TL;DR: The most likely outcome for 2024 is a soft landing for the US labor market. Unemployment will remain low and job gains will continue, but Federal Reserve vigilance about inflation will put a soft ceiling on labor market strength.

In the rest of this piece, I’ll talk about (1) my baseline expectation for the state of the US labor market during 2024, (2) downside risks, and (3) upside risks.

1. Baseline: Soft Landing, Then Taxiing on the Runway

The single most significant macroeconomic development of the past 12-15 months has been a significant cooling in inflation, from “far above the Fed’s target” to “just a moderate/little bit above the Fed’s target”. And this significant cooling has happened with only a tiny negative impact on unemployment.

To paraphrase a former Vice President, this is a big deal. In the summer and fall of 2022, when the inflation crisis was near its peak, a lot of smart folks were convinced that you couldn’t get inflation down without a recession and a meaningful surge in unemployment.1 2

The experience of the past year has debunked that mainstream opinion, and instead replaced it with a widespread-but-not-universal believe that we’re headed for a soft (or at least soft-ish) landing of low inflation and low unemployment. Even the Fed is now on-board:

It’s true that the inflation problem is not yet fully solved; the Fed will keep policy restrictive rather than neutral until inflation is back to 2%, and perhaps a little past that point, to be sure they’ve put the genie back in the bottle. But the appropriate policy stance with a small inflation problem is very different than the appropriate policy stance with a big inflation problem; the Fed now has room to be patient, something they sorely lacked 12-18 months ago.

A few weeks ago Federal Reserve Governor Christopher Waller said:

“[If the decline in inflation continues] for several more months ... three months, four months, five months ... we could start lowering the policy rate just because inflation is lower… It has nothing to do with trying to save the economy. It is consistent with every policy rule. There is no reason to say we will keep it really high."

Another frame is how the Fed approaches recession risk. When inflation was running at 5%-6%, you could imagine the Fed pondering, “we hope we can get inflation back down without a recession, but disinflationary monetary policy that causes elevated risk of recession is a necessary evil.” With inflation running at 2.5% or below, the Fed will be far less eager to run that risk.

Of course, that’s why we have reason to be relatively optimistic about avoiding a bad outcome (recession, spiking unemployment). But we probably shouldn’t be too optimistic about what comes after. The soft landing I’m describing is one where the Fed will keep policy somewhat restrictive for quite a while, initially to get inflation the rest of the way to 2% and then to be sure it stays there. We’re going to spend time, maybe a lot of it, “taxiing on the runway”.

What this means from a labor market perspective is “balanced growth” :

A historically-very-low unemployment rate that’s flattish or going down only a little. (I’ll be surprised, for instance, if we finish 2024 with an unemployment rate closer to 3% than 3.5%.)

Hiring and quits growing slowly, in proportion with employment

Layoffs remaining muted.

Moderate employment gains, keeping up with population growth. It wouldn’t surprise me if prime-working age employment creeps up, but probably at a pace comparable to the late 2010s rather than what we’ve seen in the post-pandemic period.

Moderate nominal pay growth that exceeds inflation, but only by a little.

2. Downside Risks

I see two major sources of downside risks to this forecast, a policy accident and a resurgence of inflation.

2a. Oops, I Caused a Recession

One thing we’ve been lucky about so far is that the cooling of the labor market has been very gradual - job growth, wage growth, hiring, quits, you name the indicator, it’s come down relatively smoothly. That’s been useful in properly calibrating monetary policy - the Fed’s been able to turn up the thermostat without “breaking” anything, and will hopefully be able to turn it down gradually too.

But what if something breaks? The story here is pretty straightforward: there’s some sort of latent problem hidden within the macroeconomy or financial system that’s already set a recession in motion or (if the Fed doesn’t move quickly enough) will set a recession in motion soon. In the “something breaks” narrative, the Fed reacts by easing policy, but too late to avoid a recession.

As far as latent problems hidden within the macroeconomy severe enough to trigger a recession, I’m pretty skeptical these currently exist. The most dangerous is a negative feedback loop where rising unemployment begets more rising unemployment, but we don’t yet see signs of such a loop underway. Most evidence suggests the labor market is fairly stable and not yet close to a tipping point.

I do think it’s possible that overlooked financial stress somewhere in the system could do it - overvalued illiquid assets that suddenly mark to market could be the trigger. Candidly, I don’t have a good handle as a labor market economist to judge how serious the risk here is - except to observe that the sudden implosion of several large regional banks in early 2023 had only a minimal impact on the economy.

For what it’s worth, in this scenario I anticipate the Fed easing more aggressively than under the baseline - i.e. we’ll have a brief but real downturn and then a relatively brisk recovery due to countercyclical monetary policy.

2b. Resurgent Inflation / “No Landing”

Another hand-wavey but non-trivial downside risk! What if inflation stops moving toward the Fed’s target and starts creeping up again? In that case, Fed easing would come off the table and additional rate hikes would come into view.

This outcome seems relatively unlikely to me, but inflation has consistently surprised the broader economics profession over the past 3 years and our certainty about its trajectory should be low.

While a recession wouldn’t be immediate in this case, risks of a downturn in the second half of 2024 or first half of 2025 would increase.

3. Upside Risks:

I view two sets of upside risks to the baseline, one bad (“overheating”) and one good (“miraculous inflation downshift”).

