TL;DR: Despite lots of bad headlines, labor market data from early April didn’t show additional deterioration relative to 1-2 weeks ago.

Three Items This Week

Employer Headcount Plans

Claims for Unemployment Insurance

Google Trends Search

1. Employer Headcount Plans

I was really interested in what the Census Bureau’s Business Trends and Outlook Survey would show in today’s release, which covered the two weeks from March 24th through April 6th - i.e., it included 4 days subsequent to the big April 2nd tariff announcement. But it looked very similar to two weeks ago.

There was no marginal deterioration since mid/late March, but the picture was still glum. Future employment plans by US firms are more downbeat than they’ve been at any point between September 2024 and early February 2025. A higher share of firms plans to shrink employment; a lower share of firms plans to expand employment. For what it’s worth, relative to the pre-election period, the rise in firms planning cutbacks is the biggest change; i.e., we may get more layoffs, not just less hiring.

We’ve also seen a little bit of leakage into firms’ recent self-reported behavior. The share of firms cutting employment hasn’t changed much, but the share of firms expanding employment has fallen further.

The decline in optimism since early February is widespread across all size classes. Tiny firms, small firms, medium firms, bigger firms - they’re all more downbeat about their future employment than they were a few months ago.

I’ll wrap up this section with a focus on the sector that policies like tariffs are often meant to help: manufacturing. Unfortunately, despite hopes of reshoring factory employment, this industry is just as jittery about headcount as everyone else.

The higher tariffs announced on April 2nd (and modified on April 9th) are going to eventually cause damage to these headcount plans, and also to actual employment. But we’re not seeing it in the data yet.

2. Claims for Unemployment Insurance

The claims data is also being really well-behaved. The Y/Y increase in initial claims has been very low the past 2 weeks. I think substantially higher layoffs are coming, but clearly we’re not there yet.

On the continuing claims side, we’re seeing a slow upward creep but no acceleration so far.

The initial spike of former federal employees claiming unemployment insurance continues to ebb, though I think we’re probably going to see additional spikes in the future.

