Why I'm Only a Little Worried About Hiring

A reply to Dean Baker

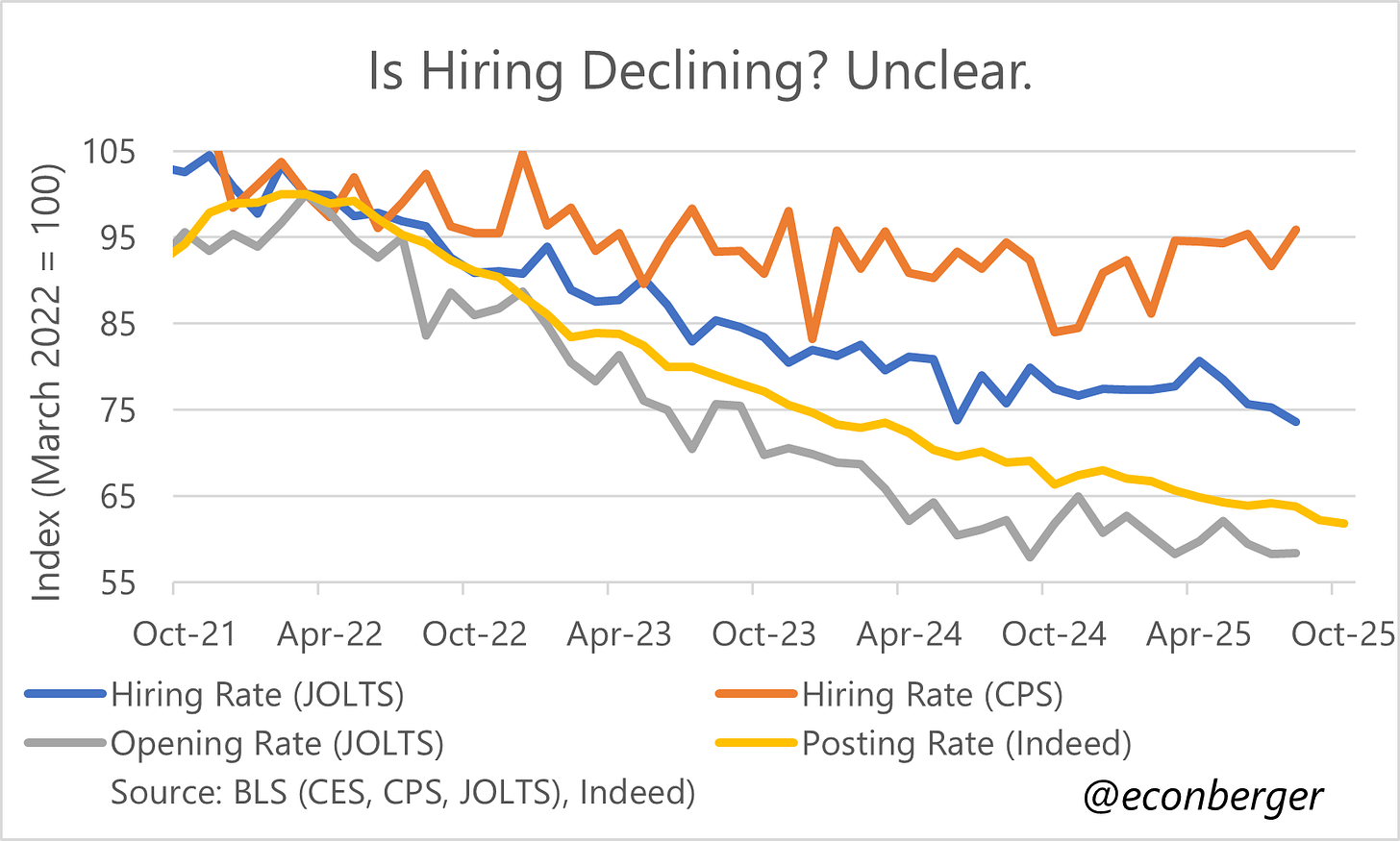

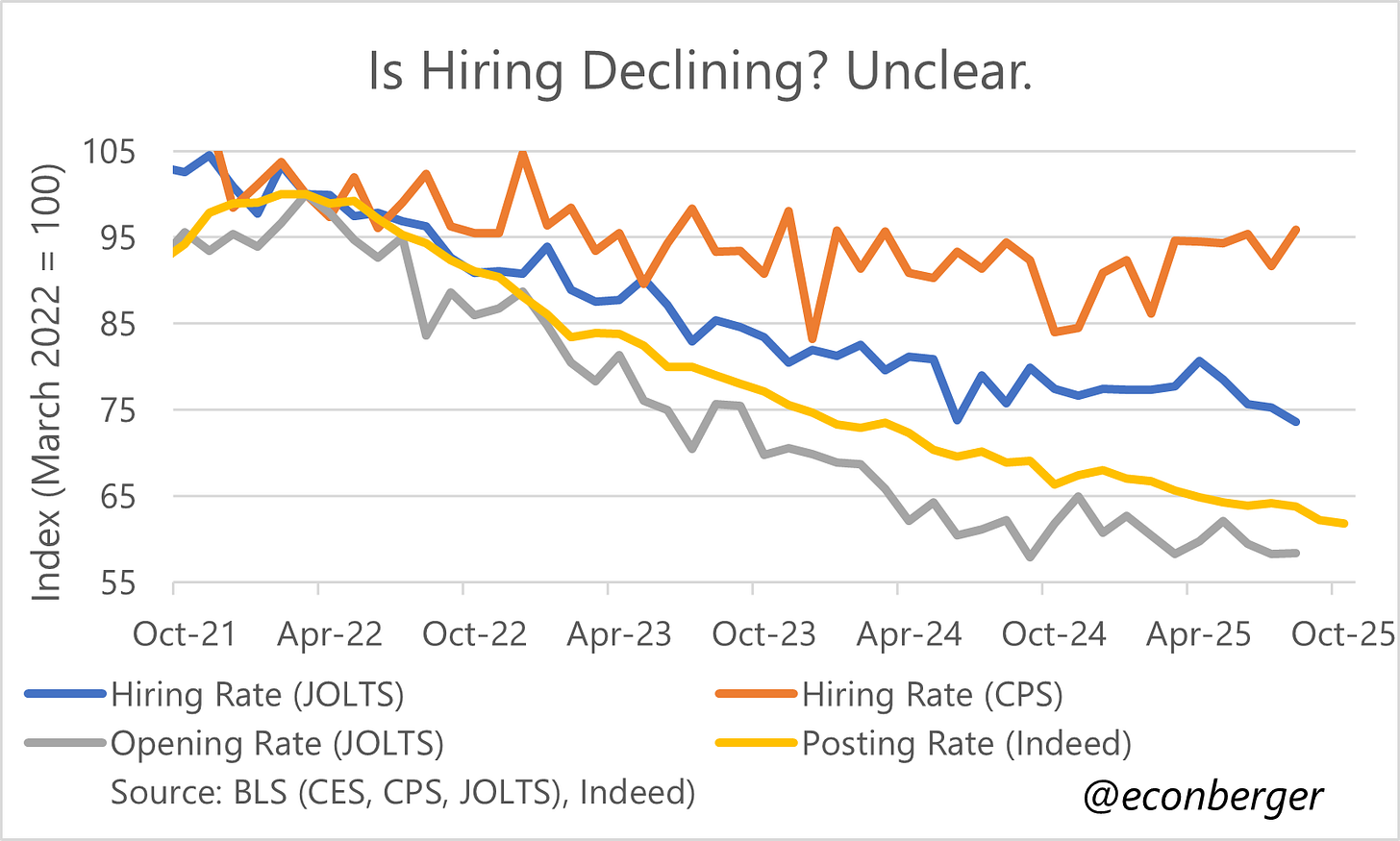

TL;DR: The labor market data we’re getting during the shutdown is consistent with, at worst, a mild weakening in hiring (and possibly no weakening at all).

This post covers:

A Friendly Disagreement

Why I’m Only a Little Worried About Hiring Right Now

On the Indeed Data

More below chart.

1. A Friendly Disagreement

A few days ago, Dean Baker responded to my most recent High Frequency Labor Market Indicators post with some very kind words as preface to a disagreement on the state of the labor market:

Where I differ with Guy is his more generally sanguine view of the state of the labor market. Guy points to the weekly data on unemployment insurance, where both initial and continuing claims show no major upticks. This is important evidence that there has been no big uptick in layoffs.

