TL;DR: This was a mediocre report - nothing terrible, nothing particularly good.

Key stats:

Unemployment rate: rose a small amount, from 4.19% to 4.24% (not good)

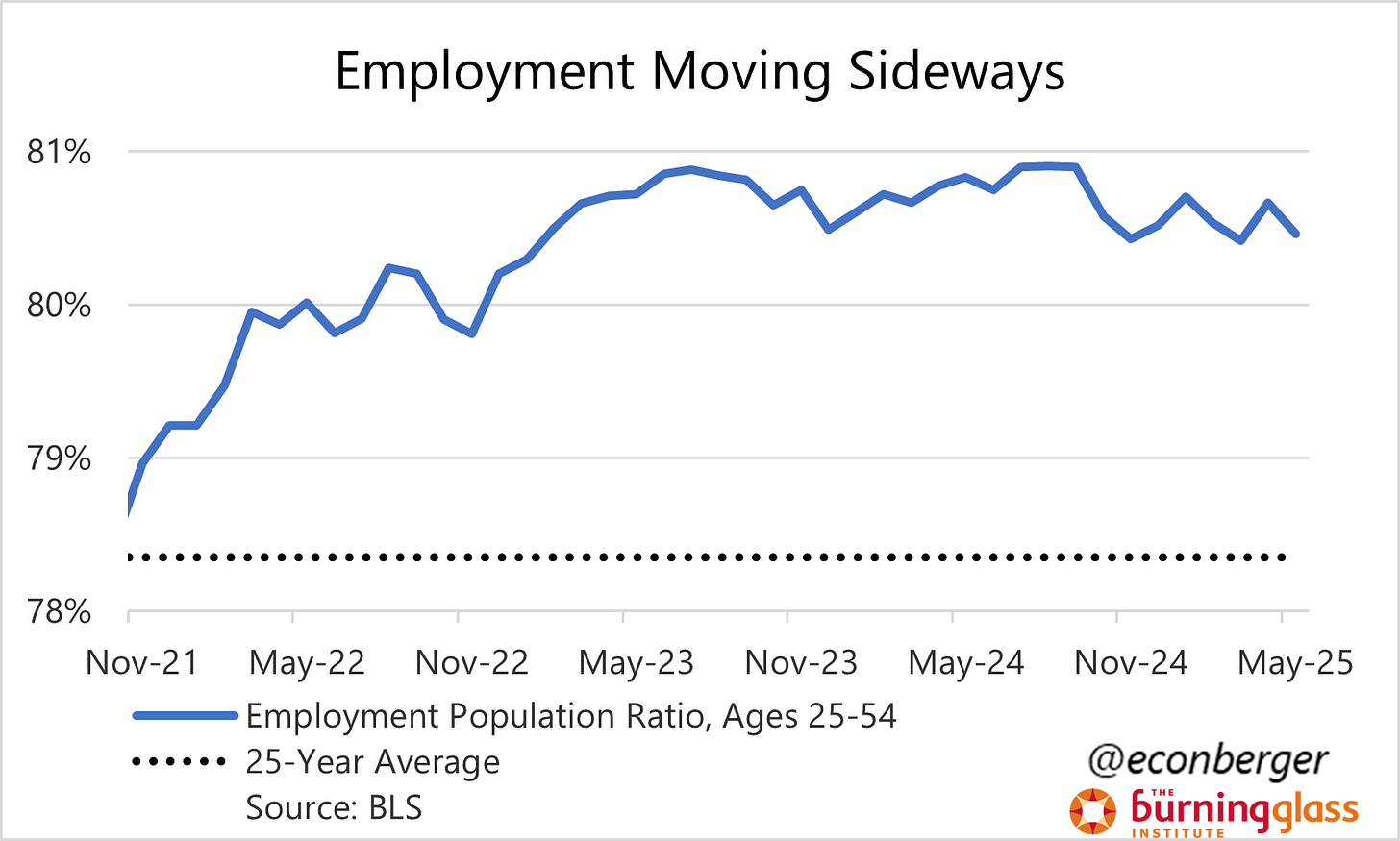

Prime working age employment population ratio: fell to 80.5% (not good)

Nonfarm payroll employment: rose by 139K (OK, but large revisions to prior months, and more to come)

This recap is split into 4 parts:

The Big Picture

Key Data Roundup

Recent Grads Update

More Below Chart.

1. The Big Picture

A year ago, in my recap of the May 2024 jobs report, I wrote:

Two things are simultaneously true at present:

We’re adding a lot of jobs each month

Supply is growing sufficiently fast to have mildly loosened the labor market, a process that is probably still ongoing.

