TL;DR: Continuing claims for unemployment insurance showed further acceleration in early June, probably signifying higher unemployment in the next monthly jobs report.

More below chart.

Claims for unemployment insurance were the only labor market data of note released this week. The news was bad: continuing claims rose to 1.956 million, the highest level since November 2021, and up about 7% Y/Y. A month or so ago I set a benchmark of 4% Y/Y increase for the remainder of the year as a threshold for additional labor market deterioration, as that was the growth rate for much of 2024 and into early 2025. This week’s data was over 50K above that benchmark.

Continuing claims are a useful proxy for an important segment of unemployment: “due to permanent layoff”.1 Since claims are going up, there’s good reason to think that this segment, and probably unemployment more broadly, will be higher in the June jobs report than it was in the May jobs report.

If this is the worst it gets, that’s small potatoes. But we should all be a nervous that this is just the 1st inning of a more substantial and possibly disorderly cooling in labor markets.

Interestingly, while continuing claims have clearly accelerated, there isn’t much evidence of a comparable acceleration in initial claims (a layoff proxy). They’re tracking right near my benchmark, which anticipates a brief hump during the summer due to residual seasonality. And yes, they’re a little higher than they were in the fall, but that has been true since the fall and hasn’t changed recently.

My hypothesis - which won’t be tested until we get the May JOLTS data in early July - is that the recent deterioration in continuing claims is mostly being driven by renewed weakness in hiring, not layoffs.

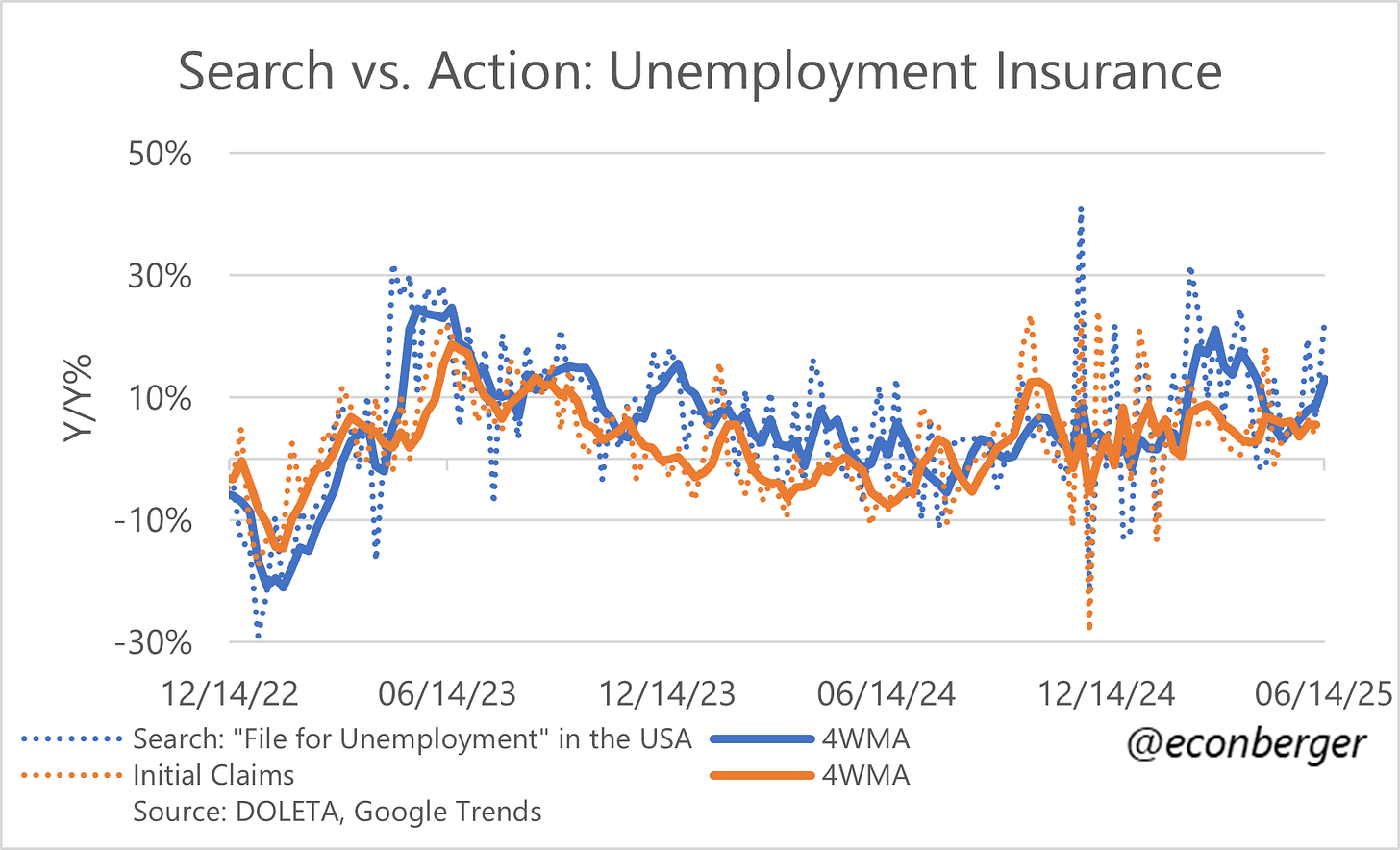

I’ll wrap up this week’s high frequency update with a related data point: Google Trends data on “file for unemployment” searches. As a quick reminder, during the pandemic this data was a very useful nowcast for initial claims, and has caught some of the trend shifts over the past few years as well (acceleration in late 2022; deceleration in 2023; reacceleration in the latter half of 2024). But a big acceleration in late winter turned out to be a headfake, so I’m a little leery of attaching much meaning to a recent pickup in growth for these searches.

Theoretically other categories like “completed temporary job” or “temporary layoff” may also be relevant, but in practice most of the cyclical movement in unemployment comes from permanent layoffs.

Is it not the case that this week is the survey week for payrolls - this Continuing claims increase and next week’s claims data will only flow into the June Report? So yes, some low single digit boost to UR in June payrolls. Is that fair?

Some anecdata that I've seen this week: Indeed app is in the top10 apps in appstore, while it was barely holding in top 50 for the last 3 years