3a. Overheating

This is a variant of scenario (2b), in which the explanation for why inflation is increasing again is that the economy heats up more than expected! I’ll throw out there that the economy reaccelerated in 2023 and inflation still came down a lot, but I don’t think this scenario is outlandish, just unlikely.

3b. Miraculous Inflation Downshift / “Goldilocks”

In my opinion this is the most intriguing possibility of all - inflation doesn’t just come down a little further, but actually goes down enough to convince the Fed to loosen the “growth lid” I mentioned in the baseline discussion.

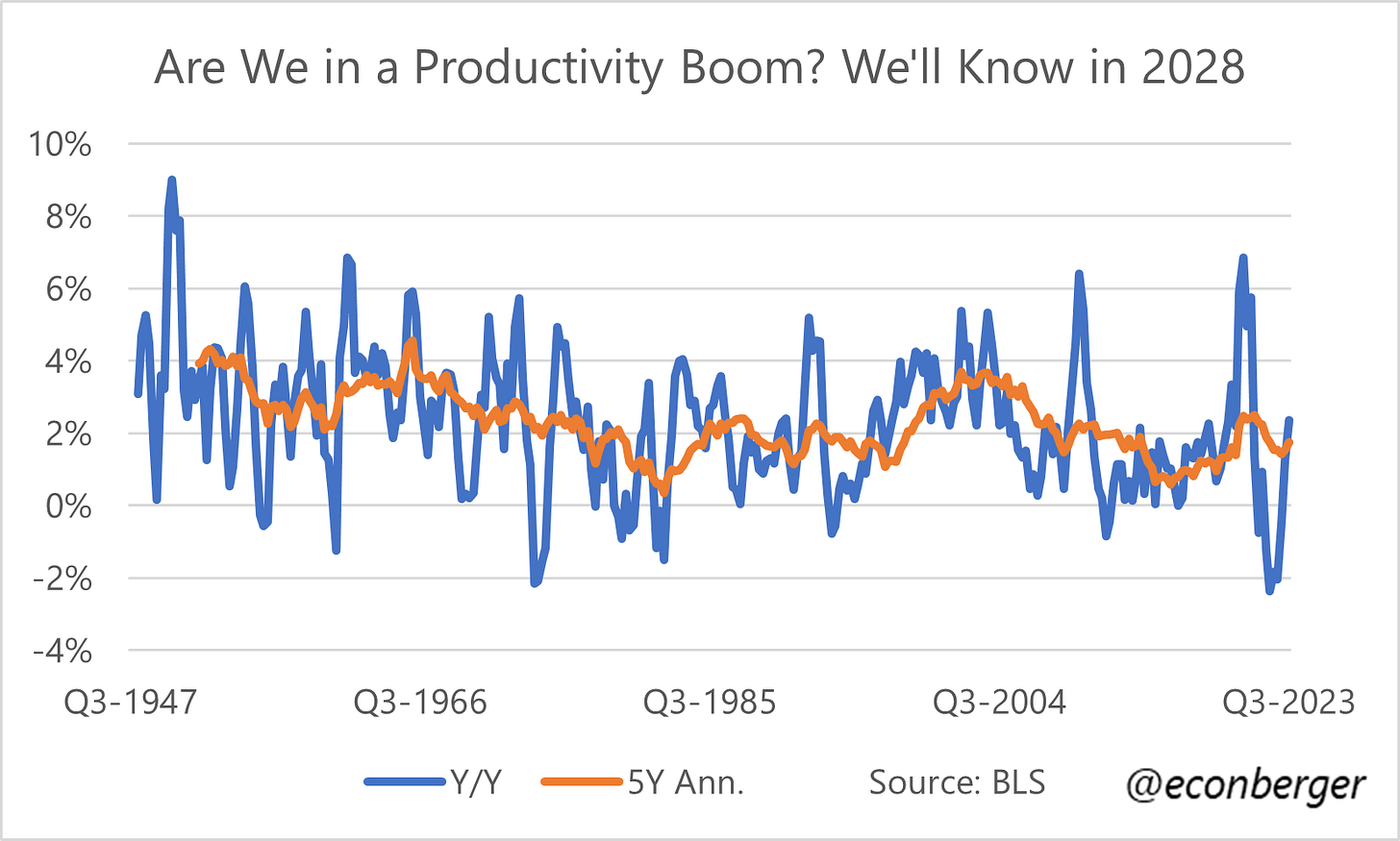

One possibility is that the recent strength in productivity growth, rather than being an unwinding of post-pandemic problems, actually is the 1st inning of a sustained productivity boom that allows for sustained, above-current-trend strength in the US labor market.

In some ways, the Federal Reserve’s recent success in lowering inflation with minimal unemployment impact echoes an earlier and easier soft landing, by the 1994-95 Greenspan Fed. That landing was followed by the greatest American growth & jobs boom of the post-1970 era. I hope we’re that lucky again.

Also, some less smart people like… me.

Kudos to the minority who challenged this consensus. A few I can think of: Claudia Sahm, Skanda Amarnath, Adam Ozimek, Julia Coronado, Dan Andolfatto, the Goldman Sachs economics team, Federal Reserve Governor Waller… sorry if I forgot to include you.