TL;DR: Today’s claims data was OK, but is likely to get worse in the coming months.

Claims for unemployment insurance are among the most timely “hard data” we have on the labor market (along with the wonderful job postings published by the Indeed folks), but the huge trade policy change implemented yesterday has made today’s data obsolete.

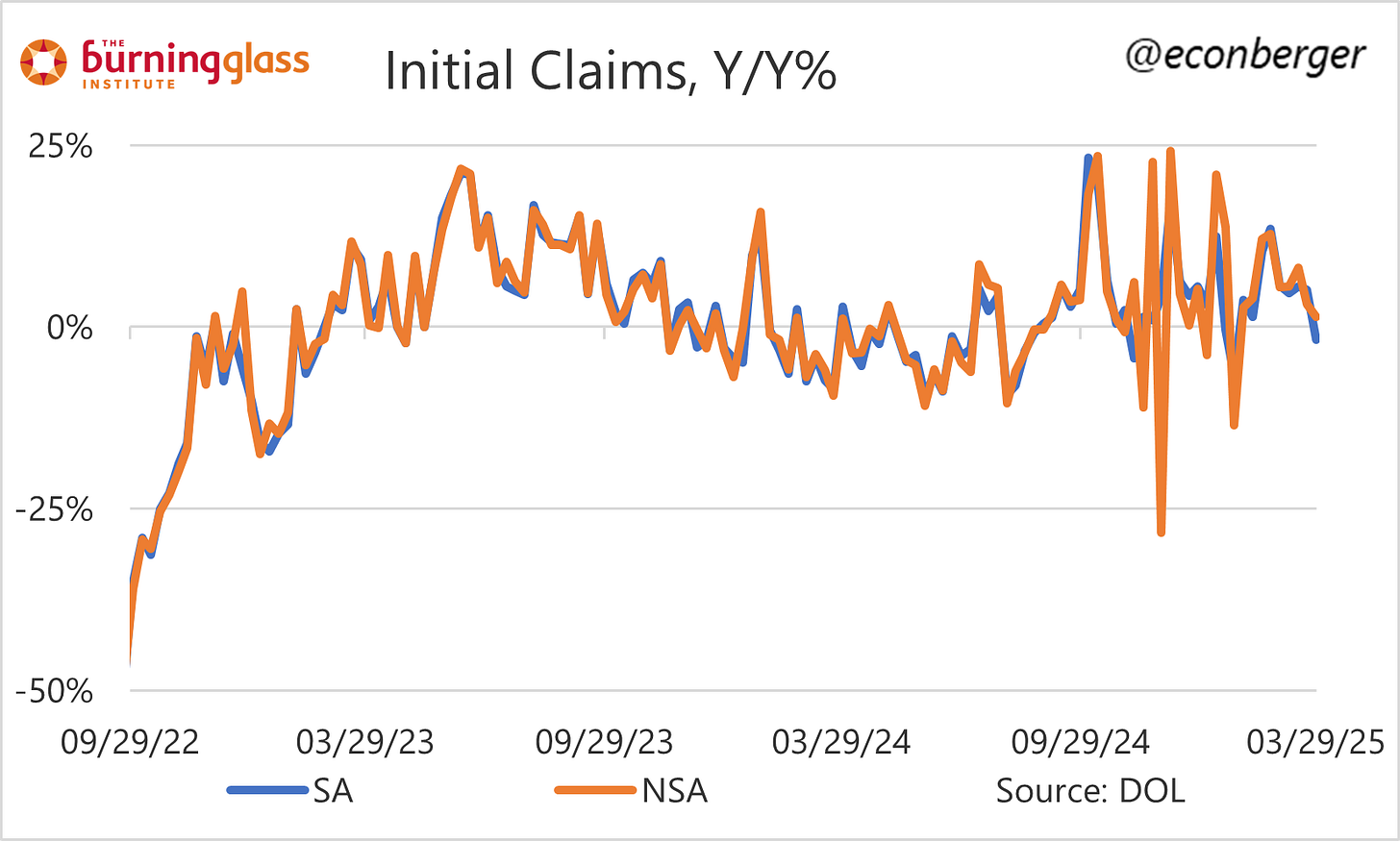

That said, today’s data looked OK. Initial claims were a little better than we’ve seen recently - the Y/Y increase was the smallest in a few months, and in the case of the seasonally adjusted series, negative. Initial claims were elevated during the spring and summer months in both 2023 and 2024, and last year this was interpreted (correctly I think) as residual seasonality. I wonder if that’s going to happen again this year.

