I’ll be publishing two more pieces this week - a jobs report preview later today, and a jobs report recap on Friday.

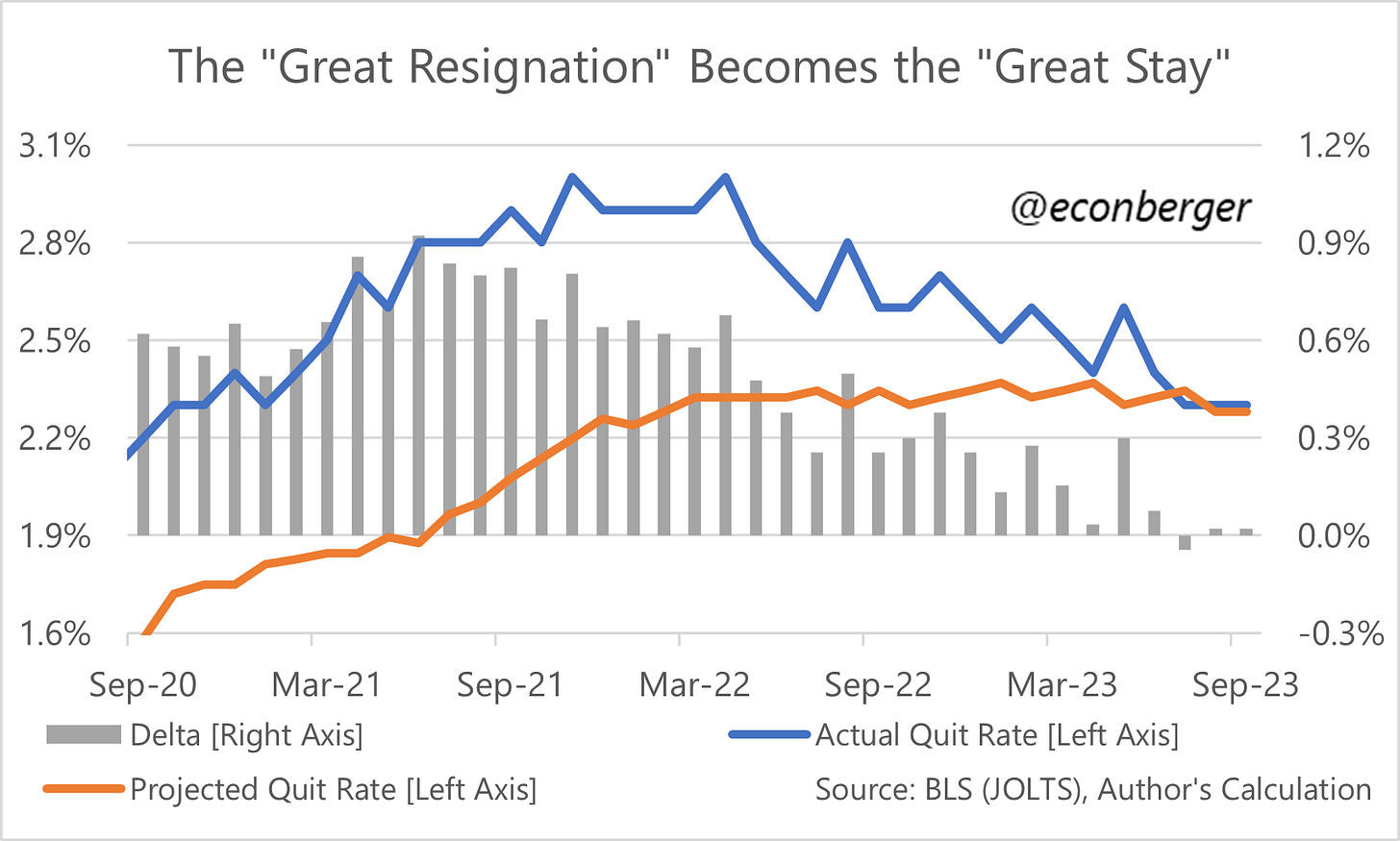

TL;DR: The BLS’s September JOLTS report indicated that the US job market is experiencing a “Great Stay”, but hires and quits may be stabilizing. Layoffs declined and remain extremely low.

In this post, I discuss (1) hires and quits (2) layoffs and (3) job openings [CRINGE].

More below chart!

1. Hires and Quits

Two years ago, hires and quits were running far above what you’d expect given the unemployment rate - a behavior that caught the popular imagination as “The Great Resignation”.

Hiring and quits have both fallen a lot since then, consistent with a “Great Stay”:

Hiring is below what you would expect given the current unemployment rate (I use the 2010s expansion as a benchmark); you would have expected a hiring rate of 3.7% with an unemployment rate north of 4.5%

Quits are around what you would expect given the current unemployment rate.

One bit of good news: stable hiring and quit rates in the 3rd quarter. We’ve had enough headfakes over the past few years so caution is warranted, but it is plausible that businesses’ hiring activities are back in line with the economic outlook (unlike 2 years ago, when they were hiring “too much” given slowing growth). The odds that this stabilization is real are higher than they were, say, during the faux-pause early last fall.

