TL;DR: Confounding expectations of another soft jobs report, September’s monthly missive from the BLS was unambiguously strong. It remains to be seen whether this is a blip in the cooling trend or an early sign of reheating - I lean toward the former.

Key Data Points:

Unemployment rate: fell to 4.1% (good)

Prime working age employment population ratio: unchanged at 80.9% (good)

Nonfarm payroll employment: rose by 254K (good, even after considering future revisions)

In the rest of this recap, I’ll discuss:

The Big Picture

Details of Interest Within the Report

More on Unemployment

The 20Somethings Get a Partial Reprieve

Immigration, Again

Full text below chart.

1. The Big Picture

If you’ve been unfortunate enough to read my labor market musings on a regular basis, you know that I’ve been mildly pessimistic in recent months. A wide range of labor market indicators has indicated labor market cooling that was still gradual (non-recessionary) but showed no sign of stopping. And as a result, I predicted that the unemployment rate would top out early next year somewhere between 4.5%-5.0%.

Then came the September employment report out of BLS and made a mess out of that thesis. It’s extremely hard to find any bad news in the report. Nonfarm payrolls grew at 254K and there were positive revisions to the prior 2 months; even considering the possibility that the weakness in the March 2024 preliminary benchmark estimate is carrying forward, we’re still talking about a solid number around 187K. The unemployment rate fell to a 3 month low of 4.1%. And a few other important details in the report also moved in the right direction, partly but not fully reversing deterioration seen since the beginning of the year.

There are several possible interpretations:

This is a blip in an overall deteriorating trend; it’s just one jobs report

This is an early signal of the labor market reheating

The labor market has been stable; the “mediocre, then good” sequence of reports is just noise

I’m landing tentatively on 1. The unemployment rate is still up a small amount relative to earlier this year; hiring and quits are down; consumers’ confidence about the labor market is down. I think the probability of the unemployment rate being higher in 3 months rather than it is today is more than 50%.

And even if 1 is correct, today’s report is still welcome news. We can think of the labor market as a “race” between a cooling trend and the Fed easing that is designed to stop it. Today’s data indicates that the Fed has more breathing space to win the race.

But 2 and 3 are definitely possible. And as a “full employment stan”, as long as inflation remains low, I’ll be delighted to be proven wrong.

For what it’s worth, if 2 or 3 are vindicated, it has implications for what the Fed is going to do. Their current projections are anchored around the labor market deteriorating a little further from where it was a month ago. What if that doesn’t materialize? Barring an offsetting “bigger/quicker than expected” improvement in inflation, we’re going to get fewer rate cuts from them.

2. Details Within the Report

a. More on Unemployment

One of my favorite “deep cuts” within the report is the BLS’s decomposition of unemployment into “reasons”. And those reasons allow us to see what allowed unemployment to fall in September.

One thing that didn’t budge: the most recession-sensitive component of unemployment, “due to permanent layoff”. This hasn’t moved since early this year! That’s good news. It also didn’t fall this month.

We did see declines in some of the categories that rose in recent months - new entrants, re-entrants, and “completed temporary jobs”.

I don’t have any big take on this decomposition; I just think it’s interesting. But one related take I do have: the jobless claims data is really useful, because it’s been nowcasting the “permanent layoff” component of unemployment really well:

b. The 20Somethings Get a Partial Reprieve

One of the biggest bright spots in recent employment reports has been persistently strong employment for prime-age workers. And one of the biggest counters has been that the current slowdown, with its combination of very low layoffs and weak hiring, is imposing the brunt of labor market cooling on younger workers; i.e., focusing on prime age workers was creating a blind spot.

