TL;DR: The June JOLTS data was broadly consistent with stability in the labor market.

This post covers:

The Big Picture

The Data

Sectoral Talent Shortages

More below chart.

1. The Big Picture

A whole host of indicators in the JOLTS report, and in the Current Population Survey, indicate that the labor market is stable: not cooling, not heating up. This is a little surprising - a month or two ago I was pretty sure that renewed cooling would be on the menu for the remainder of 2025. I still think that’s the most likely case, but I’m far less sure than I previously was.

The best case for renewed cooling (at some point though clearly not yet) comes from the tariffs: they’re taxes squeezing the economy, on the demand side and also to some extent on the supply side. With any other tax hike we’d anticipate a weaker labor market, and this is no different. Complementing that, the Fed believes it is squeezing the economy (though this is contested).

On the flipside are the new fiscal legislation (which partly offsets the tariffs, but probably not all of it) and the squeeze on labor supply from more aggressive immigraiton enforcement. It’s possible that ongoing labor market stability indicates those two forces are sufficient to offset the effect of the tariffs. A scenario of renewed labor market warming later this year is unlikely but can’t be ruled out - we already see it in a few sectors (see section 3).

I don’t have a strong opinion on these, just a weakly-held one. I still think renewed cooling is more likely than renewed warming. If I’m right, the process will take longer than I and many other people thought.

