High Frequency Labor Market Indicators (4/24)

Sentiment is worsening, but the hard data is still OK

TL;DR: Employment headcount plans continue to deteriorate, but jobless claims data remains tame.

The rest of this post covers two topics:

US firms’ plans for employment

Claims for Unemployment Insurance

1. US firms’ plans for employment

It’s hard to believe, but as recently as 3 months ago, US firms were optimistic about their business prospects and planning to expand employment. This optimism led at least one foolish economist to predict that we were headed for a stabilization, and perhaps reheating, of the US labor market.

But we’ve packed 80 years’ worth of trade policy changes into those 3 months and employers’ plans have adjusted radically. The share of firms planning to expand headcount on a 6-months-forward basis has fallen to 12.6%; a year ago it was at 14.0%. Alarmingly, the share of firms planning to cut headcount has surged to 10.5%, vs. 8.9% a year ago. Plans can change, but firms don’t like what they see on the horizon and want to adjust in a way that’s bad for US workers.

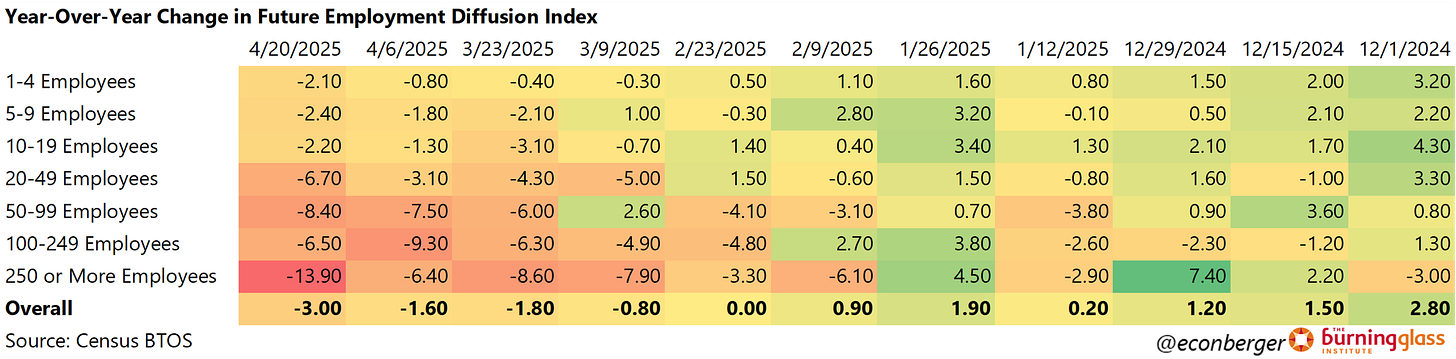

Americas’ largest firms (250 employees or more) are the most pessimistic about planned headcount changes. They tend to be more pessimistic on this front in general, and eyeballing the heat map below, it seems like the real “break” happens at roughly the 20 employee mark. (Firms with more than 20 employees have experienced a larger swing in sentiment on employment much more than those with fewer than 20 employees.)

If you want good news, there’s still time for US policy to pivot (though, if you pay attention to logistics experts, that window is closing). Changes in recent headcount behavior have been quite comparable, at least from a year-over-year diffusion index perspective, to those before the election. This helps explain the resilience of the hard data (see next section). But at some point, firms will put those grim employment austerity plans into action.

