This will be a pretty short recap, mostly because the snapshot offered by this report is fairly outdated by subsequent developments.

TL;DR: This was a decent, but not great, jobs report. Given that various labor-market-negative policy actions mostly came after the report survey period, we’re probably headed for another wave of cooling in the coming months.

Key Data Points:

Unemployment rate: rose from 4.01% to 4.14% (not good)

Prime working age employment population ratio: fell to 80.5% (not good)

Nonfarm payroll employment: rose by 151K (ok)

The rest of this recap is split into 4 sections:

The Big Picture

Trends in Labor Market Slack

No Country for Young Men

Weather Hurt the Establishment Survey at Least a Little

1. The Big Picture

The most important thing to remember about this month’s report: its reference period was February 9th-15th, pre-dating layoffs in the federal government. It also predated the most recent (partly implemented?) round of tariff escalation. And in general, economic uncertainty has been higher in the past 3 weeks than in the month leading up to the survey period. So the data we saw today is relatively stale, and there’s bad (or at least not-good) news about the labor market which won’t show up until next month’s jobs report, or even later.

That’s why a decent February report is mildly concerning. We’re not coming into that wash of bad labor market developments from a position of massive strength. At the very least, we’re probably going to nudge the labor market into a path of gradual, mild cooling like we experienced over the past few years.

I’ve written a lot about this and want to spare you the repetition, but should mention: it’s not inevitable. I came into this year anticipating a policy mix that would stabilize and maybe heat up hiring; a different policy mix has been implemented so far (with a whole lot of uncertainty mixed in). It’s not too late to adopt a more predictable, labor market friendly mix.

2. Trends in Labor Market Slack

It’s just one month but most of the key household survey ratios moved slightly in the wrong direction. For instance, the unemployment rate rose from 4.01% to 4.14%. That’s a little below where the Fed’s most recent projections (from December) expect 2025 to end up. I was pretty sure until recently that the Fed was too optimistic, but based on the policies being implemented, the odds of finishing the year at least slightly above the dashed line have gone up substantially.

