Greetings from London where I’m marveling at pigeons the size of poultry, Magnum bars and the Peppa Pig bus tour (which doesn’t stop at the Bank of England). My labor market writeups are going to come with a significant delay (and may be shorter than usual).

TL;DR: The gradual deterioration of US labor markets continues.

This writeup covers:

Claims for Unemployment Insurance

The Conference Board Survey of Consumers

More below chart.

1. Claims for Unemployment Insurance

If you read this newsletter, you know: these are our most timely high-quality hard data on the labor market, and they’re getting worse.

Continuing claims, a proxy for (the most recessionary portion of) unemployment, are still very gradually accelerating. Whether it’s tariffs or uncertainty, the labor market took a turn for the worse in May. The deterioration is small so far - I’m more worried about what’s coming than what has happened so far.

I’m a fairly strong believer in claims’ (both initial and continuing) residual seasonality. As a result I think the recent trajectory of the published data is steeper than reality, and exaggerates the pace of recent deterioration; we’re about 50K (2-3%) higher than the pre-May trajectory. (FWIW, this hypothesis also means that the flatness of the data in H2 2024 and Jan-Apr 2025 masked a slow upward creep.)

We’re seeing this deterioration in continuing claims without a corresponding worsening in initial claims. My takeaway here is that, after a period of stability, hiring is declining again without much of an upward move in layoffs. Beyond “it could always be worse”, that’s not very reassuring - falling hiring alone can power a meaningful increase in unemployment.1

Speaking of increases in unemployment, we’re probably going to see one next Thursday (the BLS jobs report is coming out a day early because of the holiday). Continuing claims provide a useful nowcast of unemployment due to permanent layoff, the most recession-relevant component of the unemployment rate.

I’ll wrap up this section with an update on searches for unemployment insurance, which keep suggesting a false-positive acceleration in initial claims.

2. The Conference Board Survey of Consumers

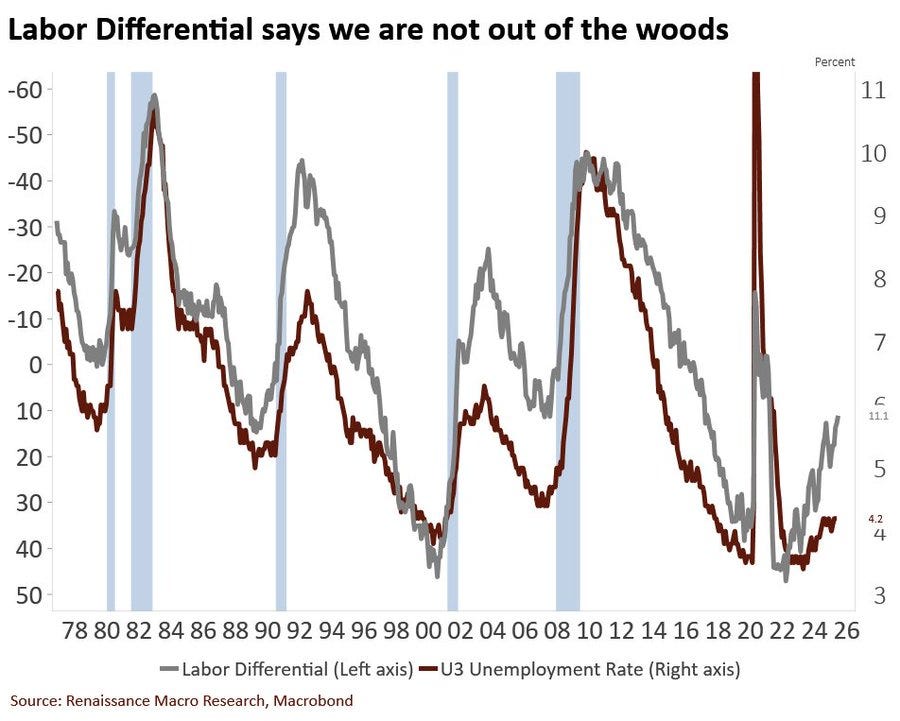

I’ve written about my mild skepticism of survey data (portions of which tends to be overly vibes-based vs reflective of the economy), but I do think some of it is genuinely informative, and the labor market differential (people saying “jobs are hard to get” less people saying “jobs are plentiful”) from the Conference Board is one of them. It tends to be a useful proxy of the unemployment rate.2

It’s sending a comparable message to continuing claims: unemployment is going up. Unless you’re someone who likes bad news, next Thursday will be disappointing. Better stock up on the Magnum bars.

Chart borrowed from Neil Dutta, an awesome economist

Also, if the labor market keeps getting worse… layoffs will eventually go up.

If you look carefully at the chart, you’ll notice that this series, too, has residual seasonality. So the very recent pace of deterioration (last few months) in the differential is exaggerated.