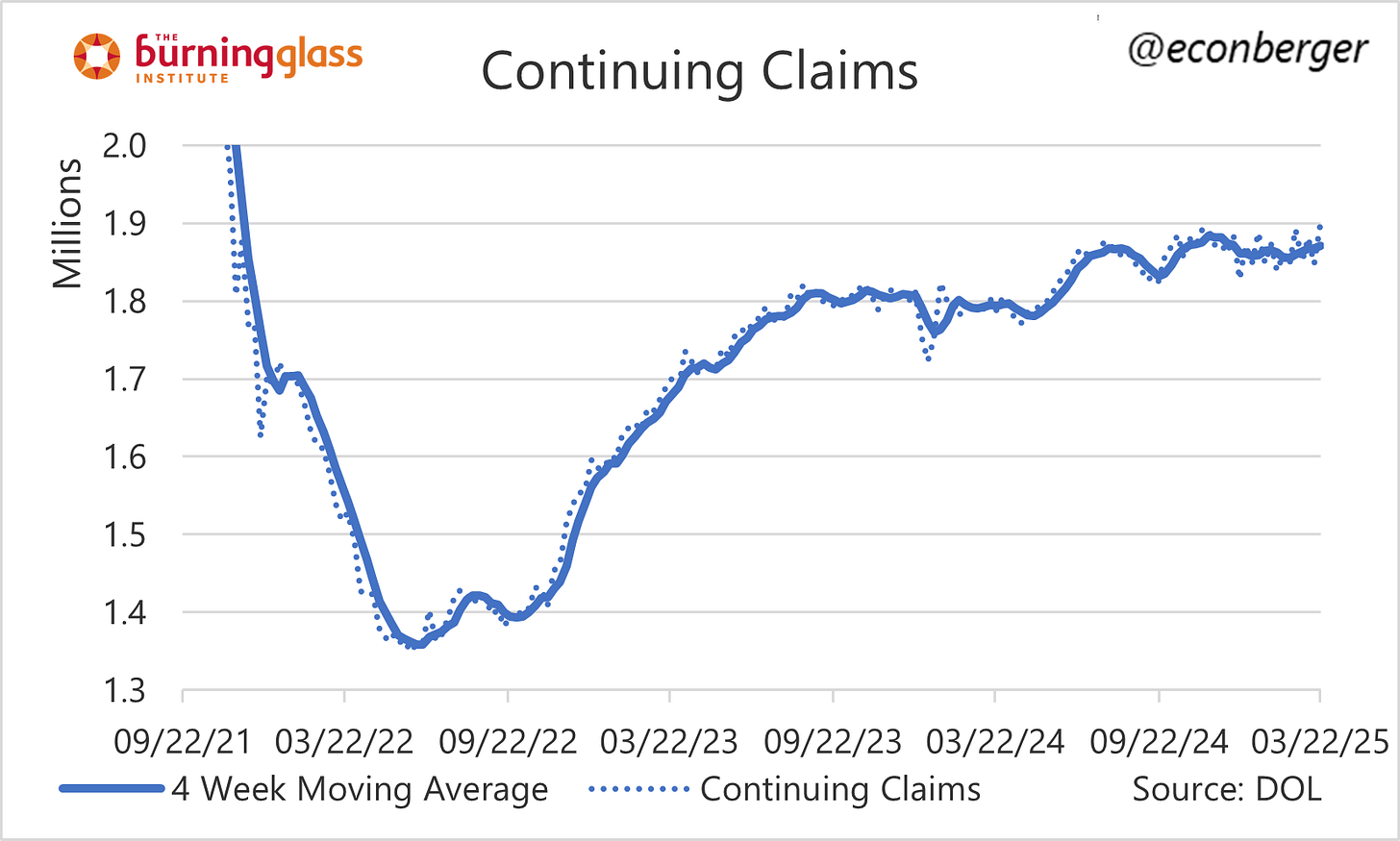

Continuing claims continue to be a moderate amount above year-ago levels. If you squint, that increase may be accelerating. It was around 7% Y/Y in today’s data, a little higher than we’ve seen recently.

In level terms we’ve been flat recently. I don’t know whether seasonal adjustment is working properly here. Did we experience a one-time increase in late 2024 (as the published series indicates), or are we experiencing an ongoing slow creep upward?

In any event, I have an informal nowcast of the “permanently laid off unemployment rate” using continuing claims data, and it suggests a very mild increase in tomorrow’s report (note that the blue line doesn’t include the small increase in federal worker claims):

Moving onto the impact of federal government layoffs, the initial wave seems to have crested. Initial claims for federal workers (UCFE) have peaked, and it’s possible that continuing claims have too. But federal worker layoffs are ongoing (a bunch more were announced this week) so more surges may be in our future.

We’re seeing a similar peaking in regular initial claims in the DC region. These aren’t federal workers - it’s probably a combination of contracting and grant dollars and 2nd order effects (laid off federal workers spend less money on goods and services).

It was weird to write all this because it’s clearly 2nd or even 3rd order compared to what’s coming later this year. See you tomorrow!