2. The Data

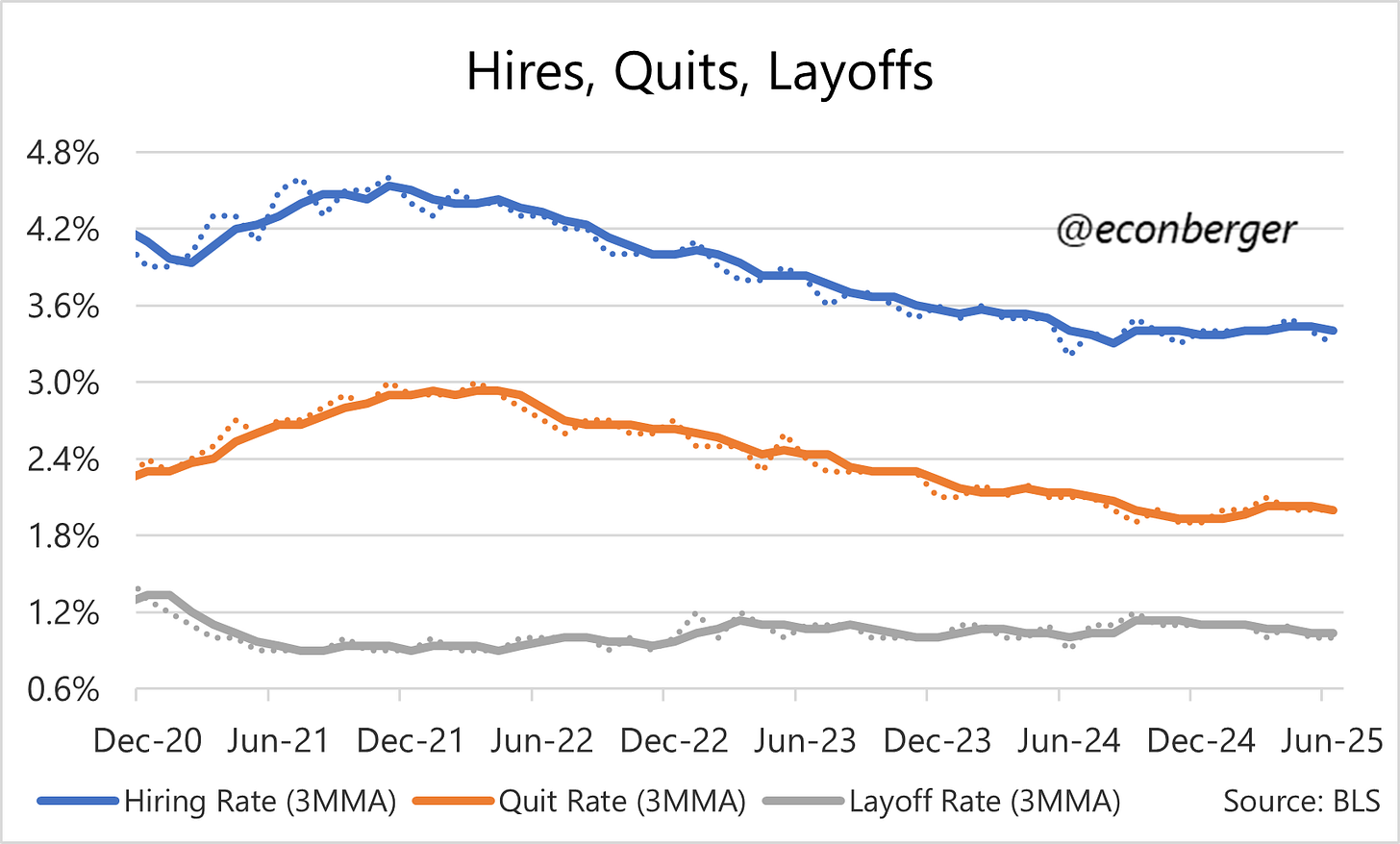

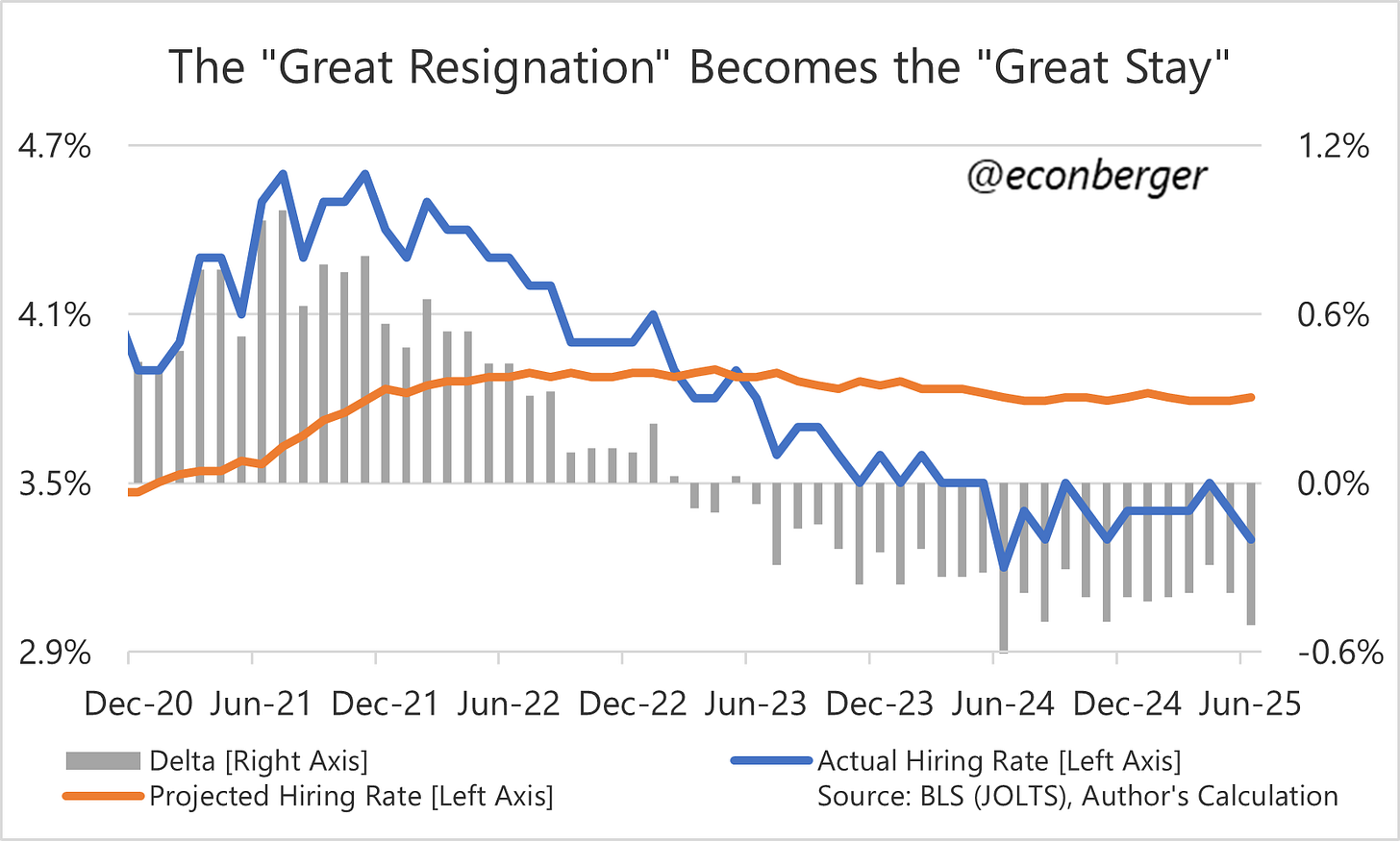

The weakest data point in today’s release was hiring. The hiring rate fell to 3.3% in June, the lowest since November. If you want to be pessimistic, maybe this is the first step in a renewed downward slide. But it’s also possible that we’re just bouncing around the 3.4% hiring rate we’ve had for the past year.

For what it’s worth, 3.3% is very bad - it’s comparable to what we had from late 2011 to early 2013. Back then it was consistent with an unemployment rate slightly above 8%. It’s a very hard time to find a job.

