TL;DR: With the recovery from hurricanes and strikes behind us, we’re likely to see mediocre numbers in the final job report of 2024. Hopefully 2025 will look better!

The rest of this report is divided into:

The Big Picture

Data I’ll Be Looking At

Revisions to Household Survey Seasonal Adjustment Factors

1. The Big Picture

In the past year and a half, the labor market has cooled gradually but substantially. That cooling is apparent nearly every indicator, but to save us a laundry list, I’ll cite one: the unemployment rose from 3.51% in February-April 2023 to 4.15% in September-November 2024.

This cooling is “problematic but not scary”. It’s problematic in that employment is good and unemployment is bad (all other things being equal), and both of these series are currently moving in the wrong direction. It’s not scary in the sense that it’s happening gradually, and there doesn’t seem to be a risk of it spiraling out of control.

In any event, I think the cooling process is going to stop this year. You can read my reasoning here - in short, there are a confluence of factors that will lead the labor market to stabilize and possibly even warm up a little. There’s a ceiling to how much warming can happen: the Fed has been explicit that they don’t want the employment situation to worsen further, but unless we see a dramatic further improvement in inflation, they’d probably lean against a renewed labor market boom.

Despite expecting stabilization in 2025, I think December 2024 is too soon for good news. Census Bureau data indicates that firms’ future headcount plans are more upbeat than they were a year ago, but that their recent headcount behavior is more negative than a year ago. I think we’re going to have to wait a little bit.

2. Data I’ll Be Looking At

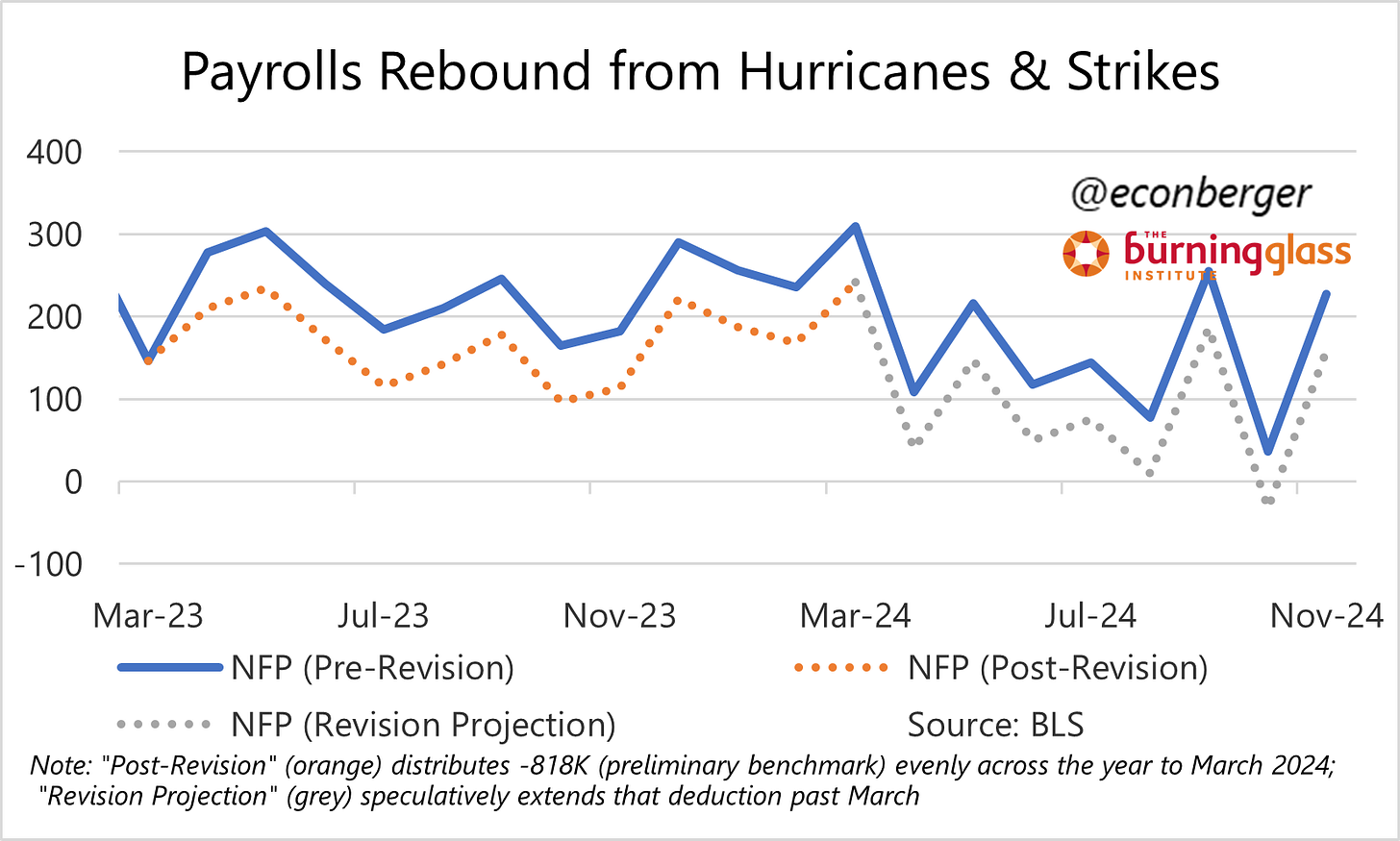

Let’s start with nonfarm payroll employment. I’m not a huge fan of this data at present and think it is sending a distorted signal. We know it has a significant overcount through at least March 2024, and probably beyond that. We get the annual revision next month and a lot of these data will look worse. But for now, I’m mentally subtracting about 50K-60K from each monthly number as shorthand.

