TL;DR: Another not-great jobs report. The job market’s current state is OK (not bad, not great) but we’re moving in the wrong direction.

Key Data Points:

Unemployment rate: fell to 4.2% (ok)

Prime working age employment population ratio: unchanged at 80.9% (good)

Nonfarm payroll employment: rose by 142K (mediocre, especially after considering future revisions)

In the rest of this recap, I’ll discuss:

The Big Picture

Details of Interest Within the Report

Employment vs. Unemployment

Unemployment Rate Composition

Nonfarm Payrolls - How Fast Are They Growing?

Full recap below chart.

1. The Big Picture

Last month’s jobs report was scary, mostly because we saw a big jump in the unemployment rate. The worry was that this was a step change in the labor market’s cooling - from the slow, gradual deterioration we’d seen earlier this year to a more disorderly, recessionary dynamic.

The good news is that today’s jobs report put the worries of such a step change to rest for the time being. But that’s about the extent of the good news. The labor market is still gradually getting worse, month over month, and even though the incremental changes are small, they’re adding up. If we end up with an unemployment rate north of 5%, it won’t matter how we get there.

That said, there’s one a massive advantage of a slow deterioration relative to a fast one: early on, there’s time for policy to react and avoid an unhappy ending. Folks who think the Fed is “behind the curve” have more and more evidence on their side, but the labor market is currently giving the Fed breathing room to catch up.

I’ll wrap up this somewhat downbeat “big picture” with an emphasis on the importance of ongoing dynamics. The job market is no longer “hot” (and it’s hard to find a job), but it’s not bad by any means. I think “meh”, “lukewarm”, or “OK (derogatory)” are all good shorthand. If we just stopped here, that would not be the worst thing in the world. But it seems very unlikely, given ongoing trends, that we will stop here - we’re headed toward a near-term unemployment overshoot, even with relatively optimistic beliefs about Fed easing. I’m crossing my fingers it will just be a small one.