But I am more concerned about the other side of the story. It looks like hiring has fallen off. My main piece of evidence here is the Indeed hiring index. Guy also points to this index but says that we are just on the same downward slope we’ve been seeing for the last three and a half years.

First off, if you don’t follow Dean, you should! He’s a legend in “practical macroeconomics” (I encountered him via Brad Delong’s blog back when blogs were a thing), and an influence on my career.

Second, I’ll high-five a key point he makes on the importance of hiring relative to layoffs in explaining what’s going on in the labor market (and what’s gone on since early 2022). Weakening hiring rather than rising layoffs has driven most of the cooling we’ve seen. So stable and low layoffs, on their own, are not that reassuring.1

But he and I disagree on the interpretation of the data to date, and I think it’s worthy writing more at length about my perspective.

2. Why I’m Only Worried a Little About Hiring Right Now

Let’s start with a really basic point: there’s nothing in the messy post-shutdown data that suggests, at least from the perspective of labor market slack, a big change in labor market trends. I covered a lot of indicators in my most recent Friday round-up. Some of them have gotten a little worse during the shutdown, some have not - but they generally look like a continuation of what was going on before the shutdown.

Now, it’s true that none of them measure hiring directly, but most if not all are downwind of it. For example, continuing claims (unlike initial claims) can go up due to rising layoffs, but they can also go up because weak hiring causes a “backup” in exits out of the claimant pool. And indeed, during a 2.5 year period when initial claims have been pretty stable, continuing claims have risen modestly.

If hiring had taken a significant turn for the worse during the shutdown, I’d expect we’d see (1) a break in these trends and (2) a clear worsening across almost all of the data. Granted it’s only been 1-2 months without government data. Maybe it would add up over a longer stretch of time, and worse things could be around the corner.2 But I’m quite sure that once things take a substantial turn for the worse in the labor market, we’ll know it, BLS data or not.

I think the most reasonable conclusion is that any additional recent weakening in hiring has been, at worst, small.3

3. On the Indeed Data

I cannot heap enough superlatives on the Indeed data - along with ADP, they set the standard for what private sector labor market data creation should look like. They’re transparent, they measure a straightforward and useful concept, and they publish their data for all to use.

That said, it’s important to understand that Indeed’s job postings have subtly diverged from related BLS measures over the past 12-16 months, and that we should be careful in inferring from them that hiring is cooling right now.

Let’s start with the points of agreement - from early/spring 2022 through some point in 2024, most key labor market metrics agree that the labor market was cooling. They disagree on the magnitude - the CPS hiring-from-unemployment rate4 declined by 10-15%, the JOLTS measure by about 20-25%, and job postings measures (which don’t measure hiring directly) by 35%-40%.

But more importantly for this post and my disagreement with Dean, they disagree about what happened after the summer/fall of 2024. The CPS and JOLTS measures all leveled out for an extended period;5 the Indeed job openings just kept creeping down slowly.

So my take here is that slowly falling Indeed job openings were, for much of the past 12-16 months, consistent with stable hiring. They do not signify, on their own, a further decline in hiring activity. That doesn’t mean a small further decline in hiring over the last month or two is impossible or even unlikely, but just that I’d need to see further evidence to be convinced - and that I really doubt there’s been a big slide.

Anyway, I appreciate Dean challenging me on this, as an opportunity to explain my perspective more clearly. I really hope I’m right and he’s wrong, because it would be bad if the labor market is taking a more substantial turn for the worse.

Though of course, the alternative, rising layoffs, is much worse!

Folks sometimes criticize me for not being sufficiently forward-looking. Fair enough! But I think it’s useful to be precise and clear-eyed about what the data currently says.

I’m pretty comfortable ruling out an increase in hiring. So we’re really talking about a range of scenarios from “hiring stable” to “hiring falling slightly”.

More explicitly, flows from non-employment into employment. This excludes one key dimension of hiring - job-to-job transitions - but these stabilized in 2023.

There’s a small dip toward mid-summer 2025 in the JOLTS data. We don’t know what has happened since, but the “totality of the data” makes me skeptical we’ve seen a further slide since.