TL;DR: Barring a change in the policy mix, we’re likely entering a period of renewed cooling in the labor market.

This preview is split into two parts:

The Big Picture

Tracking the Relationship Between AI Adoption and Employment Growth

More below chart.

1. The Big Picture

March’s jobs report will probably be OK. Job gains will be positive, maybe the unemployment rate will be flat or maybe it will go up a little.

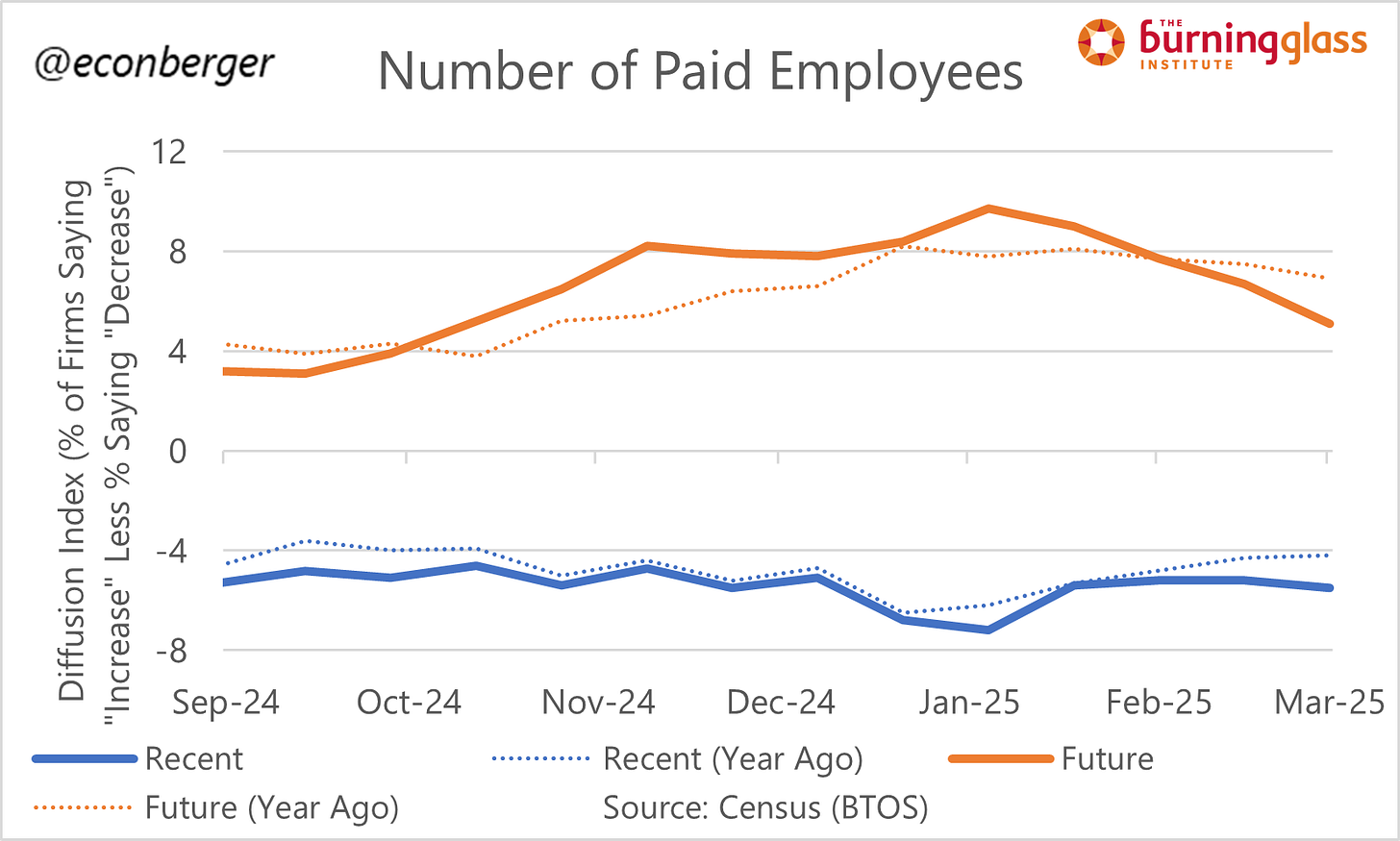

But I think you should be worried about what’s coming: higher unemployment and lower employment. After several months of post-election optimism, US companies’ headcount plans have once again become pessimistic… and the latest data we have in hand on these plans predates the massive, comprehensive tariffs announced on Wednesday. Additionally, it looks like firms are already putting those more downbeat plans into action.

A lot of macro discourse has emphasized the very real surge in policy uncertainty. But the recent pessimistic turn isn’t just about uncertainty - it’s also about negative effects from policies actually being implemented. The tariffs are a big tax hike that, whatever the impact on inflation, will put a sizeable dent into economic growth.

I’ve seen some alarmist takes on that growth dent, comparing it to the COVID shutdown or to the Lehman Brothers collapse. I think that’s too pessimistic. But at this point a protracted low-growth slog seems like the optimistic case and a recession is a very realistic possibility. In either case, I’d expect the weakness to manifest itself gradually over the next few months.

I’ll wrap up this downbeat assessment with a few “silver linings”. (II don’t know if any of these are actually “good”.) The first is that Congress is planning a big unfunded tax cut which may offset the drag from higher tariffs. The second is labor force growth: the administration’s aggressive actions on trade may be echoed with aggressive actions on immigration, which could tighten labor markets (while slowing employment growth). And the third is the Fed’s reaction - depending on their assessment of tariff’s impacts on medium-term inflation, they may offset some weakness with lower rates.

2. Tracking the Relationship Between AI Adoption and Employment Growth

I’ve started building out a suite of data tracking the relationship between artificial intelligence adoption and employment growth. Every 2 weeks, the Census Bureau publishes the wonderful Business Trends and Outlook Survey, which asks firms about a bunch of things including employment and AI usage. Conveniently, this survey disaggregates data by industry, which allows us to rank them by planned AI adoption.1

Applying this ranking to the monthly nonfarm payroll employment data (private sector only) allows us to see how much each group contributes to monthly employment growth.

We can also see how much each industry group has grown cumulatively over a period of time - for instance, since the November 2022 launch of ChatGPT 3.5. (Spoiler: there’s no obvious relation between AI adoption and employment growth.)

And finally, we can look at pay growth by industry group:

I don’t anticipate any immediate insights from these, but plan to update regularly. And in a few weeks, I’ll share them as part of a broader overlay analysis of AI adoption across the US labor market. Stay tuned!

I used the percentage of firms saying they don’t plan to use AI in the next 6 months because that question generated numbers for the broadest set of industries. However, a ranking based on the percentage of firms saying they DO plan to use AI in the next 6 months would be very similar, as would a ranking based on the percentage of firms saying they did or did not use AI in the last 2 weeks.