High Frequency Labor Market Indicators (5/29)

Tiny Cracks in the Hard Data Get a Little Bigger

TL;DR: Claims for unemployment insurance, our timeliest source of “hard data” on the labor market, are showing slight signs of deterioration in the labor market.

In this note:

Jobless Claims

Conference Board Survey of Consumers

More below chart.

1. Jobless Claims

The Department of Labor’s Employment & Training Administration publishes data on claims for unemployment insurance - our timeliest source of “hard data” on the labor market.1 In the first month after the shocking April tariff announcement, there was no apparent impact on this data from the tariffs; continuing claims were increasing by about 4% Y/Y, comparable to their growth rate since the spring of 2024.

But that’s changed recently. Whether it’s due to tariffs or something else, continuing claims are growing a little more rapidly (5%-6%).

The increase, taken in isolation, is pretty small. We’re talking about 42K in extra continuing claims relative to the prior trend - just 2.2% in extra claims. The increase in continuing claims during the 2022-23 period was much larger in percentage terms. If we’re stopping here, then this won’t amount to much. But I think we should all be a little worried that it’s not a stopping point.

I’ve harped on about residual seasonality in continuing claims. Even before this deterioration, I was expecting claims to experience a one time increase to 1.95 around million during June. But the deterioration, if it sticks, means 2 million is possible.

Continuing claims have been a somewhat useful proxy for the most recession-relevant component of unemployment published by the BLS, unemployment due to permanent layoff. So maybe we’re going to see this go up in the next few jobs reports, too.

I’m a little less sure what’s happening with initial claims, a layoff proxy. These were higher than I anticipated this week, at 240K (my benchmark, based on a 4% Y/Y increase, was around 231K). It’s possible layoffs are accelerating (they’ve been going up by a modest amount since late last summer); it’s also possible this is noise, or the residual seasonality I anticipate in June/July/August is getting an early start.

The acceleration in continuing claims worries me on its own, even if the initial claims jump turns out to be a headfake. It’s indicative of renewed loosening in the labor market. And since it predates thiss week’s initial claims increase, it may be signaling that hiring is cooling again after a period of renewed stability. We won’t know the latter until the May JOLTS data, due out in early July.

Two addenda to this discussion. The first is that filings for unemployment insurance by former federal workers remain elevated, but the numbers are very low in absolute terms.