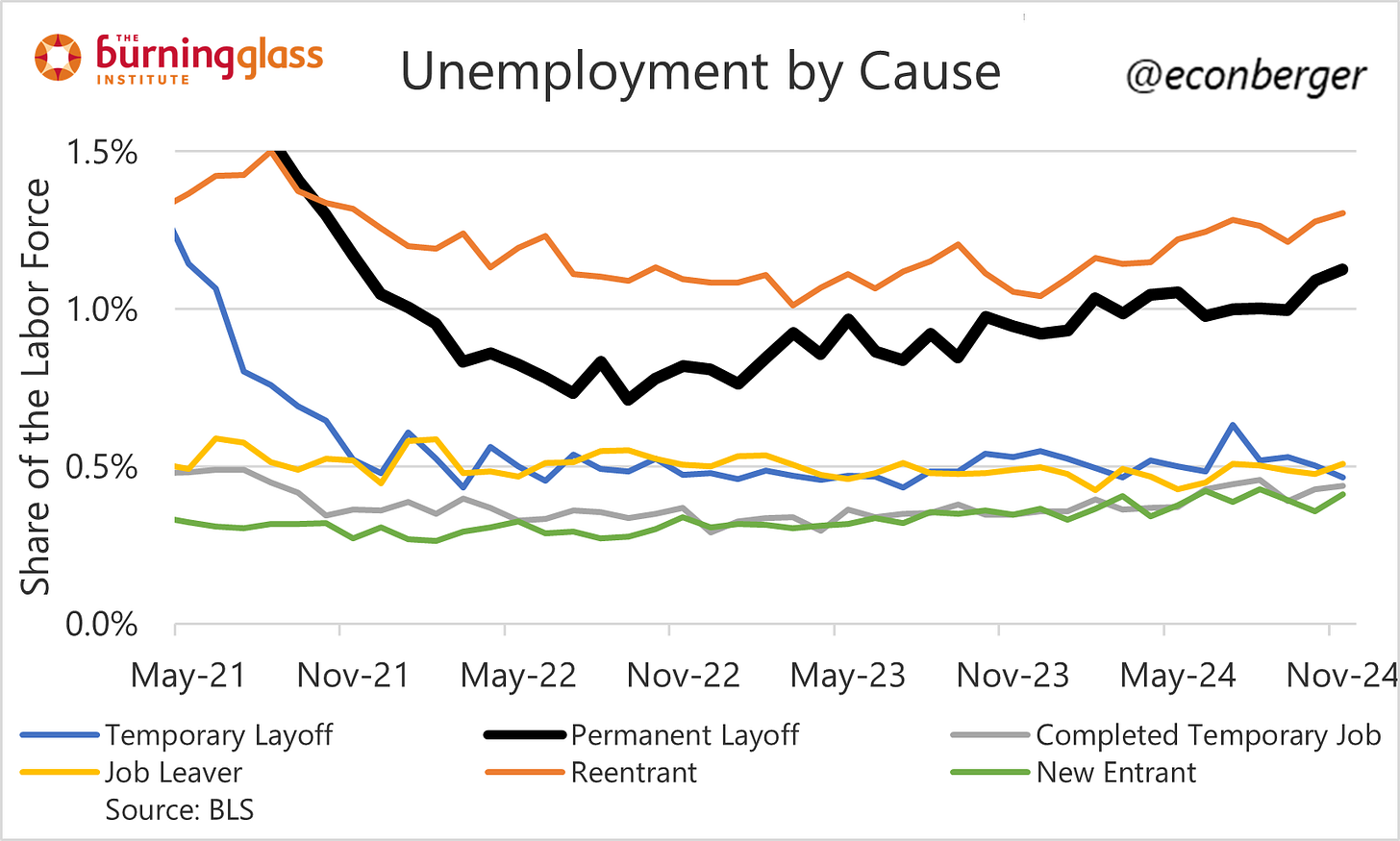

Of course, these revisions don’t matter all that much. Whether the nonfarm payroll employment data are an undercount or an overcount, the household survey ratios are sending a clear and glum (but not terrible) signal. For instance, the unemployment rate has gone up, and we also know about its deteriorating composition: in recent months the worst category of unemployment, that due to permanent layoff, has crept up. I’m not sure it will go up further in December’s report (a nowcast based on jobless claims data suggests no further deterioration) but worth following.

