TL;DR: Today’s BLS jobs report, a snapshot of the labor market in early/mid-April, was a solid/decent one. Early effects from the trade war are starting to show up in the data.

Key stats:

Unemployment rate: rose a small amount, from 4.15% to 4.19% (ok)

Prime working age employment population ratio: rose to 80.7% (very good)

Nonfarm payroll employment: rose by 177K (very good, but large revisions to prior months)

This recap is split into 4 parts:

The Big Picture

Key Data Roundup

Early Signs of The Trade War’s Impact

Tough Times for the Young

More below chart.

1. The Big Picture

I wrote in my preview that I thought this would be a decent report, and that turned out to be right. The share of prime working age Americans with a job rose to 80.7%, a 3 month high; we had a solid increase in nonfarm payroll employment of +177K;1 and the unemployment rate rose modestly. If we didn’t know anything about policy, we might have reason to think this could go on indefinitely - and that wouldn’t be a bad thing.

But as I keep saying over and over, trade policy is going to adversely impact the job market. In fact, if you look at section 3 in this writeup, it’s already starting to do so, albeit on a very small scale so far (and ironically, in a flattering way). How long that process will take, or how gradual it will be once it gets going, I don’t know. The best we can do is keep watching the data, trying not to overreact to noise / underreact to signal.

2. Key Data Roundup

My first pass at this section was a bit of a laundry list, and it still kind of feels like that, so let me summarize: this is a decent labor market. Maybe it’s cooling a little, maybe it’s steady. Some data points are great, others are mediocre; some are moving a little in the right direction, others are moving a little in the wrong direction. In a few months we’ll probably be looking back at it with warm nostalgia.

Let’s start with nonfarm payroll employment. It increased by 177K in April, though there were downward revisions to February and March (-58K) and there are reasons to expect downward revisions (unclear how big) in the coming months. Another thing to keep in the back of your mind: labor supply growth has slowed sharply over the past year (less immigration) and we’d expect the slack-neutral rate of employment growth to be substantially lower as a result. Last year I constantly gave the advice “pay attention to the household survey ratios more than to NFP” and it still holds.

Speaking of the ratios, the unemployment rate inched up to 4.19% from 4.15%. It’s moving on the track the Fed projected two months ago, almost on the dot.

