One narrow point: the jobs report is a snapshot from mid-month, whereas the turnover data covers the entire month. So to some extent, the January JOLTS data covers developments subsequent to the January jobs report and reflected in the February jobs report.