TL;DR: Layoffs are modestly higher than a year ago; Chair Powell and the rest of the Fed are scratching its head at all the uncertainty.

1. Claims for Unemployment Insurance

The news on this front is the same as it was last week. Alarmist warnings about federal government layoffs' impact on the labor market have not yet materialized. Things are a little weaker for sure, with bigger impacts locally, and more could be coming.1 But nothing looks recessionary or even close to it on a national level.

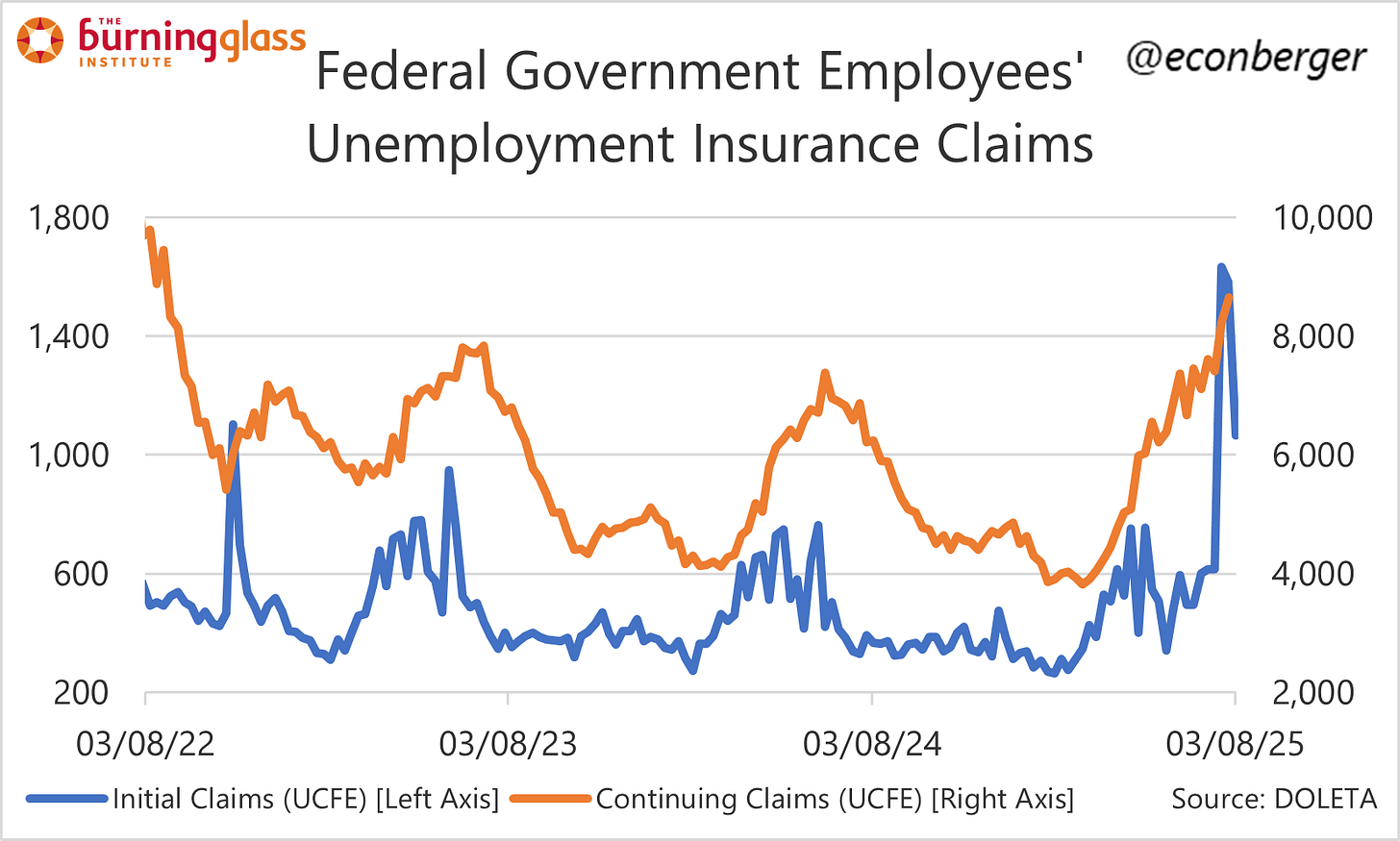

When it comes to unemployment compensation for federal employees (UCFE), initial claims are elevated but not rising further (indeed, the latest data was a 3 week low). There’s plenty of evidence that more is coming, and continuing claims are rising, but the numbers are still quite small in aggregate.

In the “regular” (non-federal-worker) data, we’re seeing notable increases in initial claims for both DC and Virginia. These could reflect contractors, employees at entities that depend on federal money, or 2nd order effects (laid off federal workers have less spending power to support private sector employment). But the numbers, as with UCFE, are still quite small.

Overall, regular initial claims are above year ago levels, consistent with other data sources on layoffs. It’s not clear whether the increase is ongoing, or was a one-time persistent increase in the 2nd half of 2024. And it’s still relatively small - I’m mildly concerned, not seriously worried.

Continuing claims have been flat recently, but are up a small amount (about 5%) relative to a year ago. I’m not sure how much I trust the seasonal adjustment process - as with initial claims, was this a one-time persistent increase, or is it an ongoing deterioration?

Finally, my nowcast for “unemployment due to permanent layoff” appears to be flat in early March. I think this will be a mild undercount since it doesn’t include UCFE.

2. FOMC Meeting: “What Would You Write Down?”

Just like everyone else, the Fed has uncertainty on its mind. I personally find this situation to be frustrating - I know a decent amount about the labor market but not much about politics, and would much rather spend time thinking about the former than about the latter. But here we are.

The only change to its assessment of the economy in the policy statement mentioned it:

And if you look at the projections the Fed published, they believe uncertainty about future labor market outcomes has gone up (and risks are now more weighted to the upside).