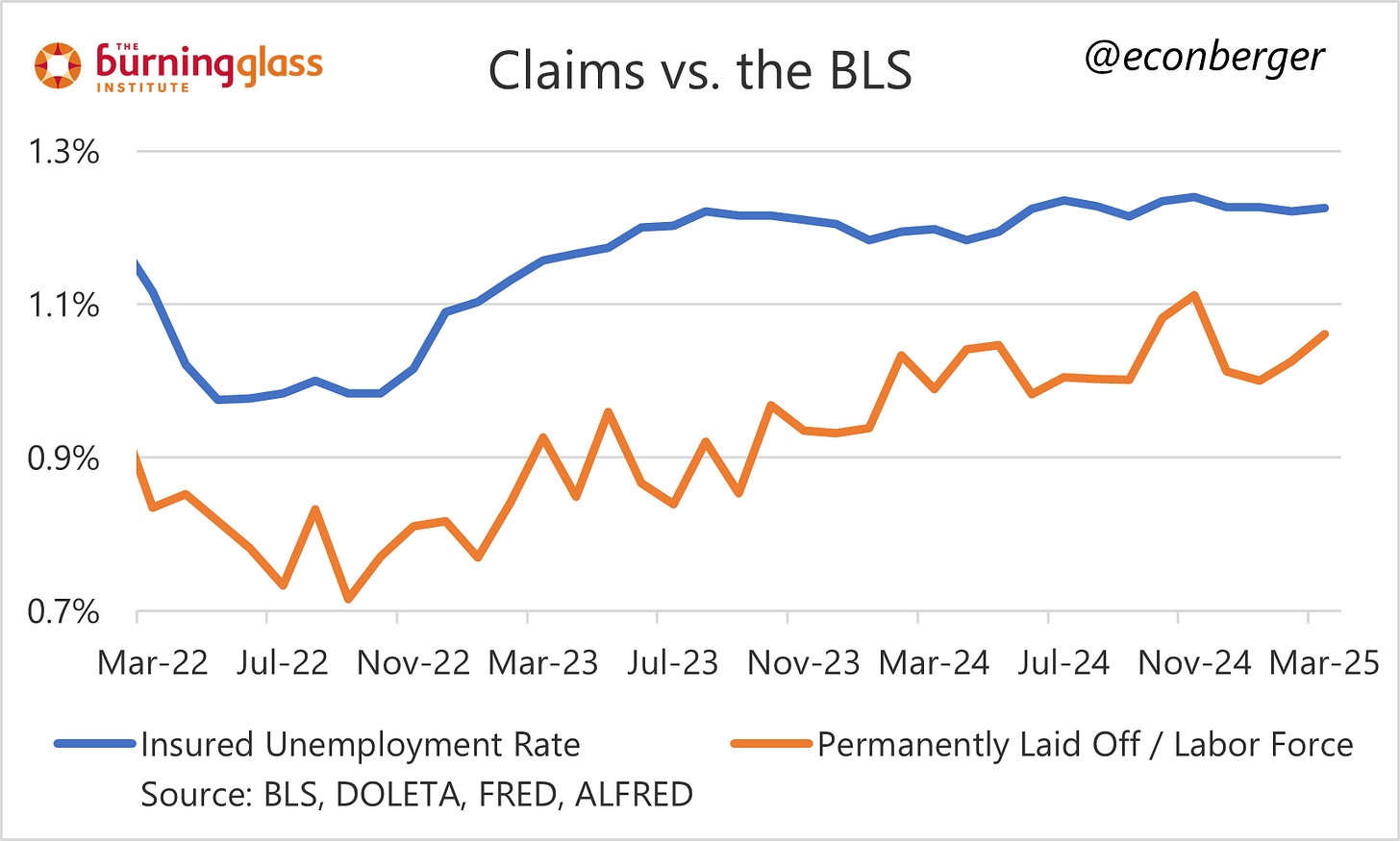

Finally, we don’t have any data from April yet, but the claims data continues to perform fairly well at nowcasting BLS data on unemployment due to permanent layoff. This is usually the most recession-relevant unemployment category.

3. Google Trends Searches

During the darkest days of the early COVID pandemic, a power trio of economists (Aaron Sojourner, Elizabeth Pancotti, and Paul Goldsmith-Pinkham) developed a nowcast model of unemployment insurance filings that was based on google trend searches (in particular, the term “file for unemployment”). You can read their original paper here.

Anyway, I recently saw Aaron (who does a lot of awesome work and is also an extremely nice guy) present some of this data, which prompted me to dig into it. And I was surprised by what I found:

The volume of google searches started rising at a modest pace in late 2024, not unlike initial claims. But since mid-February 2025, the volume of searches has started growing much faster! We don’t see this in the claims data, at least not so far.

I’m not sure what we should make of this. Over the past 2.5 years, the search data has led claims at times (early 2023) but not consistently; there have also been some headfakes by the search data, particularly during the glide downward in late 2023 and early/mid 2024.

The timing is also interesting. The big acceleration is associated with the commencement of DOGE layoffs; we don’t, yet, see an impact from the April 2nd tariffs (but it’s early). Maybe, as some folks think, we have a latent layoff wave in federal employees that will show up soon. (Also transparently, I was too lazy to add the UCFE claims to the orange line - but the numbers are too small to put a meaningful dent in the orange-blue gap.)

To wrap up this update, aside from the relatively speculative (and ominous) search data, this week’s high frequency indicators look less bad than what I think is coming. If they remain where they are for an extended period, I’ll become a convert to “the US economy has survival superpowers”. But even exceptional economies eventually crack under pressure.

A thought about why Google searches for unemployment might be exceeding actual claims right now:

People may be fearing layoff and proactively searching before actually making a claim.

This makes for a great leading indicator but one that is susceptible to "headfakes" if the fear of layoff end up exceeding layoffs that actually occurred.

Maybe the problems with this indicator are the same as the problems with Challenger & Gray layoff announcements-- sometimes the actual layoffs aren't quite as big as the announced ones. On the other hand, the announced layoffs in Challenger are still only about 5% of the JOLTS layoff rate.

A 20% rise in Google searches for unemployment is consistent with this indicator being about 5x as high. And a rise in searches coincident with DOGE cuts without the accompanying rise in claims also fits the reality of many federal workers still being on admin leave for 60 days before they are technically unemployed and thus eligible for unemployment.

So maybe it all depends on how much of the announced layoffs actually happen, and to what degree they impact the more seasonal workers whose layoffs are less likely to be announced (and who are likely more familiar with applying for unemployment without doing a Google search)?

Thinking about this made me wish I'd incorporated the scale of Challenger into the charts I'd made a few weeks ago comparing the rate of occupational churn to the rate of quits and layoffs overall: https://www.2120insights.com/p/is-a-robot-or-a-recession-more-likely

I really enjoy your work! Please keep it up!