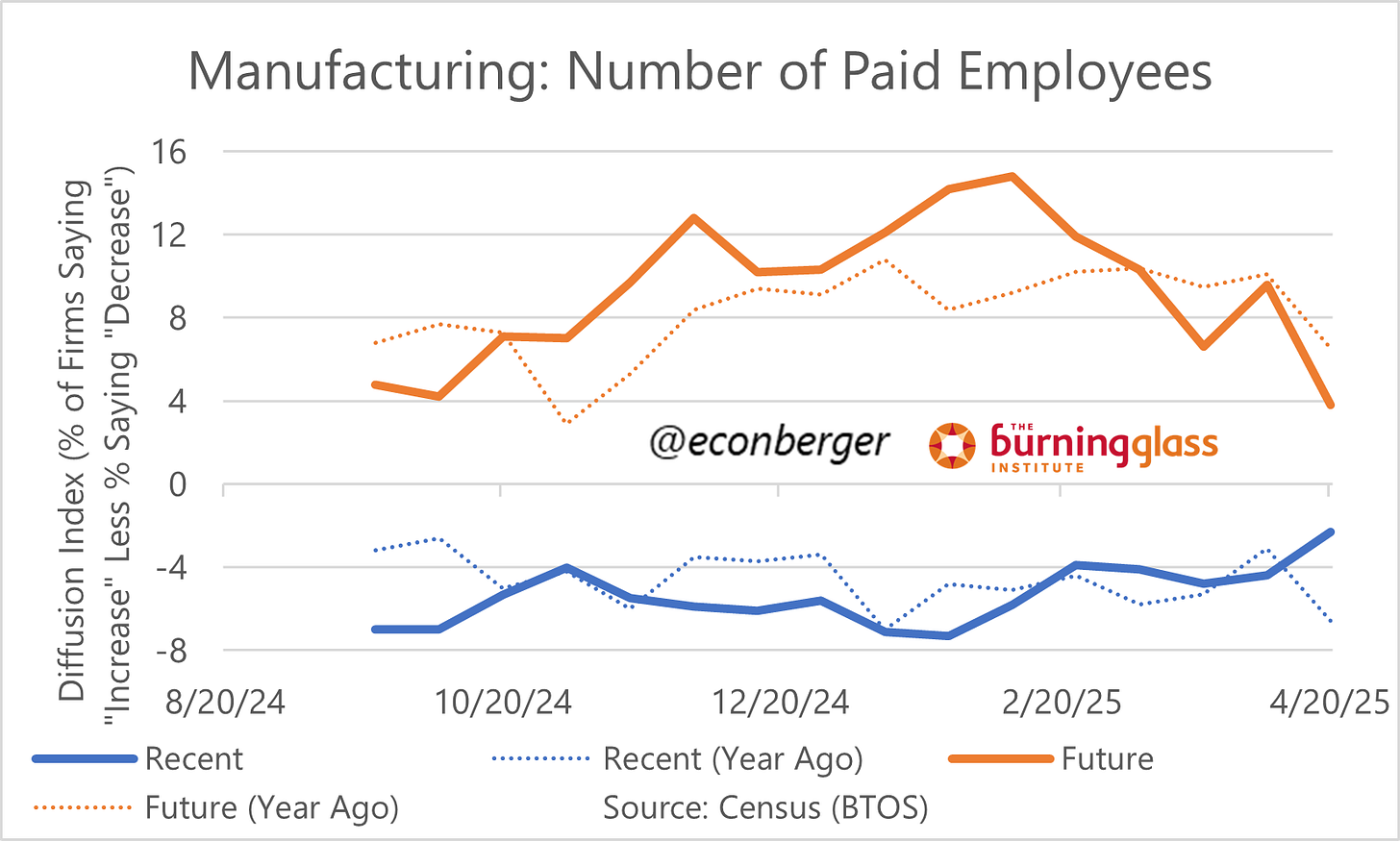

I’ve been doing a few sectoral deep dives using this data. One is into manufacturing, the sector that’s supposedly being helped via these high tariffs. Unfortunately and unsurprisingly, it shows the same pessimistic pattern the cross-economy metrics above, with a rapid deterioration in future employment plans.

What did surprise me is transportation & warehousing. This is a sector that, given recent headlines, you would expect to also plan significant reductions. But so far, the deterioration is only visible if you squint.