My absolute favorite part of the press conference was when the Wall Street Journal’s Nick Timiraos asked about the projections and Powell answered:

So people, not everybody, but on balance people wrote down similar numbers. The changes aren't that big. The other factor though, as I mentioned, is just really high uncertainty. What would you write down? I mean, it's just, it's really hard to know how this is going to work out and again.”

What would you write down, indeed.

Another thing I really liked that Powell stated was his schema for thinking about policy - the “four areas” approach is a good one, as is the “net effect” criterion.

Looking ahead, the new Administration is in the process of implementing significant policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation. It is the net effect of these policy changes that will matter for the economy and for the path of monetary policy. While there have been recent developments in some of these areas, especially trade policy, uncertainty around the changes and their effects on the economic outlook is high.

At this point you’re probably sick of me singing Powell’s praises, but he’s also right about sentiment. If you read my work you know I spend a fair amount thinking about it in the labor market context (mostly about business plans to hire and household assessments on the difficult to finding a job). But in the end it’s just a potential means to predicting/interpreting hard data, not the hard data itself. Here’s what he said in response to the NYT’s Colby Smith:

The survey data, of both household and businesses, show significant rise in uncertainty and significant concerns about downside risks. So how do we think about that? And that's the, that is the question, as I mentioned the other day, as you pointed out, the relationship between survey data and actual economic activity hasn't been very tight, there have been plenty of times where people are saying very downbeat things about the economy and then going out and buying a new car. But we don't know that that will be the case here. We will be watching very carefully for signs of weakness in the real data.

I’ll wrap up this update with the new labor market projections. A small and temporary increase in the unemployment rate is anticipated this year:

A lot of folks have observed that many of the laid off workers are currently on administrative leave, and therefore won’t claim for a few more months.

I would like to ask whether the impact of Trump's deportation of immigrants has not yet become apparent?