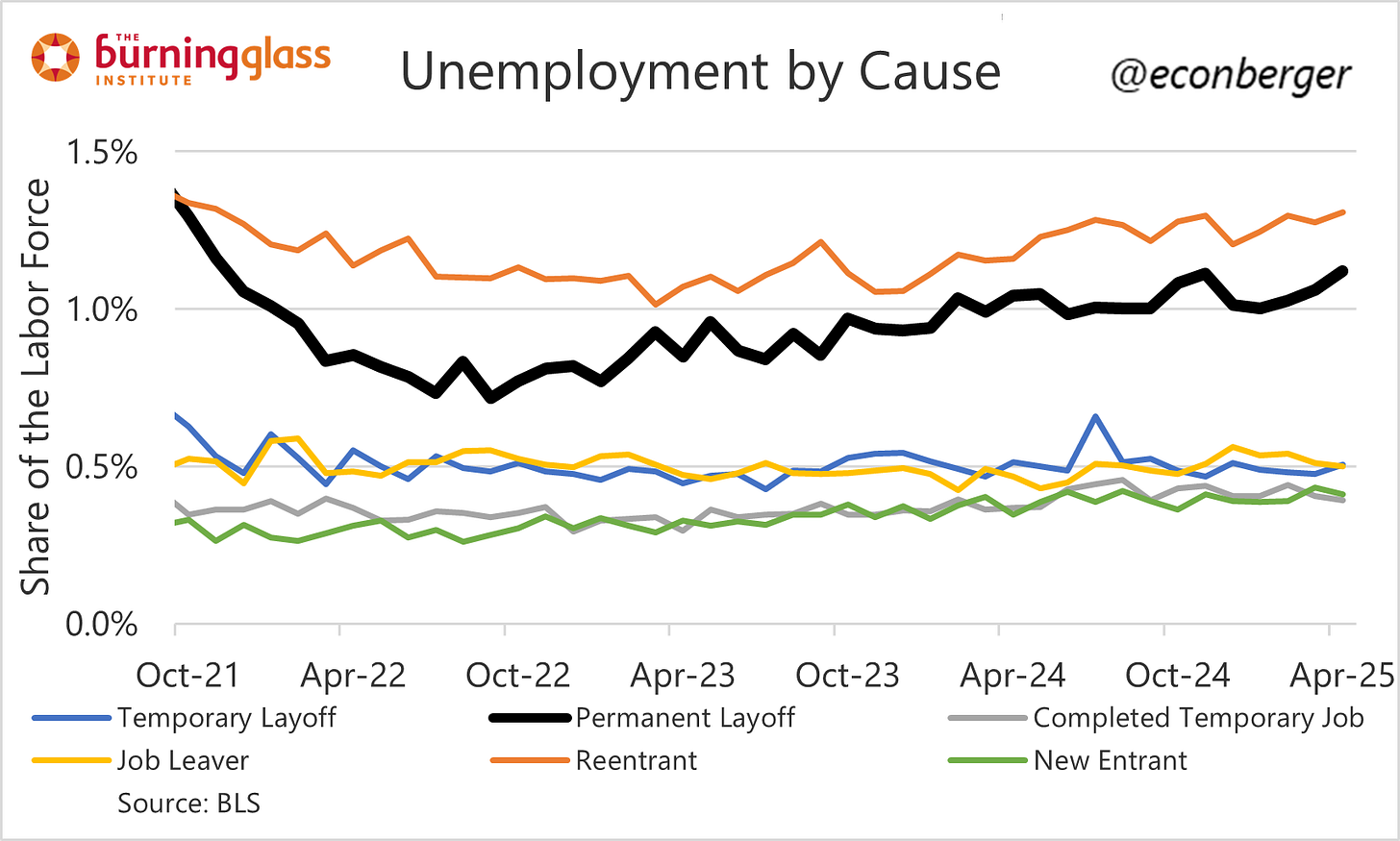

Within unemployment, we saw a new cyclical high in the permanently-laid-off unemployment rate (at 1.12%). It’s still quite low, though, and has been going up extremely slowly. This tends to be fairly well-proxied by continuing claims.

The share of prime working age Americans with a job rebounded to 80.7%, a 3-month high and only a hair below the cyclical high of 80.9%.

We saw a downtick in the share of the labor force that’s working part-time for economic reasons, which is good.

Wage growth has been unusually muted recently. My guess is this has to do with a pickup in hours, and possibly composition effects, since the bad weather early this year.