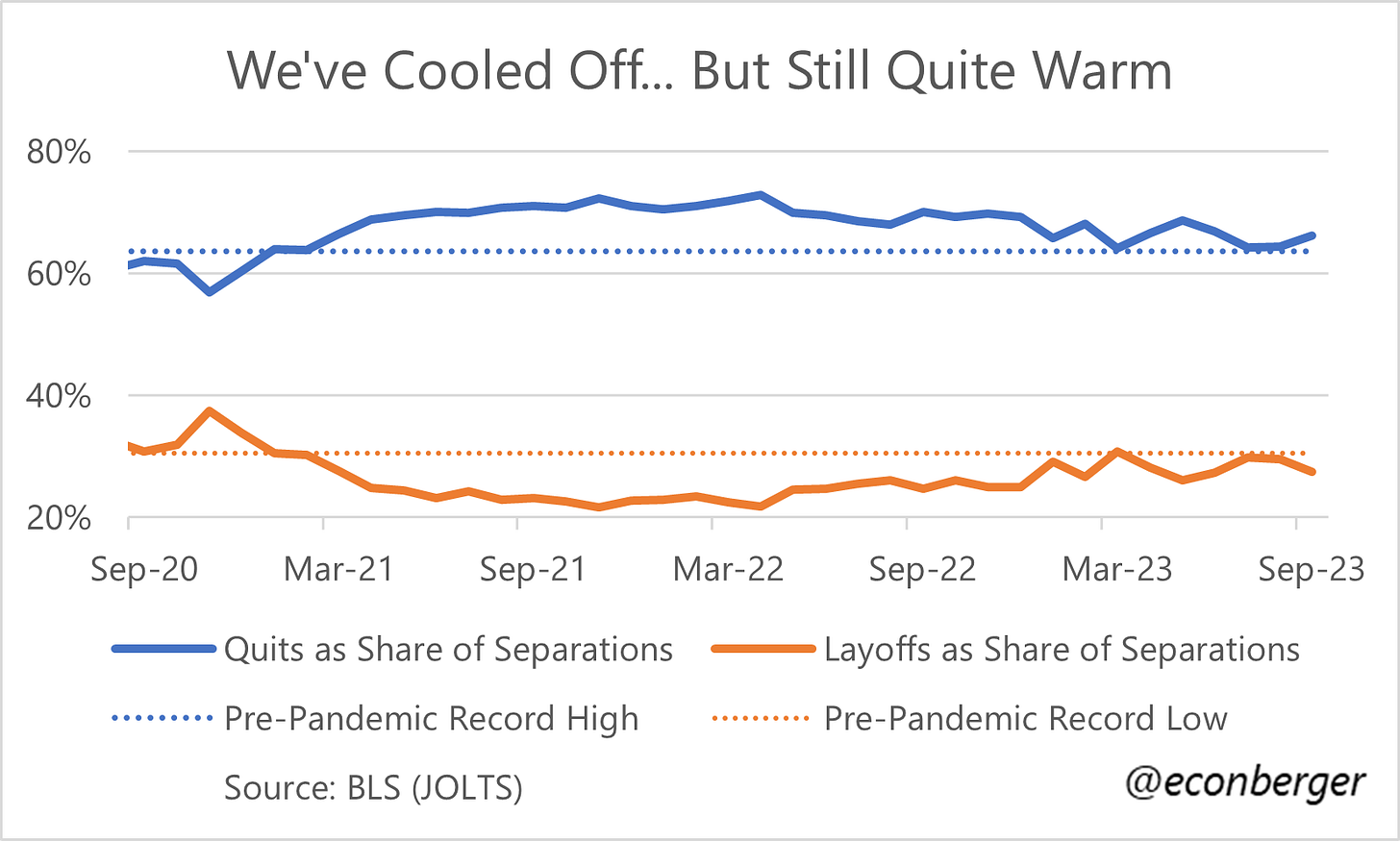

2. Layoffs

Layoffs declined in September. They’re still a little higher than the all-time lows experienced during The Great Resignation, but they’re also a little lower than the pre-pandemic all-time low. I like to joke they’ve gone up from “insanely low” to “extremely low” over the past two years.

If you normalize quits and layoffs as shares of total separations, quits are a little higher than the pre-pandemic record high, and layoffs are a little lower than the pre-pandemic record low. The job market has cooled, but still remains quite warm!

Finally, in terms of how much they’ve contributed to the labor market cooling, the small increase we’ve seen in layoffs over the past two years has played a smaller role than the large decline in turnover.

3. Job Openings

If you’ve been reading my work for a while, you know that despite being a huge fan of the JOLTS report, I don’t like the job openings data very much - I think hiring and quits are much more concrete and reliable indicators of what’s going on. The kindest thing I can say about job openings is that, if you adjust for their flaws, they send a similar message to those other two series. (Sometimes I joke, “take job openings seriously but not literally”).

Job openings do send a message of “maybe things are stabilizing”, like hires and quits, but continue to also indicate the job market is much hotter than it was pre-pandemic. I don’t buy it.