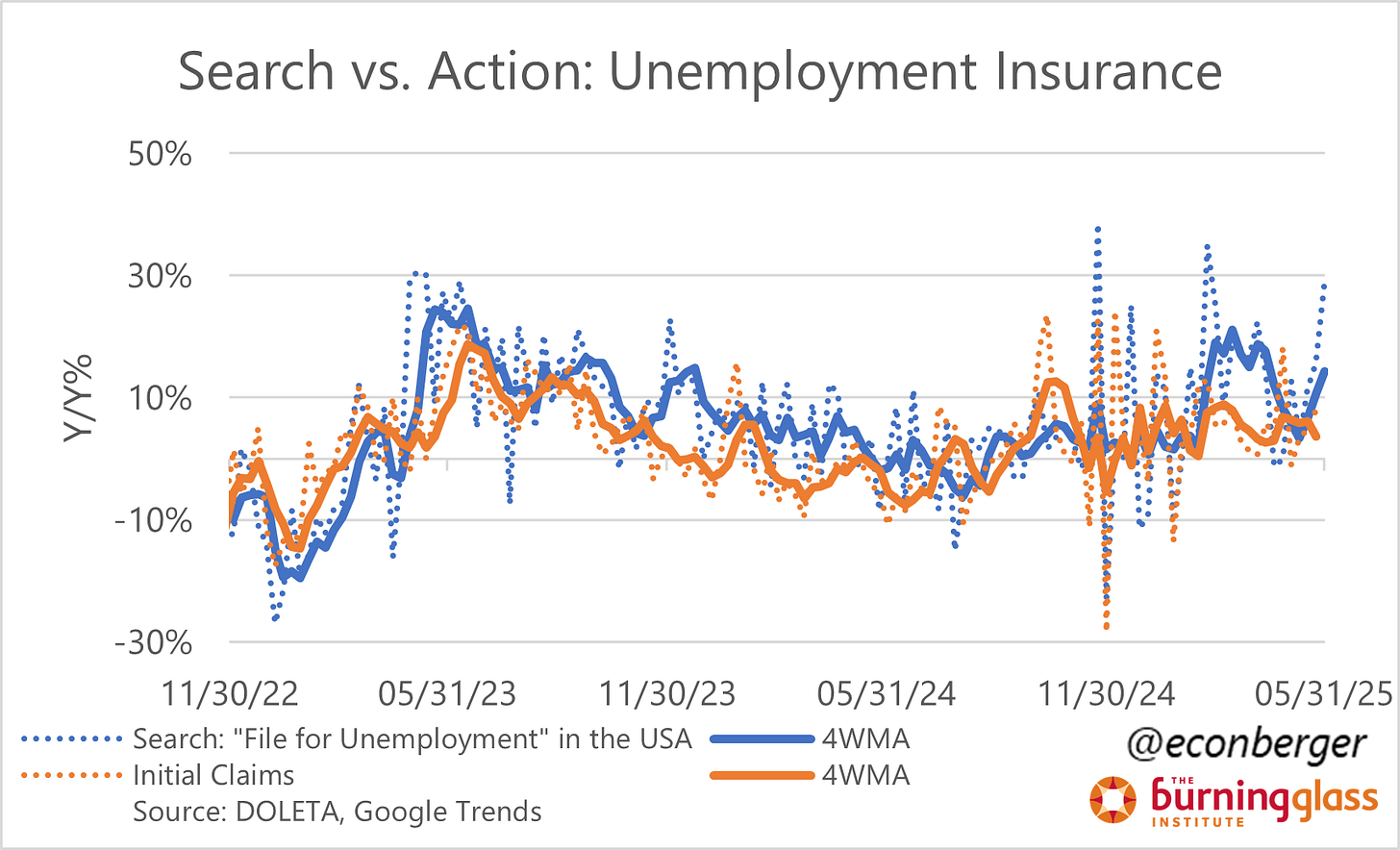

The second addendum is on Google searches for unemployment insurance, which are reaccelerating. This has an impressive track record of nowcasting claims during the pandemic, but a surge in February/March of this year turned out to be a nowcasting dud - not a critique of the approach, but maybe at relatively small magnitudes the relationship is imprecise and/or unstable.

2. Conference Board Survey of Consumers

Last week, when commenting on the Census Bureau’s Business Trends and Outlook Survey (BTOS), I wrote:

Firms are becoming less pessimistic about future demand for their products, but their assessment of current demand is getting worse. This is a nice encapsulation of how the economy has evolved over the past two weeks!

Respondents to the May Conference Board Survey of Consumers exhibited this same divergence in its assessment of the US labor market:

I put more weight on the present assessment. Households are not labor market superforecasters and in this case their response reflects more vibes than reality. (I do put a little weight on comparable surveys of employers because at least in that case expectations have some correspondence to plans.)

The way to think about this: the good news is households are becoming less panicked about the labor market; that panic was somewhat overdone. The bad news is that to some extent reality is converging toward “the bad place”.

I hope everyone’s excited or filled with dread - next week we’re getting April JOLTS (Tuesday), the Q4 QCEW (Wednesday), and the May jobs report (Friday). You’ll be hearing a lot from me.

In my opinion, the gap between “hard data” and “soft data” has been exaggerated; the portions of soft data corresponding to current labor market conditions have been consistent with the hard data.

The 2nd screenshot has a somewhat confusing “also” between “was” and “less” - sorry, it’s in the press release and makes sense in context. Mentally delete it when reading this newsletter.

Good data. Thank you