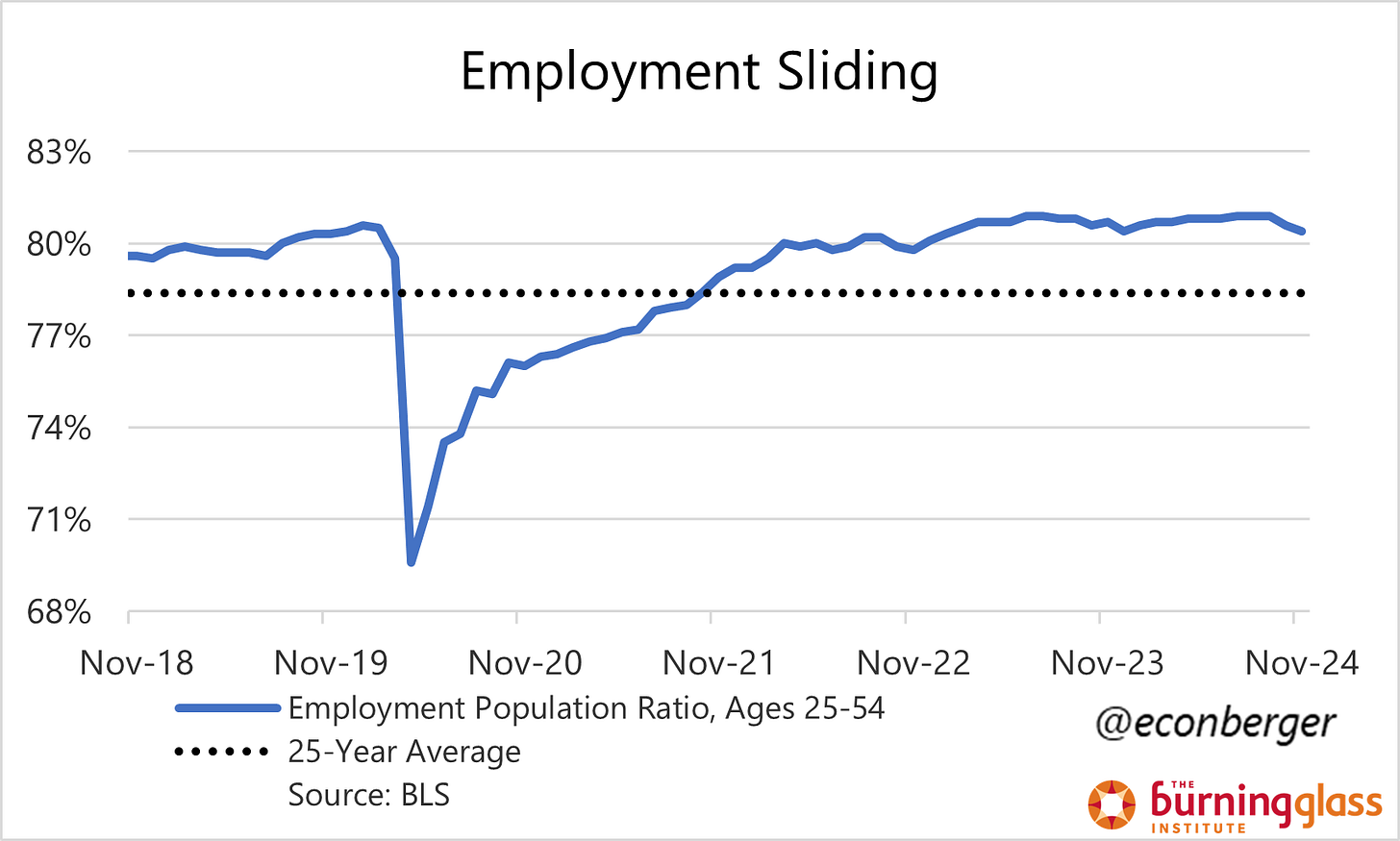

One troubling development in the last few reports has been the decline in one of our best all-in employment metrics: the share of prime-working-age Americans with a job. As recently as early fall, it was at a post-2001 record high of 80.9%. But it’s slid down to 80.4% as of November and is a little lower than it was a year earlier. Hopefully this is just noise.

Also unsettling: the increase in duration of unemployment, and in particular the share of unemployed who have been looking for work for at least 6 months. To some extent this is a lagging indicator of past layoffs, but it’s not good!

Finally, an indicator that has weakened over the past year and a half but has looked a little better recently: the share of the labor force that is working part time for economic reasons:

3. Revisions to Household Survey Seasonal Adjustment Factors

The big revisions and adjustments to the jobs report are coming next month, with the January employment report (released in early February), but this month we get something minor: a revision of the seasonal adjustment factors over the past 5 years for the household survey.

This will have little if any impact on our perception of the labor market; it tends just to smooth the wiggles in the data. But it will probably ruin a lot of your charts unless you’re careful to replace them with seasonally adjusted data.