TL;DR: December’s jobs data was better than expected across the board. It’s too early to be sure, but perhaps 2025’s labor market stabilization has started ahead of schedule.

Key Data Points:

Unemployment rate: fell from 4.23% to 4.09% (good)

Prime working age employment population ratio: rose to 80.5% (good)

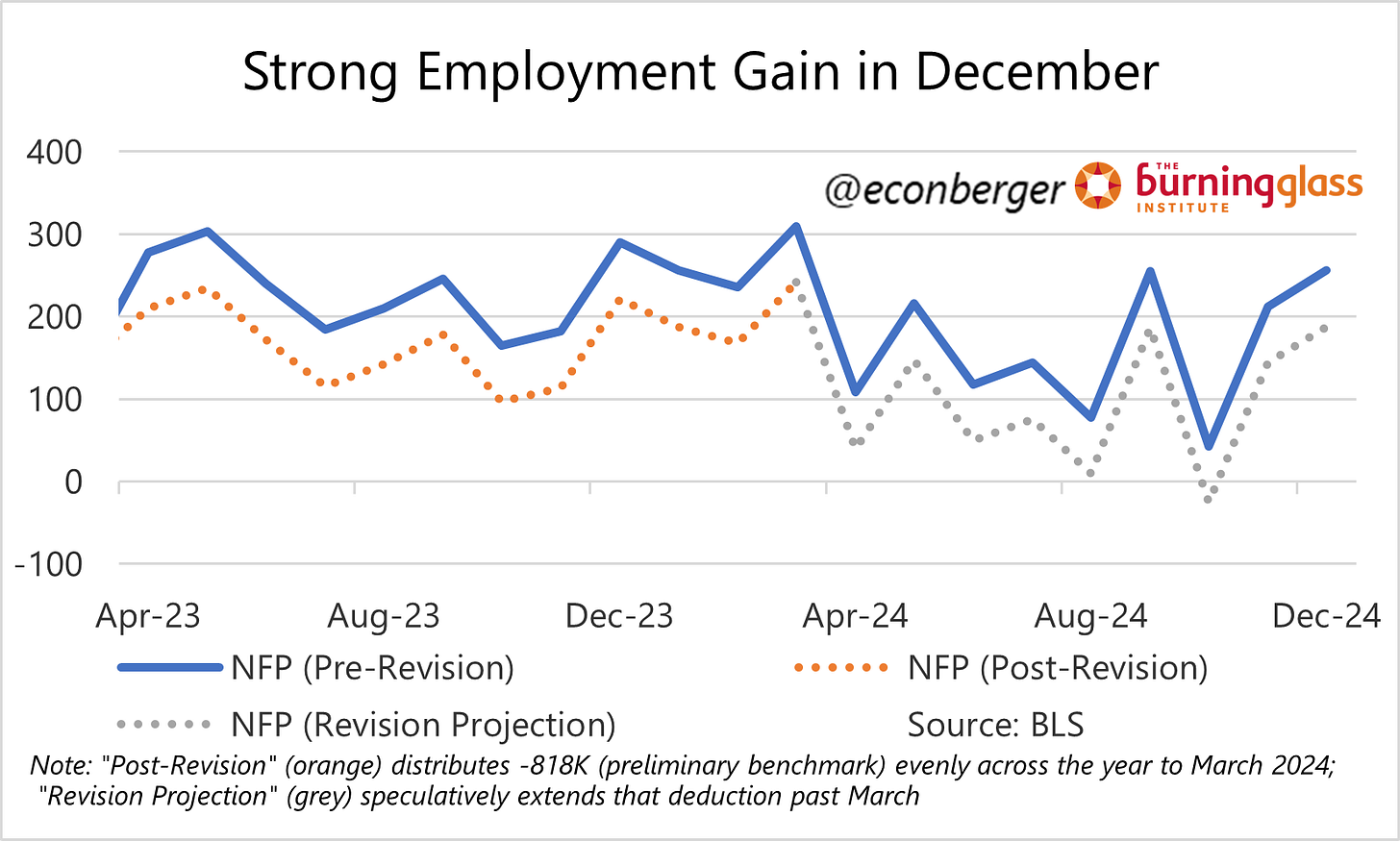

Nonfarm payroll employment: rose by 252K (good)

The rest of this recap is split into 2 sections:

The Big Picture

(Mostly) Good News Catalogue

Revisions Next Month

More below chart.