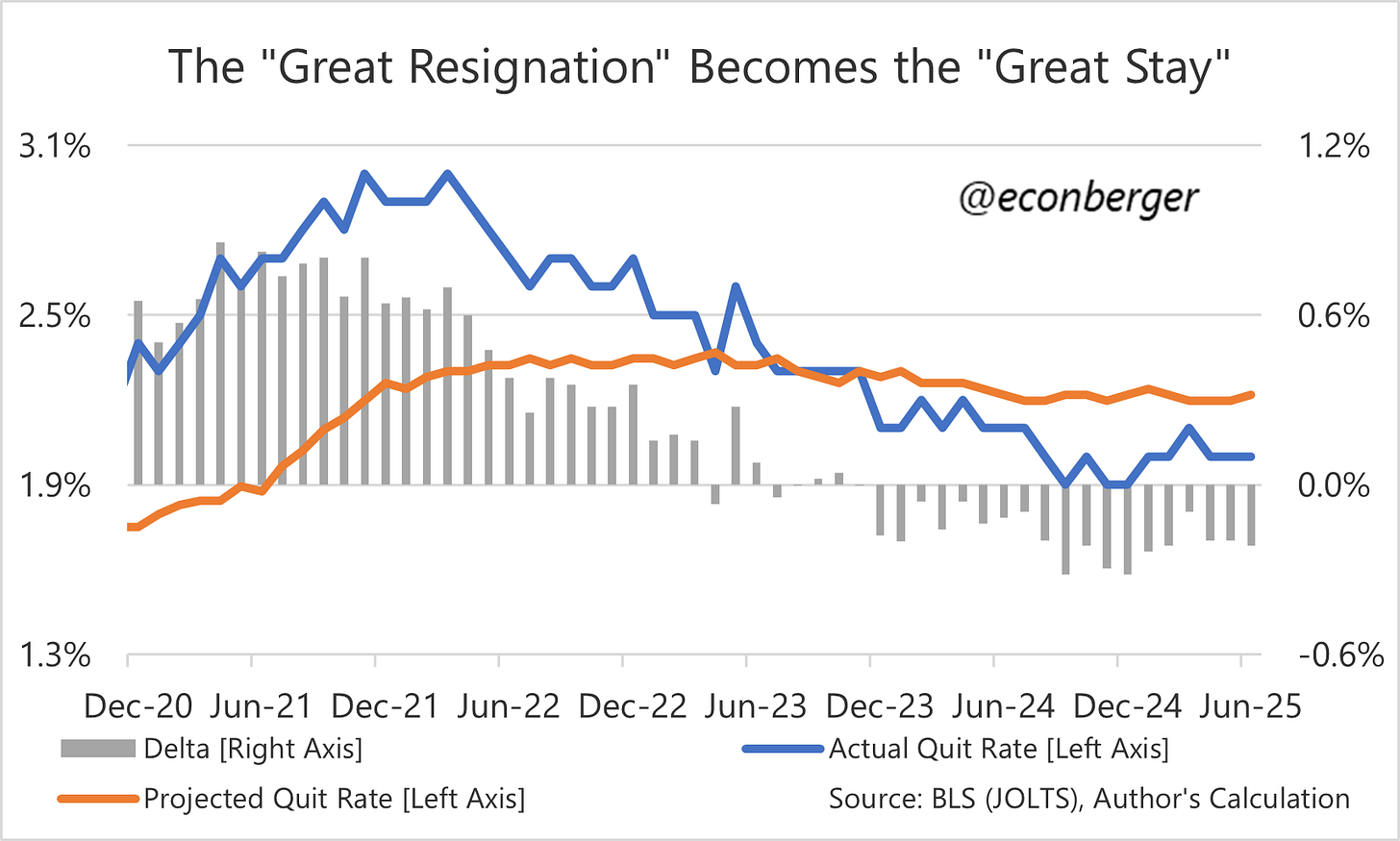

Quits were less downbeat. They’ve been steady at 2.0% since the fall - comparable to where we were in late 2015 or early 2016, when the unemployment rate was just above 5%. Not getting better, not getting worse.