2. Details of Interest Within the Report

A. Employment vs. Unemployment

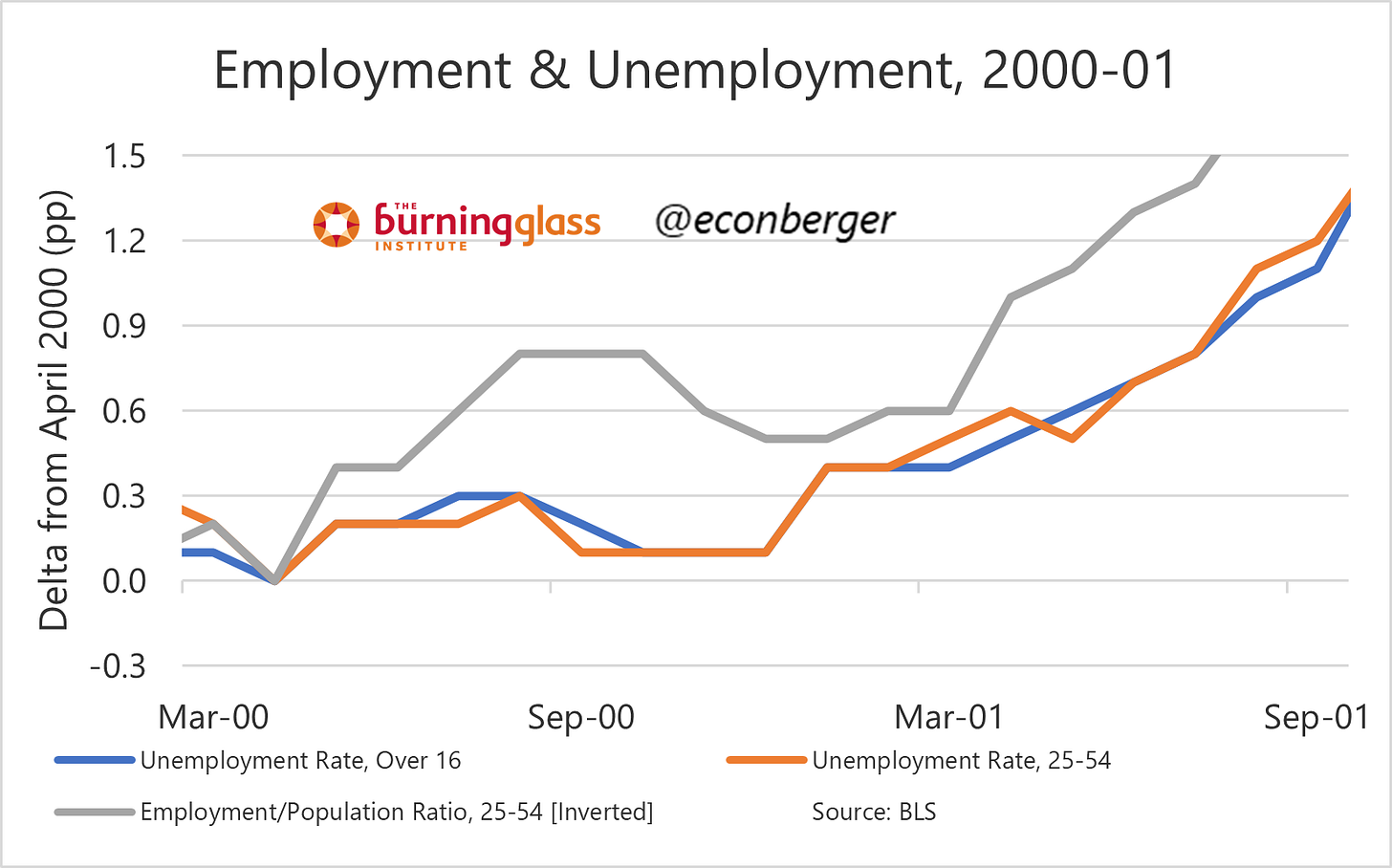

One of the ongoing mysteries of the monthly jobs report is that we’ve seen a substantial increase in unemployment, but no corresponding decrease in employment.

I haven’t seen a perfect explanation for this1, but it’s an important phenomenon because it means the increase in unemployment is, on net, coming from people who aren’t previously employed - i.e. it’s about net entry into the prime working age labor force. And it makes the increase in unemployment less alarming, on balance.

As stated a few paragraphs earlier, this hasn’t happened in recent pre-recessionary periods. In 2006-08, there were modest early-cycle deteriorations in both employment and unemployment.

In 2000-01 the early cycle deterioration in both was more substantial.

My takeaway here isn’t that you should ignore either indicator; quite the opposite, you should take both seriously. The increase in unemployment is worrying; the resilience of prime working age employment is reassuring. Unless you have a really compelling joint explanation, you must conclude that the signal is somewhere in between.

The end of this section is a good opportunity to repeat my earlier warning about dynamics. The fact that prime working age employment has held up so far is not a guarantee of future performance. I’d be surprised if we see it hold strong even with further increases in unemployment.

B. The Composition of Unemployment

The BLS is kind enough to provide “reasons for unemployment” which we can use to decompose unemployment. And when you decompose the large increase in the unemployment rate we’ve seen since January (0.56 percentage points), you see some interesting/surprising things.

The first is that unemployment due to permanent layoff has not budged recently. This is significant because in the 2000-03 and 2007-09 labor market cycles, it was by far the biggest contributor to the total unemployment increase.

And this is not just a late cycle thing. In early stages of the 2007-09 and 2000-03 cycles, permanent layoffs were playing a more significant role than they are so far in this one.

If the labor market keeps cooling, I don’t see this relatively reassuring pattern continuing. At some point falling hiring, even without a pickup in layoffs, will lead the ranks of the permanently unemployed to increase.

I also think it’s worth discussing re-entry which is a mixed bag. Labor force entry can be a positive force - and given the strength in prime working age employment, that possibility deserves some weight. Another, darker possibility: these are folks who were laid off previously, and are switching in and out of job search. As the tables above show, this was an important phenomenon in both the 2000-03 and 2007-09 cycles, albeit much less than unemployment due to permanent layoffs.

I’ll conclude this section by making my plug for the jobless claims data. A lot of people have been too dismissive of this indicator recently as “broken” because it hasn’t matched the overall rise in unemployment. But it’s doing a pretty good job matching unemployment due to permanent layoff - as you would expect given the nature of both data series! It’s nice when entirely different data sources are telling you the same thing.

C. Nonfarm Payrolls - How Fast Are They Growing?

I haven’t spent much time thinking about nonfarm payrolls recently. I don’t think the pace of payroll growth adds a ton to our understanding of the labor market once we take all these great household survey ratios into account.

But also: I think we have to worry about future downward revisions to the establishment survey job counts - so that recent “ok” job gains in the low triple digits might eventually turn out (post-revision) to be “weak” job gains in the mid-to-high double digits.

We know from the BLS’s preliminary benchmark estimate that job growth during the year from March 2023 to March 2024 was lower than previously estimated by 818K. We don’t know much about revisions to job growth after that. But it’s a distinct possibility that it will also get revised downward - because a lot of the erroneous assumptions about pre-March-2024 job growth are probably persisting into the post-March-2024 data.

This isn’t a very scientific analysis - it’s just a (somewhat informed hunch). But I urge caution using nonfarm payroll estimates of post-March-2023 job growth until we get the annual revision early next year.

Immigration might be at least a partial explanation - we’re seeing a lot of people come in who engage in job search. But other features of the unemployment data make me skeptical it’s immigration alone.

You are a fanatic analyst. I love reading your work. Please keep it up!

Hi Guy. I read all your posts on Twitter.

First time I read your analysis here on Substack.

I am impressed with your writing abilities in transmitting information and insights to the reader. All very comprehensible.

Thank you.