2. Claims for Unemployment Insurance

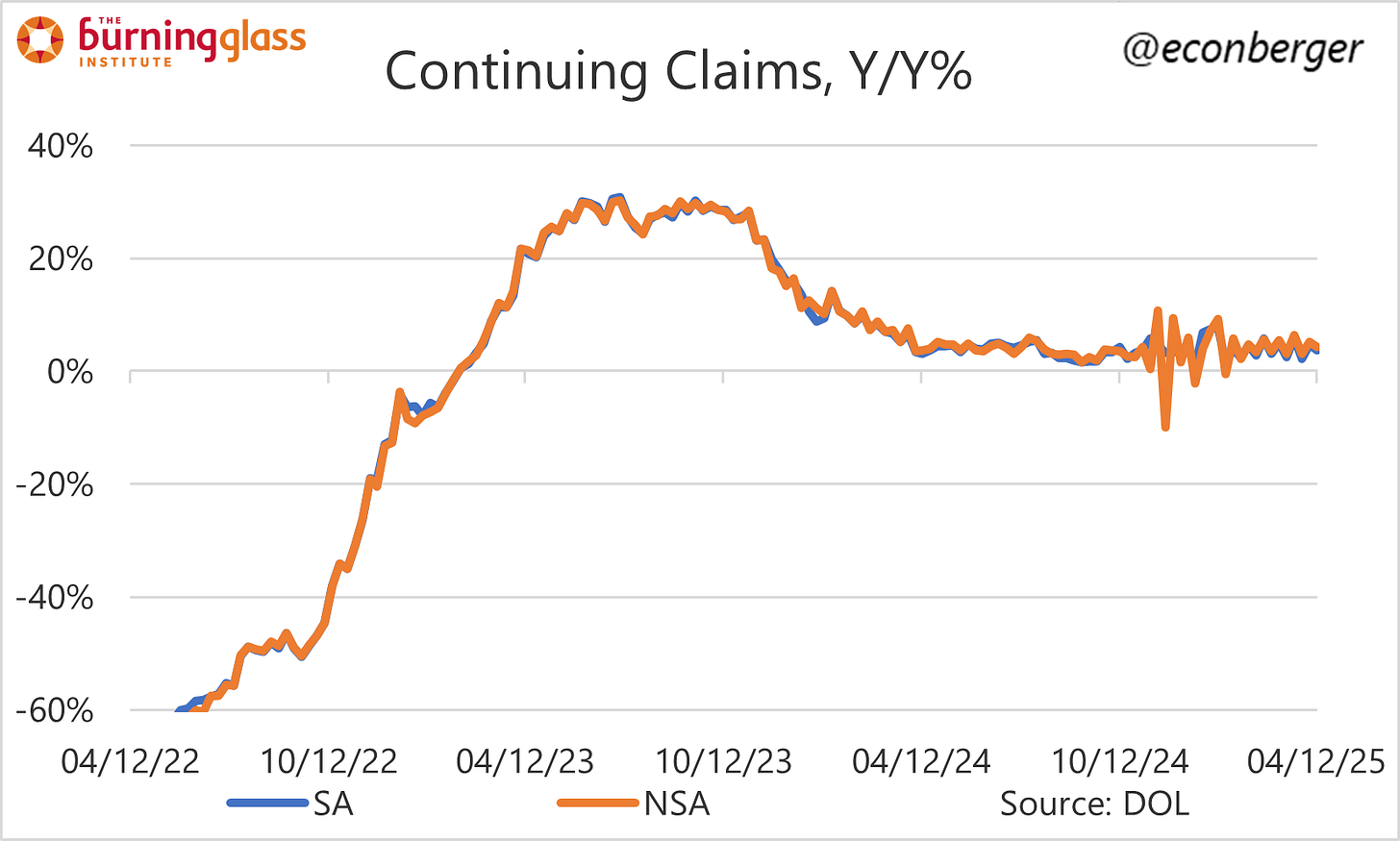

Claims are among our most timely hard data, and… they don’t show any change. Initial claims are rising by mid-single-digits-percent year-over-year.1 That’s not great (a year ago they were declining), but it’s about the same trend as what we’ve seen since late 2024.

Some folks have argued that this is a reflection of the fact that hiring leads layoffs. But continuing claims are sensitive to hiring as well as layoffs, and they don’t show a deterioration in trend either. We’ve been going up by mid-single-digits-percent for over a year. (Indeed, it’s an interesting question why layoffs have accelerated but continuing claims have not - I suspect it’s because hiring stopped falling in the 2nd half of 2024.)

Two weeks of claims in April suggest we’re not going to see much of an increase in unemployment due to permanent layoff when the April jobs report comes out.

A few other things to share before I wrap up for the week. The first is that there has been residual seasonality in initial claims during the late spring and early summer, so a sequential increase over the next few months won’t necessarily signal a real deterioration.

