I’m probably not a good book reviewer, but I enjoy writing about books I like! You can read my prior reviews here:

Being a parent means you’re constantly behind on reading; I have a book list that I put together 4(?) years ago, mostly on economic policy topics, and at least some of the books there may no longer be relevant. But Trade Wars Are Class Wars, published in 2020, may actually be even more relevant now than when it first came out.

Before talking about the book, a word about the authors. Michael is a Prof of Finance at Peking University in Beijing; Matt is a recovering(?) journalist who has an excellent data-based international macro substack called The Overshoot. I don’t know Michael personally, but I do know Matt a little, and through various conversations with him (as well as reading his writing), I was familiar with a lot of the theses in this book before actually reading it. Just a few sentences ago, I mentioned this book is particularly relevant right now, because we’re in the early stages of what is almost certainly the largest trade war of the past 90 years. The United States has imposed high tariffs on its major trading partners, is planning to impose more, and there’s a good chance that the dynamics of the war will proceed less by current plans than by the unpredictable logic of escalation.

Klein and Pettis aren’t fans of this approach (at least based on my reading of their recent work, which post-dates this book), but they do agree on one rationale for it: international trade is significantly imbalanced, the imbalances are due at least in part to bad policy decisions by large trade surplus countries, and these imbalances are harmful to both surplus and deficit countries. There’s also a supporting argument that, while free trade proponents often base their arguments on comparative advantage, real world trade flows are often driven by entirely distinct forces which are mostly financial in nature.1

One thing I did not take away from the book is the argument “trade imbalances are inherently unnatural and generate adverse consequences”. But the argument that Chinese and German (after the mid-2010s, *continental European*) trade surpluses are a result of consciously-undertaken policies, and that these policies have undesirable effects on deficit countries (either excess unemployment or financial instability) and surplus countries (depressed standards of living), strikes me as convincing. And that raises questions about what to do about it in a world where the power of multilateral institutions, never sufficiently strong even in the best of times, is eroding rapidly.

I was not entirely convinced by Matt and Michael’s arguments that US deficit reduction would be ineffective in reducing the current account deficit. After all, Germany managed to convince the rest of the Eurozone to tighten its belt, shifting much of continental Europe into surplus. But I do concur that the experience of the 2001-07 period, when capital fueled a giant credit bubble in the US (and other countries), means this isn’t a panacea.

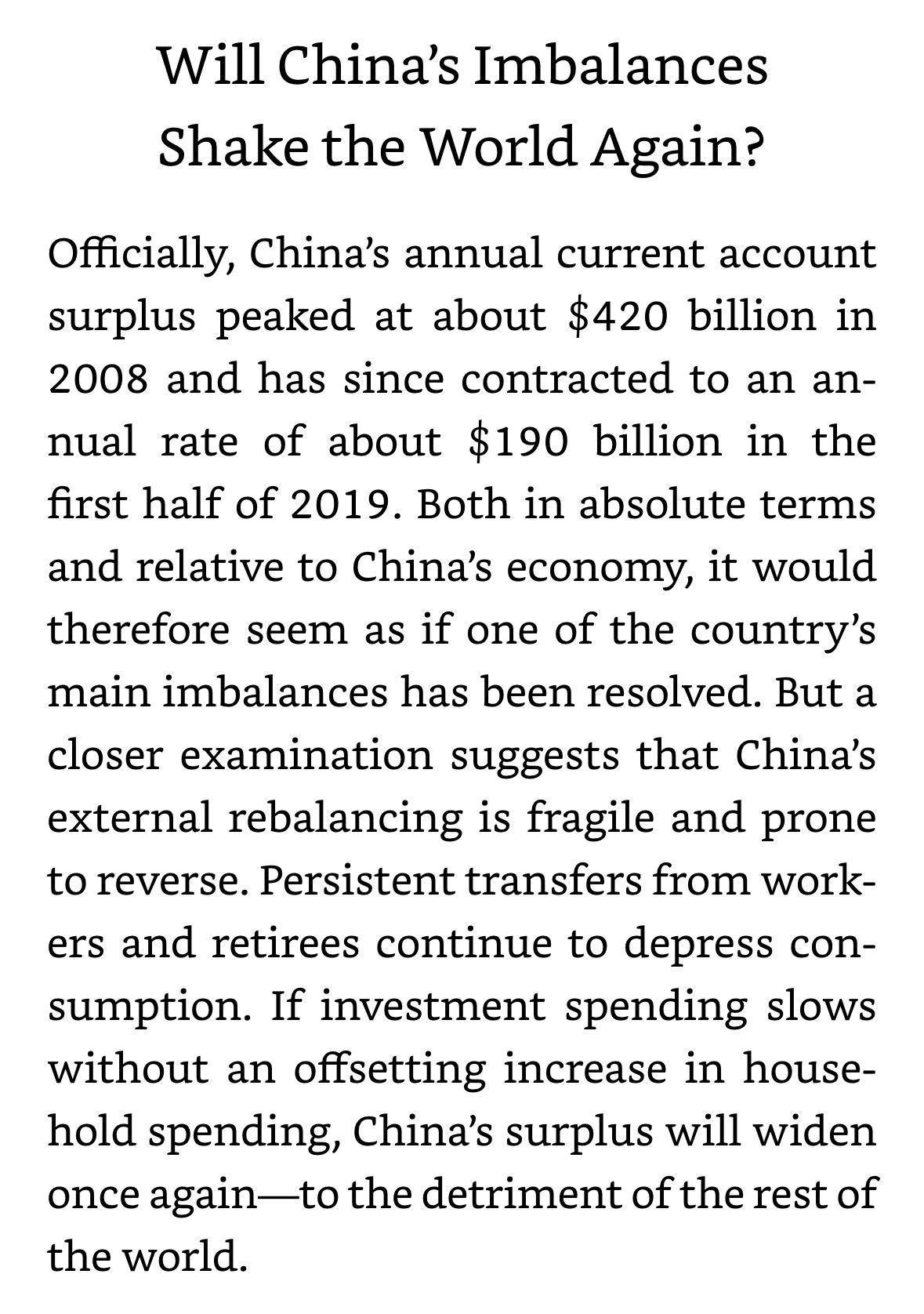

In the end I’m left scratching my head at whether anything can be done without big policy changes undertaken by major surplus countries. Is persuasion of their policymakers the best we can hope for? Some of the savvier proponents of a temporary increase in tariffs argue that, even if these tariffs are bad “on the merits”, they can be useful in engineering this “persuasion”. Setting aside whether a “persuasive” trade war has any resemblance to the one actually being pursued, I remember being struck by this passage in the book, which has proven quite prophetic:

I’m not a geopolitics guy, but my informal interpretation is that China’s post-pandemic relapse into export-fueled growth is at least in part a function of deteriorating international cooperation. It would be unfortunate if the proposed solutions enacted by real world politicians to the challenges highlighted by the authors only end up making those challenges worse.

On this point: this doesn’t mean that comparative advantage doesn’t matter, but it does mean that certain goods and services where comparative advantage is relatively narrow might switch from exports to imports depending on macroeconomic forces.