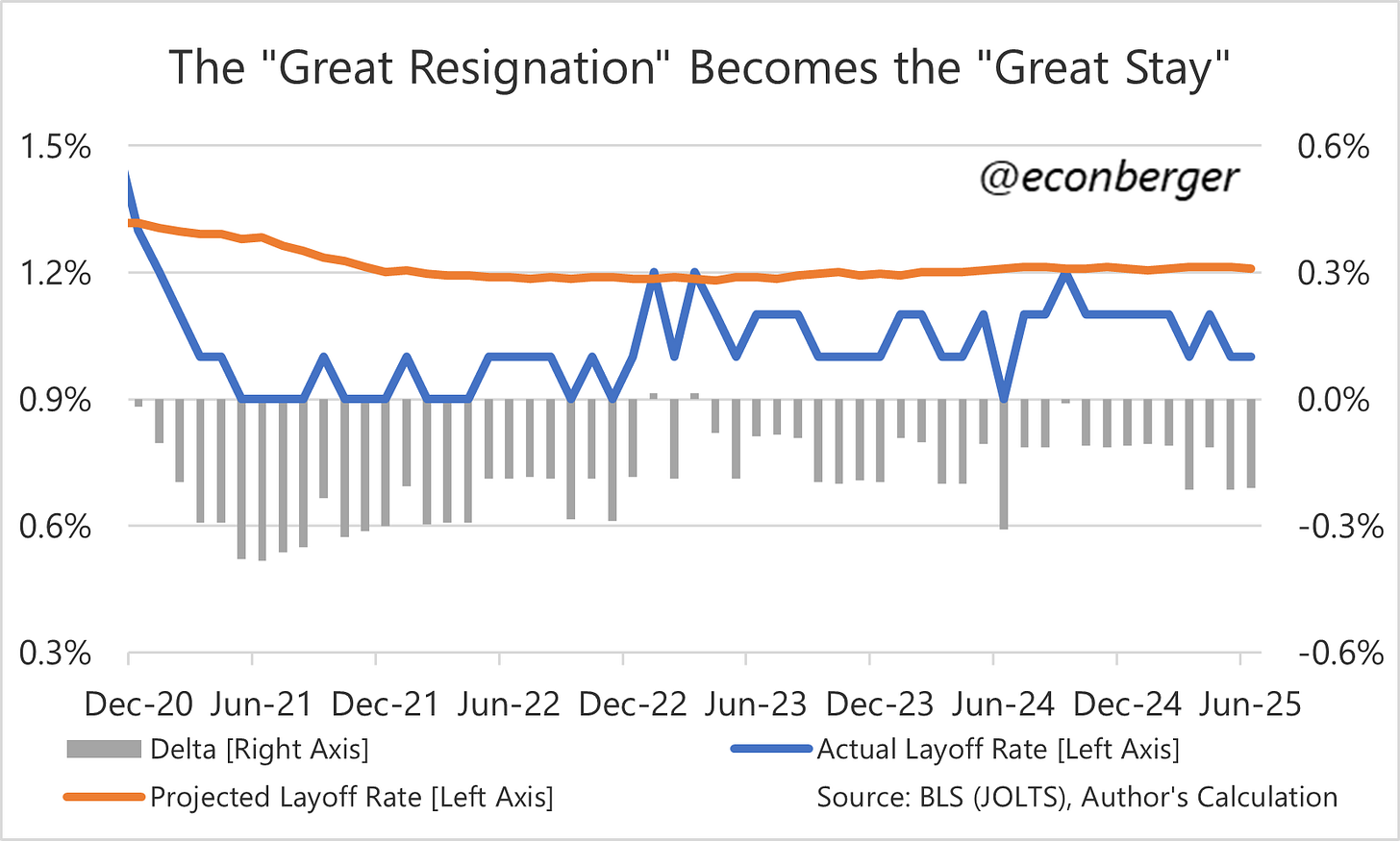

Layoffs are really low by historical standards. It’s a very bad time to look for a new job, but a very good time to hunker down in an existing one. Stepping out on a slightly speculative limb, layoffs may have diminished from their levels earlier this year, though the decline (to the degree it really exists and isn’t noise) is small. Initial claims are sending a similar signal.