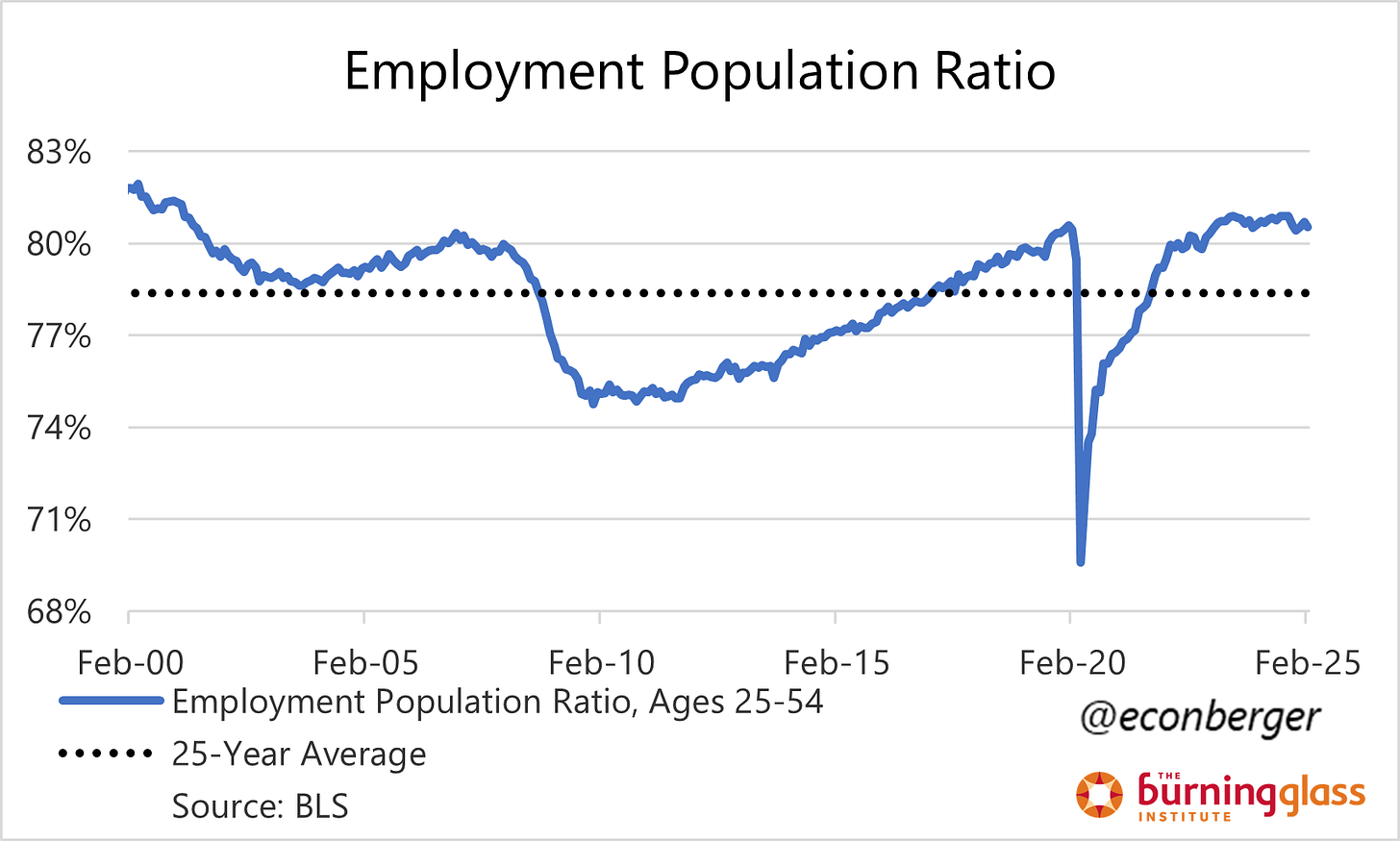

The share of prime working age Americans with a job also slipped to 80.5% from last month’s 80.7%. That’s still a fairly high rate by historical standards, but is the 3rd time in the past 5 months that we’ve been below year-ago levels. And the policy developments I mentioned above don’t make me optimistic about the near term trajectory.

We also saw a pop in the share of the labor force that works part time for economic reasons, to 2.9% - the highest since the spring of 2021. It’s still pretty low by historical levels, but ends a multi-month streak of moving in the right direction (lower). Again, I would be surprised if it doesn’t move up going forward.

Unemployment due to permanent layoff was flat in February, a bit of “better” news. But given that federal workers who lose their jobs and don’t find new employment immediately would fall into this bucket, it’s headed higher in the coming months.

3. No Country for Young People

I published a piece a few weeks ago about how, despite low layoffs, the weak hiring environment is penalizing younger workers, especially those early in their careers (who typically qualify as “new entrants” or “re-entrants”). I encourage you to read the whole piece, but I just wanted to update two of the time series charts.

The current labor market is hitting younger college graduates (20-24 and 25-34) particularly hard; for both these groups, the unemployment rate is back to where it was in 2015.

However, it’s not just young college grads who are experiencing an adverse movement in the labor market. We’re also seeing a meaingful increase in unemployment among late teens with a high school diploma and no college:

These younger folks are the ones who would have benefited the most from a stabilization in hiring (that now seems less likely to materialize).

4. Weather Hurt the Establishment Survey at Least a Little

We saw weak data on the average workweek for the second month in a row:

This could be “fundamental”, but odds are that it (and possibly other establishment survey like nonfarm payroll employment and wages) were impacted by adverse weather. As a quick reminder, people who have a job but don’t get paid (due to an absence) don’t count as employed in the establishment survey. Partial absences lower hours and have probably-positive effects on wages (reasons: salaried workers report fewer working hours and/or lower paid hourly workers are more likely to miss work).

The household survey counts “absences from work due to weather”, and also the number of people who worked part-time hours due to weather but normally work full-time. Both of these were higher than normal for February. So I imagine we’ll see some normalization in March: slightly stronger employment growth (in the establishment survey), a slightly stronger workweek, and (more speculatively) slightly softer wage growth.