TL;DR: Job market turnover was stable in March, a glimpse into an alternate economic trajectory that will probably be kiboshed by tariffs.

The rest of this post is split into 2 sections:

The Big Picture

Data Roundup

1. The Big Picture

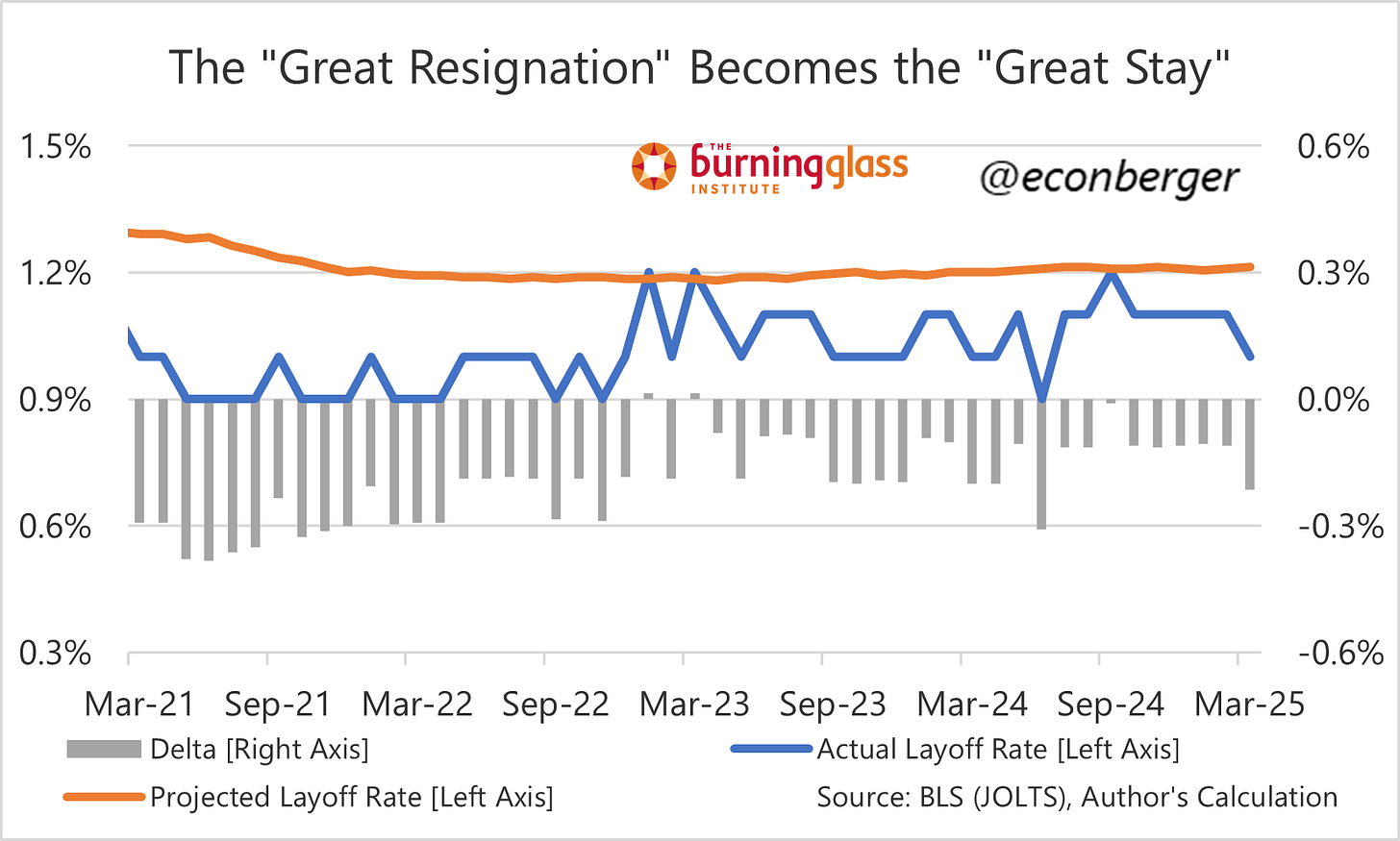

If you didn’t know anything about policymaking and just looked at March’s JOLTS data, you might feel pretty good about the job market. You might even think upbeat economic forecasts are coming true! Sure, hiring is low by historical standards and it’s hard to find a job, but it stopped going down last summer. Quits have also stopped falling and may even be exhibiting a modest rebound. And layoffs, while a little higher than a year ago, are still very low by historical standards.

But we know quite a lot about policymaking, and about a big surge in import taxes in particular. We also know that international commerce has slowed significantly, with retailers warning about empty shelves and shortages. Consumers and businesses are starting to notice higher import prices. New orders for manufacturing are plunging. And there’s intense pessimism about the labor market’s trajectory from both firms (who make hiring decisions!) and households.

They’re right to be worried. Unless these tariffs are dialed back significantly or offset in some way, hiring will be walloped and layoffs will rise. I’m not sure it will be an outright recession (though risks of the latter are elevated); gradual and protracted labor market anemia (a la Brexit) can also lead to a diminished job market. And even recessions can take a long time to get going. A key question that I don’t have the answer to: how quickly does damage filter through from the immediately harmed sectors (manufacturing, transportation) to ones slightly downstream (construction, retail) and finally to the partly insulated services economy. That last part will take the longest.

Hence, the March data was way too early to show an impact. I think there’s a pretty good chance April’s JOLTS data will look OK too. Once we head into late spring or early summer, things will get dicier. As I often say, I hope I’m wrong.

2. Data Overview

But all that lies in the future. What’s going on right now? Well, as stated earlier, labor turnover flows are stable. The hiring rate was 3.4% in March, around where it’s been since last summer. That’s not very good; in the 2010s we saw this volume of hiring in 2013-14, when the unemployment rate was just north of 7%. But at least it’s not getting worse (for now).

The quit stabilization lagged that of hiring by a few months, but it’s also quite apparent. There’s even, if you squint really hard, a possibly-emerging (and soon-to-be-squelched) recovery. At 2.1%, the quit rate is consistent with an unemployment rate of ~4.7% - around what we experienced in 2016-17.

And finally, layoffs were a little lower in March than they were in February and January. By historical standards, is a layoff rate of 1.0% is extremely low.

I’m not a fan of the job opening data (I think it’s less informative than the turnover data) but I think it is of higher-than-usual interest right now because it’s slightly more timely. The turnover data covers the entire month; job opening data dates from the end of the month. In a period where we worry about the economy shifting gears, that is a relevant distinction. That said, job openings have also been fairly stable over the past 6 months. Maybe the M-M decline in the job openings rate to 4.3% is a negative development, maybe it’s just noise.

Finally, last month we saw a small impact from the DOGE layoffs, and there’s some expectation that more is coming. But the increase in federal government layoffs partly unwound in March, matching the pattern we see in claims. We are seeing an ongoing decline in federal government hiring, possibly reflecting the federal government hiring freeze.

If you’ve made it this far, I think we have at least one more relatively benign JOLTS report ahead of us. Enjoy the not-bad news while it lasts.