We’re now in the mirror image of that world:

We’re adding relatively few jobs each month (once future probable revisions are taken into account)

Supply is growing so slowly that the job market is barely cooling, if at all

I’ve been writing about the potential slowing in immigration and what it would do to the jobs data for almost a year - well, now it’s happening and it’s confusing! Our intuition is that faster job growth reflects a warming labor market and slower job growth reflects a cooling one. But that intuition is currently wrong; the unemployment rate has barely risen since July 2024 even as employment growth has slowed sharply. With immigration slowing so sharply, a sharp slowing in employment growth can be “slack-neutral”; going forward, it will take only small increases in employment to keep the job market afloat.

Despite this supply-side effect, the demand side is also slowing, and I think we will soon see the unemployment rate go up. Today’s report is a bit of a Rohrshach test: depending on which date you index to, the key indicators are either unchanged or getting slightly worse. But even if you belong to the optimist camp, the tariffs will weigh on economic activity, even in their less aggressive form; the budget/tax package the administration is trying to pass is shaping up as much less stimulative than I expected. The deterioration I anticipate will be incremental, and an unemployment rate of 4.5%-4.6% at the end of the year seems like a reasonable guess.

2. Key Data Roundup

Let’s start with nonfarm payroll employment. As stated earlier, I’m pretty sure these numbers are going to get revised down in the future - possibly by a lot. We added 139K jobs in May, and have averaged gains of 135K over the past 3 months. A somewhat naive & speculative estimate of future revisions suggests those numbers are actually closer to 74K and 70K respectively. (Maybe lower, since my estimate takes only the benchmark revision into account, and not the early-iteration revisions we’ll get over the next 2 months.)

My spicy take: from the slack perspective, it doesn’t matter whether currently-published employment gains get revised down, up or not at all. We know what we need to know from the unemployment rate, the prime-working-age employment-population ratio, the share of the labor force working part-time for economic reasons - these are all immune to big revisions.

Speaking of those ratios, in May they were mostly:

Weaker than a month ago

Weaker than a year ago

Have not moved much in the past 6 months

For example, here’s the unemployment rate. Is it indicative of steadiness or deterioration? Pick your reference point. (Speaking of which… the Fed projections in published in mid-March have been top-notch.)

Something similar can be stated about the prime-working age employment-population ratio. It’s slightly below the cyclical peak of 80.9%. You’d need a magnifying glass to decide whether it’s gotten worse since the fall of 2024.

Maybe bucking the trend a little is part-time for economic work. It’s getting better recently but has gotten marginally worse over the past 6 months.

At high frequencies it can be extremely hard to differentiate between “getting worse/better slowly” and “not changing” and it’s not worth overthinking it. All we know is that the most pessimistic expectations when the trade war began are not manifesting so far (and probably won’t manifest, since the actual implemented tariffs, while high, are much lower than they appeared on April 2nd). We’ll get more data next month.

3. Recent Grads Update

I’ve been writing about this for quite a while, but stories about the challenging job market for young people - and in particular, graduates with 4 year degrees - are dominating the headlines. My thesis is that the flashiest culprit - artificial intelligence - is playing a smaller role in this development than many believe. There are other factors in play. Some are structural (there are a lot more college grads out there than a few decades ago), but we shouldn’t ignore the boring old business cycle. Hiring and layoffs are both low by historical standards, leading to an insider-outsider dynamic that protects older already-employed workers and harms younger workers looking for their 1st job out of school.

The unemployment rate for youngsters (age 20-24) with a college degree has risen a lot in the past 2 years (though maybe it’s stabilizing?), and that for their slightly older (25-34) counterparts. Meanwhile, the unemployment rate for college grads ages 35-44 has barely budged.

But we see exactly the same phenomenon (albeit with younger splits) for folks with a high school diploma and no college education. High school grads in their late teens are getting hammered with higher unemployment; those in their early 20s are experiencing a somewhat smaller increase; and those past the age of 25 are nearly immune.

Finally, one mystery I recently observed in the data is the “sweet spot” of the youngster with an associate’s degree - their unemployment rate is below their higher- and lower-educated peers. Unfortunately, the sweetness is souring as low hiring hits them too.

Overall, I’m pessimistic about the prospects for the youngster-oriented segment of the job market. Unless we see hiring pick up (unlikely in the near term), the doors to America’s workplaces will remain jammed. That’s thin gruel, even if it’s better than a full-blown recession when more established workers get laid off and everyone is struggling.

Great analysis, Guy

There's an interesting gender split. Unemployment is much higher for recent *male* entrants specifically. My guess is that's because healthcare, the great job maker, is predominantly female.