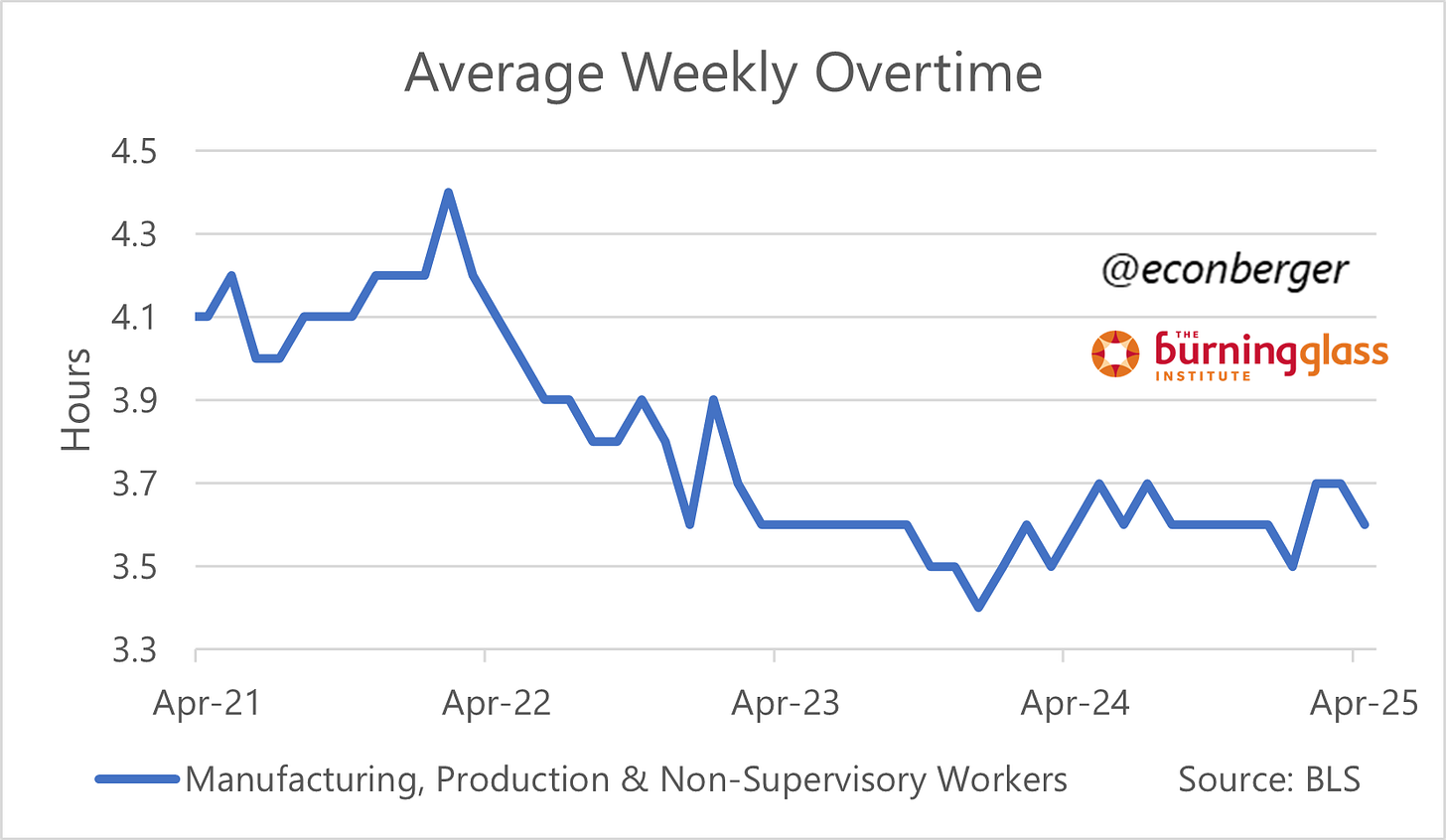

Finally (and this is a warm-up for the next section), hours have been unusually high in March and April for production and non-supervisory workers. I suspect this reflects a burst of activity ahead of the tariffs.

3. Early Signs of The Trade War’s Impact

Yesterday I wrote where I’d be looking for the first signs of the trade war’s impact. Sure enough, it showed up in the average workweek for transportation & warehousing non-managerial workers. They’ve been busy as bees trying to transport goods into and across the country. My suspicion is in May we’ll see this number normalize and perhaps crash as that pre-tariff rush fades.

There’s also a milder bump up in manufacturing hours (both overall and part-time). I’m inclined to say this is also tariff-anticipatory, but I’m not sure. It’s a less clear-cut case than transportation.

Finally, the granular hourly data for manufacturing does seem consistent in at least a few sub-sectors with a pre-tariff factory surge. But it’s pretty murky.

One takeaway here is that we’re still in the “pre-tariff surge” phase even for the most trade-sensitive sectors. We probably have to wait until May’s report (or even June’s) for these sectors to really go into reverse. And for sectors which are less exposed (for instance, a lot of services), second order effects from lower spending power and more expensive capital equipment will take a long time to manifest.

4. Tough Times for the Young

Back in February I wrote a piece on how low hiring and low firing have harmed younger workers while leaving older ones relatively insulated. And also over the past few months, the Atlantic has published 2 excellent pieces by Rogé Karma and Derek Thompson on the challenges younger folks face looking for a job right now.

A lot of discourse in this space has rightly focused on college grads. For those in their early 20s, the unemployment rate has gone up by over a percentage point in the last ~2 years! A lot of discussion has naturally focused on structural developments in the labor market, including the possibility of AI’s adverse impact on demand for young college grads (but not established ones).

But it’s not just a college grad thing! We’re also seeing unemployment for high school grads in their late teens go up by a lot. And so while we should consider structural explanations, it’s always important to remember the cyclical forces. If you slow down hiring but keep layoffs low, folks who are particularly reliant on finding jobs will suffer more than those who are secure in their current roles. That’s bad for young people.

Though there’s good reason to expect future downward revisions.