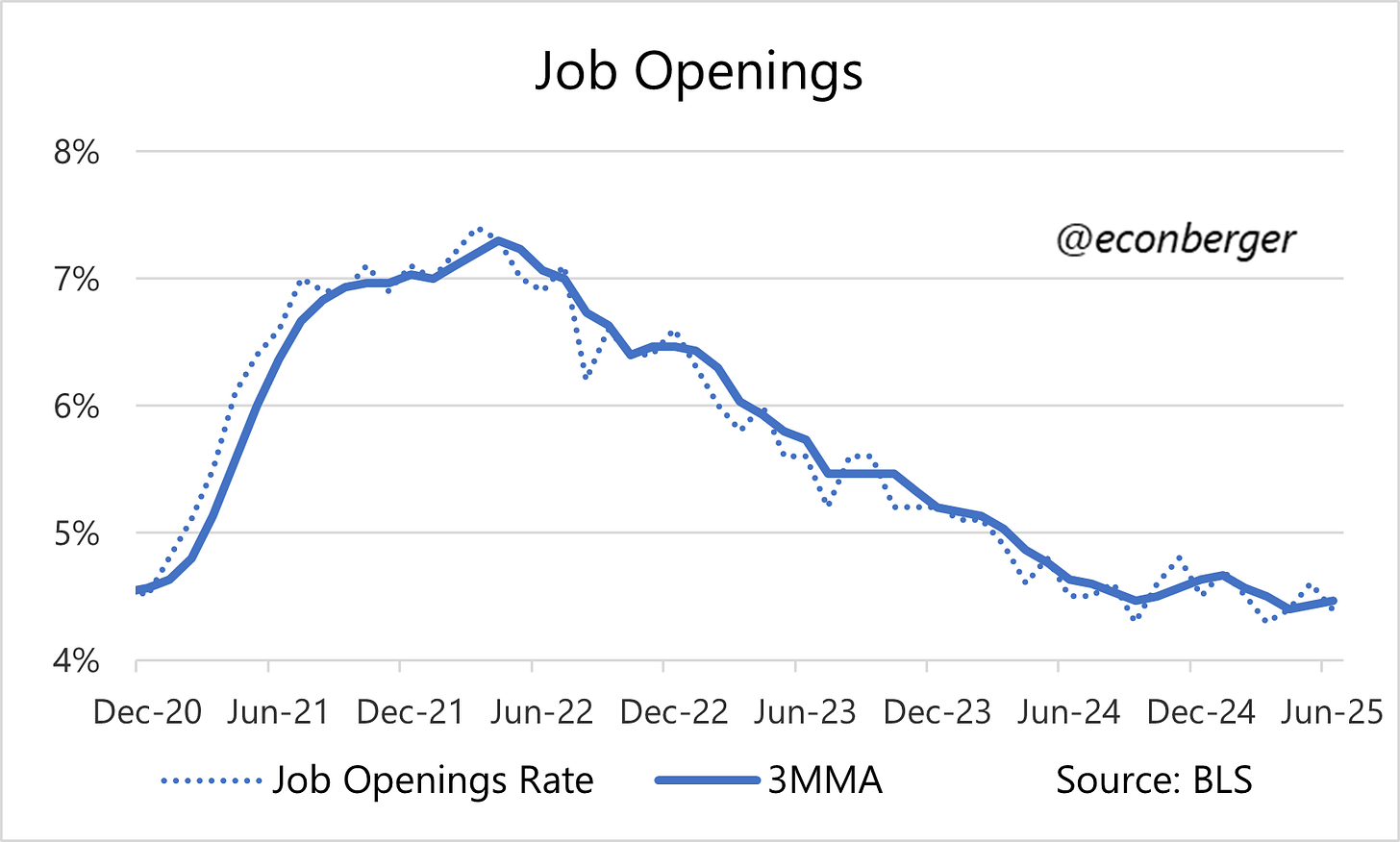

Finally, if you read this newsletter you know that job openings are my least favorite part of this report but… they've stopped falling, too.

.