The good news is that some of the deterioration in the labor market for people ages 20-24 that we’ve seen since the beginning of the year reversed in September. The bad news is that their labor market environment is still at least a little worse than it was a year ago.

c. Immigration, Again

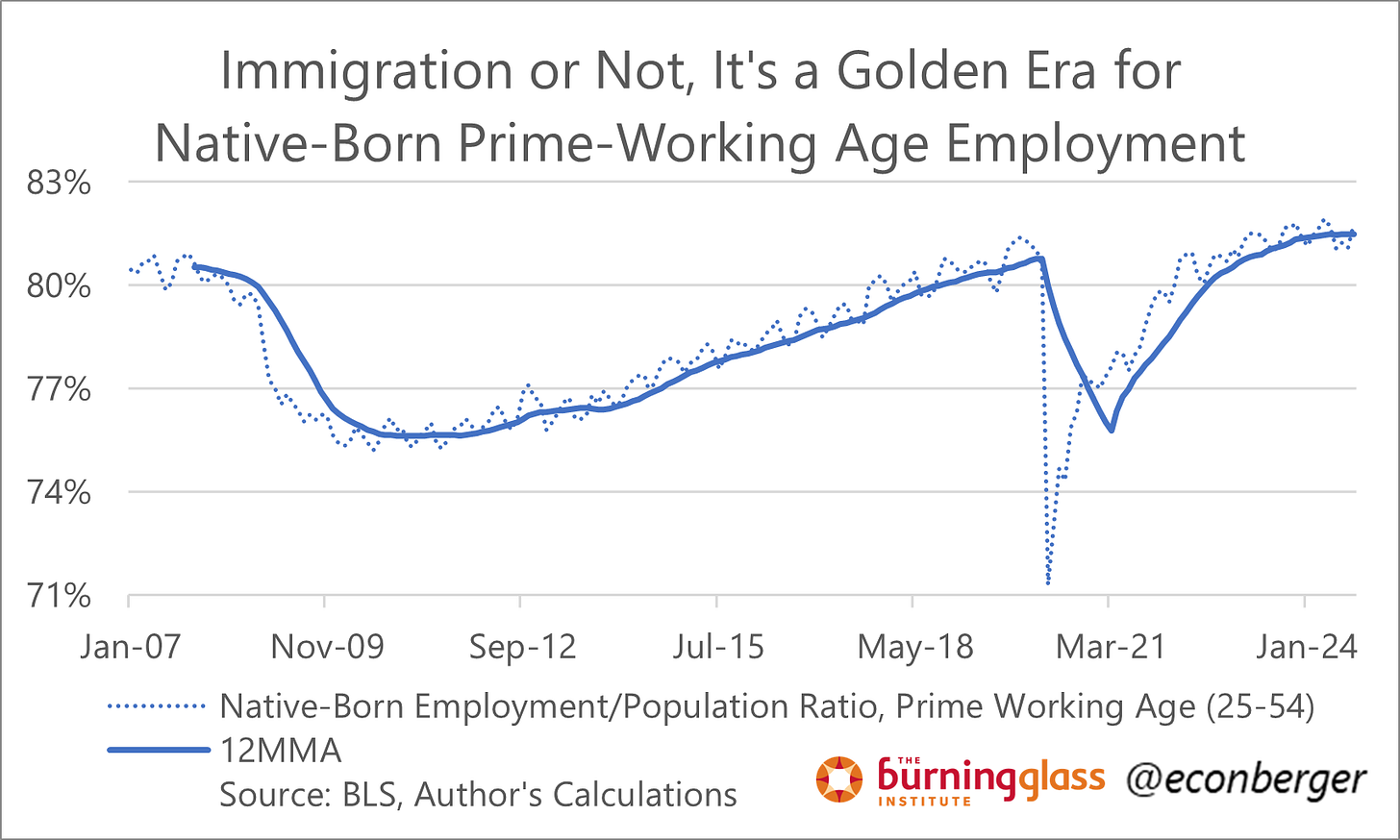

Every few months, someone looks at the Household Survey numbers, sees weak growth in native born employment and strong growth in foreign born employment, and runs with a “immigrants are taking all the jobs” story.

What this story is missing is that the US native-born population is aging, and as a result growth in the prime-working-age population is coming almost entirely from immigrants.

Once you adjust for this, you reach a very different conclusion for the prime working age labor market. Over the past 12 months, the share of prime working age native born Americans with a job has averaged 81.5%, the highest since data began in 2007.

We have seen a very small decline in the share of prime-working age foreign born Americans with a job. This may just be a supply side effect.

There is a devil in the details. Employment relative to population is down.

https://substack.com/@peternaylandkust/note/c-71702165?r=2w9z3a&utm_medium=ios&utm_source=notes-share-action