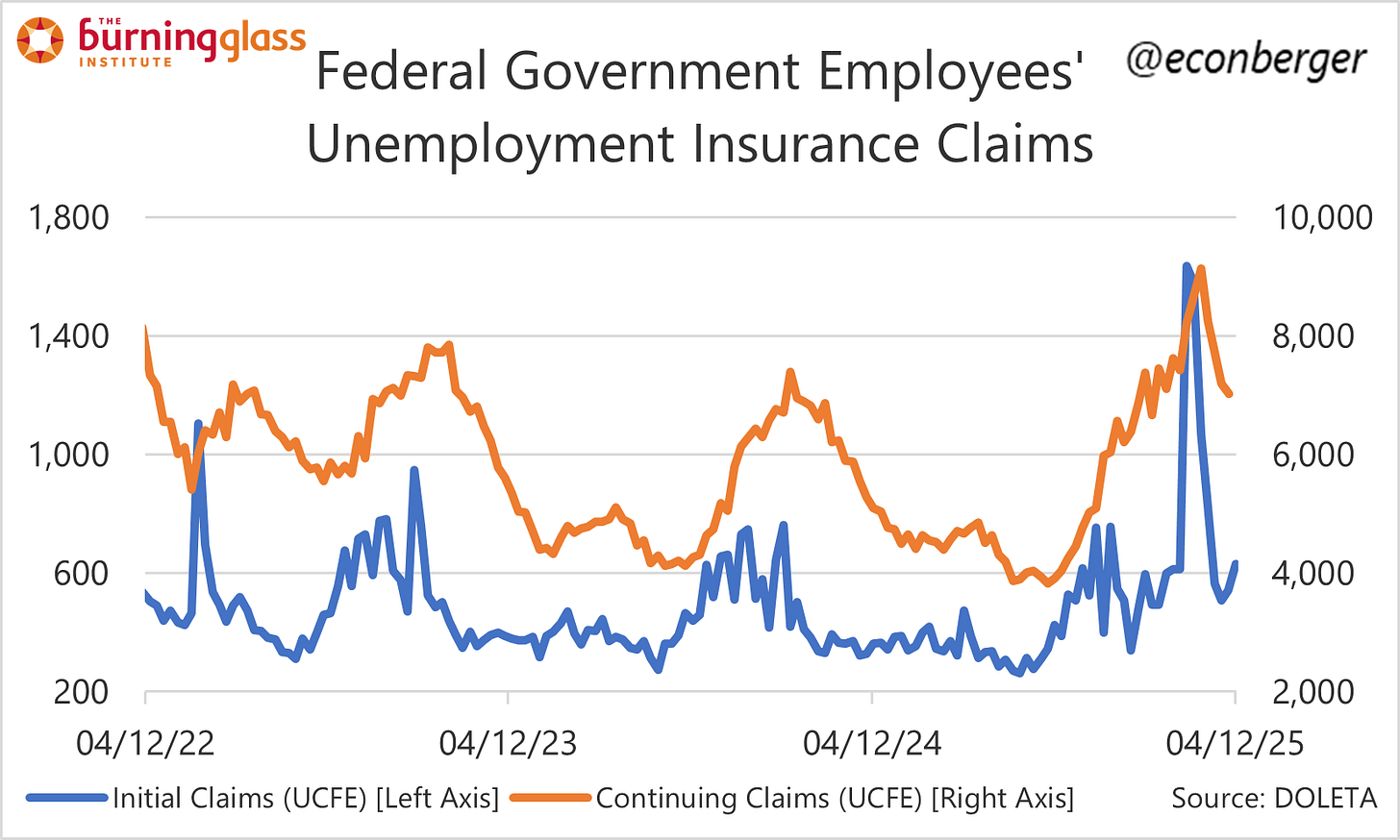

The other thing is unemployment insurance filings by federal workers, a segment that isn’t included in the regular initial and continuing claims data. These remain elevated but the absolute increase is small: about 200-300 extra initial claims per week (so 0.10%-0.15% of the regular initial claims number) and 2,000-3,000 extra continuing claims were (about 0.12%-0.18% of the regular continuing claims number).

Next week we get the March JOLTS data on Tuesday, and the monthly jobs numbers for April on Friday! I think they’ll look OK. Have a great weekend!

Some of the very recent noise may be due to Easter calendar shifts.