3. Sectoral Talent Shortages

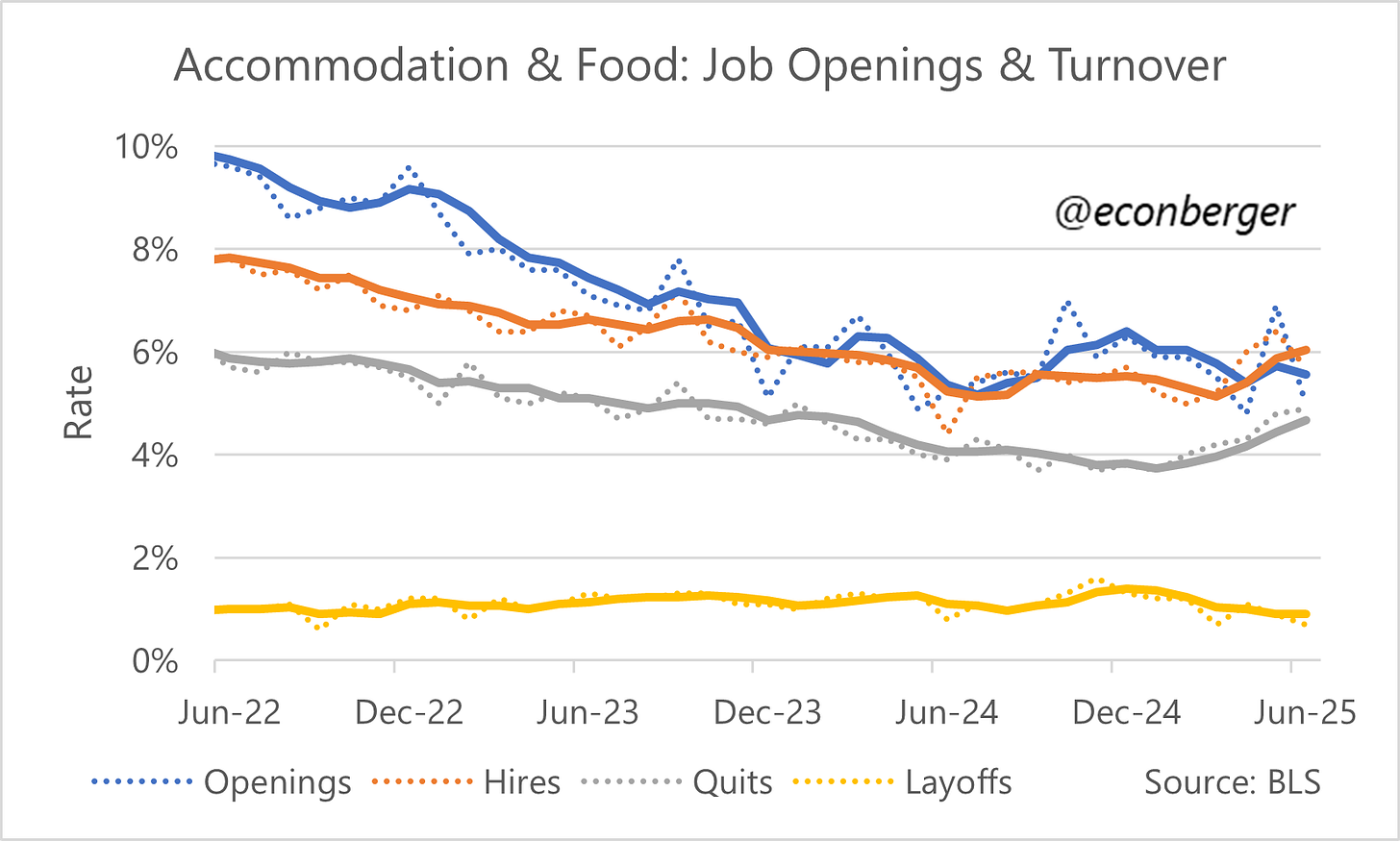

In the first part of this post, I talked about the tension between supply side and demand side contractionary forces. You would expect that in sectors particularly dependent on immigrant labor, we might see signs of the supply side pressures winning out. And that appears to be the case for hotels and restaurants. Hires and quits have risen by a non-trivial amount recently. (Though job openings have not.)