1. The Big Picture

I think the labor market will stabilize, and perhaps warm up, in 2025. But if you read my preview of today’s report, I argued that December 2024 was too soon. Well, maybe I was wrong - it wouldn’t be the first time.

There was only a little bad news in today’s report. (You can see the laundry list in the next section.) I place a low probability on next month or the one after looking like this one, but in the unlikely event that they do, the word “boom” might re-enter the conversation.

What’s more probable than a boom, at least in the near term: a sequence of decent data (slightly softer than this month), with the unemployment rate flat just above 4%, the employment-population ratio for prime-age workers hovering slightly below 81%, and no further declines in hiring and quits. That would still be an improvement rather over the mediocre data we saw during much of 2024.

Another trajectory that’s more probable than a boom in the near term: December’s upbeat data is a fluke, labor market cooling is ongoing, and we have additional small increases in unemployment ahead of us. None of us should be surprised (or overreact) if the January report is a crummy one.

As we progress through 2025, I think the probability of the top 2 scenarios materializing (“boom” or “decent”) will go up, and the probability of cooling continuing will diminish. That corner has been turned, or will turn soon.

2. (Mostly) Good News Catalogue

Let’s start with the weakest part of this report - prime working age employment and labor force participation. We saw a slight rebound in the share of age 25-54 Americans with a job, to 80.5%; it’s still a little lower than the cyclical peak experienced periodically in 2023 and 2024. December’s data provides at least a little reassurance that we’re not in a persistent slide.

Prime-working-age participation did decline to 83.4%, the lowest since the spring of 2024. But (unlike employment) it’s still above year-ago levels and I won’t be worried about it unless employment slides further.

I don’t find nonfarm payroll employment to be telling us all that much, particularly since the numbers (at least through mid-year 2024) are likely an overcount, but the December gain was impressive. Even if you speculatively subtract a big chunk in anticipation of future revisions, it’s still a solid number.

Back to the household survey, there was lots of good news. The unemployment rate has been flat since the summer.

The composition of the unemployment rate has gotten worse over this period - the share of unemployed people who are permanently laid off (the most recession-sensitive of the components) has gone up; so has longer-duration unemployment. But in December both of these indicators improved. I don’t want to overstate the significance of a small one-month move relative that’s probably just noise, but good news is good news.

Another bit of December good news that’s even more likely to be noise: the share of the labor force who are unemployed job leavers (=quits) rose to its highest level since 2022. I doubt it will persist, but if it does, that’s great news.

Part-time employment for economic reasons has also been coming down in recent months. It’s still a little higher than it was in 2022 and 2023, but is quite low by historical standards.

Finally, I haven’t spent much time talking about wage growth, but it’s stuck right around 4% annualized without much sign of further deceleration. That’s a little higher than pre-pandemic, but productivity growth is also running higher - so any inflationary implications are limited at present.

3. Next Month’s Revisions

We get two big chunks of labor market news in next month’s jobs report, aside from new January 2025 data.

The first, in the establishment survey, is the annual revision. Nonfarm payroll employment growth from March 2023 through March 2024 will be revised down significantly, though upward revisions to the benchmark source data (the Quarterly Census of Employment & Wages, or QCEW) suggest that downward revision will be smaller than previously expected (I’m thinking about 55K per month rather than the previously estimated 67K per month).

The data from March 2024 onward will also be revised (updated birth/death projections), and I suspect (though am not sure) that the revision there will be negative too. We have Q2 2024 (post benchmark) data in hand, and while quarterly QCEW data is noisy, it’s suggestive of an ongoing nonfarm payroll employment overcount.

The household survey will experience its annual population controls based on new Census Bureau population estimates. In contrast to the establishment survey’s overcounts, the household survey has been experiencing a significant undercount - primarily, but not entirely, due to immigration. We’re undercounting growth in the population, in the labor force, in employment and in unemployment.

These population controls aren’t, strictly speaking, revisions: they’re implemented as of January but there’s no “pro-ration” of the controls over the prior year. They tend to have minimal impact on the ratios in the report (which of course are the most important outputs of the household survey), but all those people darkly warning about weak growth in household employment counts are likely to see that talking point go up in smoke.

(This table is not mine - it’s copied and pasted from the US Census Bureau website. Am grateful to our nation’s statisticians.)