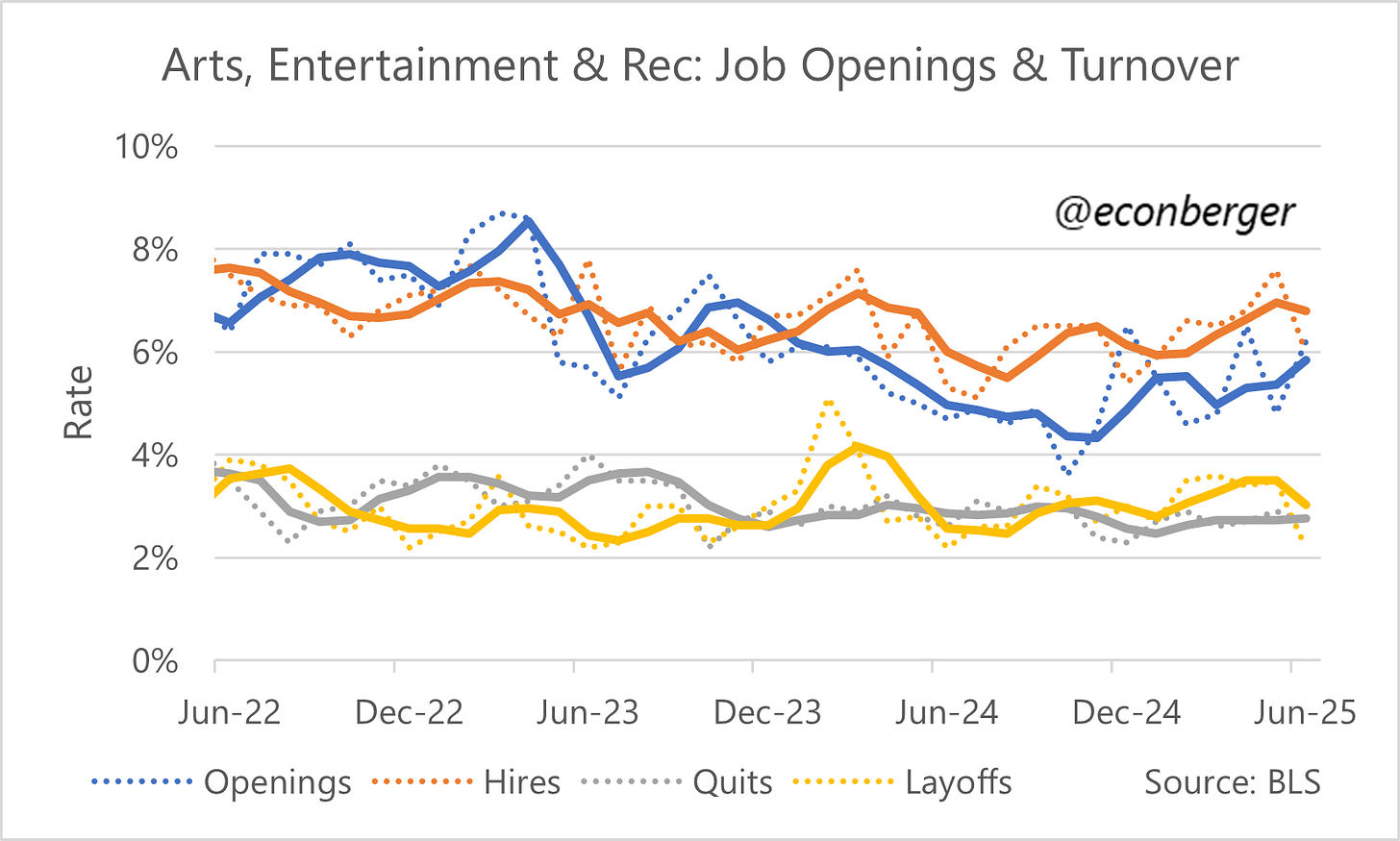

The higher-paid, smaller-headcount sibling of accommodation and food services is arts, entertainment and recreation (they share the leisure & hospitality sector). It’s less dependent on immigrants, and doesn’t register an improvement on the same scale - hires, quits, and openings are up a little, maybe.

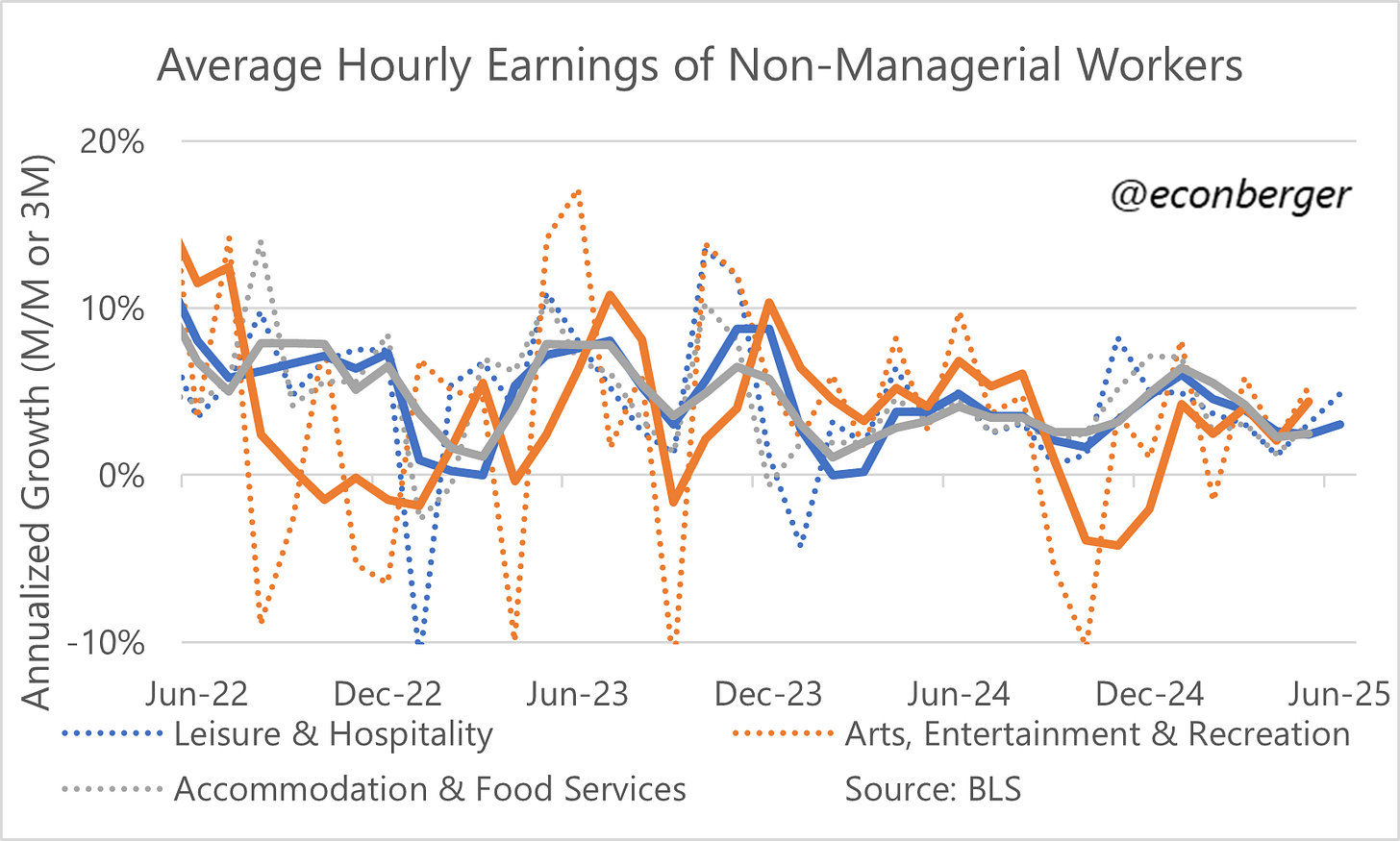

One place where we don’t see these shortages yet: the wage data. I’d expect an impact to show up here eventually if the shortages endure:

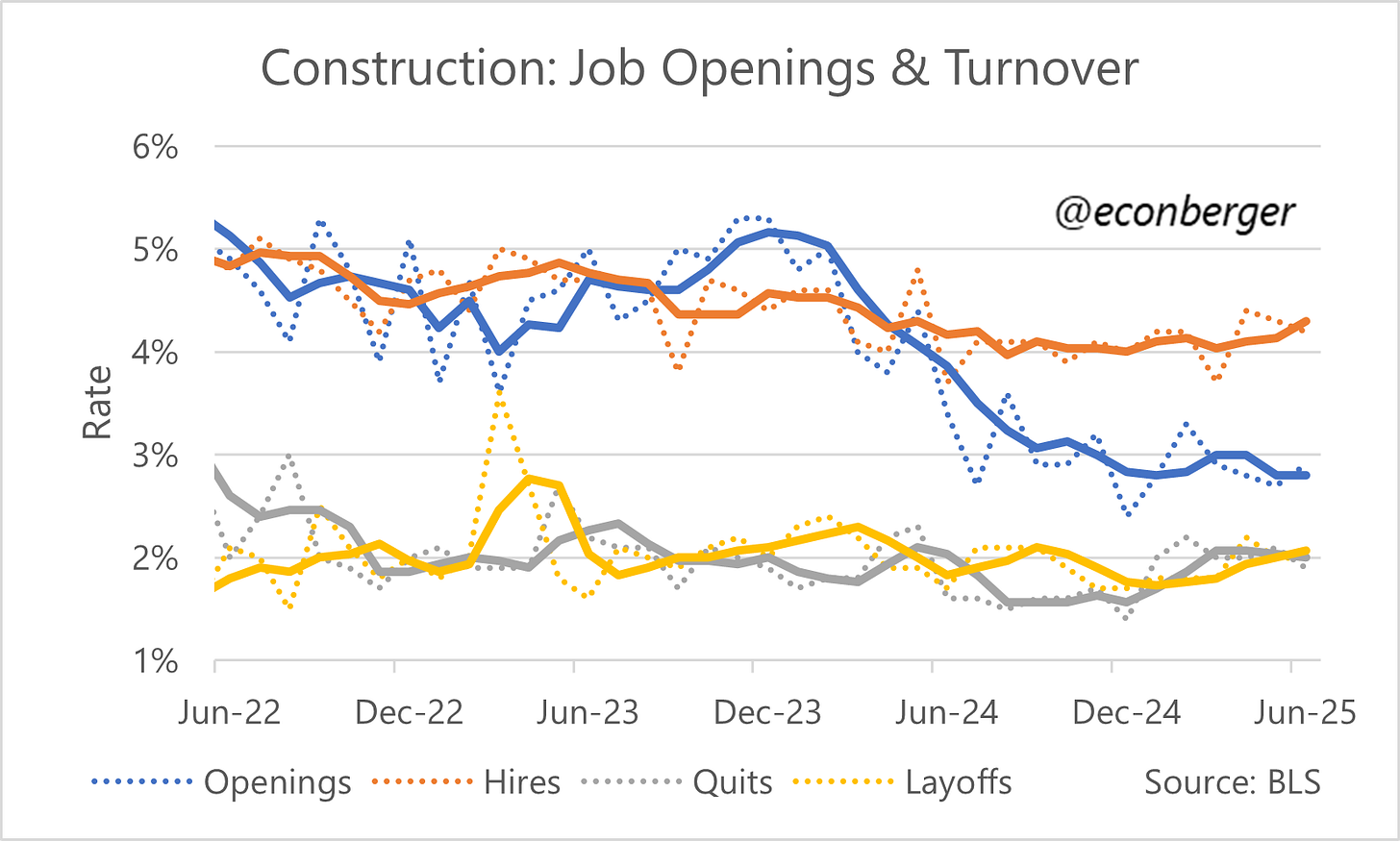

Finally, I got curious about what’s going on in construction, another immigrant-dependent sector. The answer is that hires and quits have risen recently relative to 6-9 months ago (though layoffs are too). Maybe that’s all we can hope for in a sector where aggregate spending is falling.

That’s it for JOLTS! I’ll be sending out another note on the Friday jobs report preview sometime tomorrow.