TL;DR: There are only limited signs of deterioration in the hard data.

The rest of this post covers:

Claims for Unemployment Insurance

Business Headcount Plans

Quits Stabilizing(?)

Farewell to Andor

More below chart.

1. Claims for Unemployment Insurance

Claims are our most timely data source for “hard data” on the labor market. So far, there’s no sign in initial claims (a layoff proxy) of a further deterioration beyond the modest upward increase (~4% Y/Y) that began late last year.

In the late springs and summers of 2023 and 2024, we experienced what is probably residual seasonality: non-trend fluctuations that the seasonal adjustment process had not yet ironed out. Seasonally adjusted claims rose in late spring, remained elevated during the summer, and then descended in the fall.

I’m working under the assumption that this pattern will repeat in the next few months, which means seasonally adjusted initial claims will probably rise into the 240s and low 250s in the next few weeks. For evidence that tariffs or uncertainty are damaging the labor market we’re going to need to see them going above that.

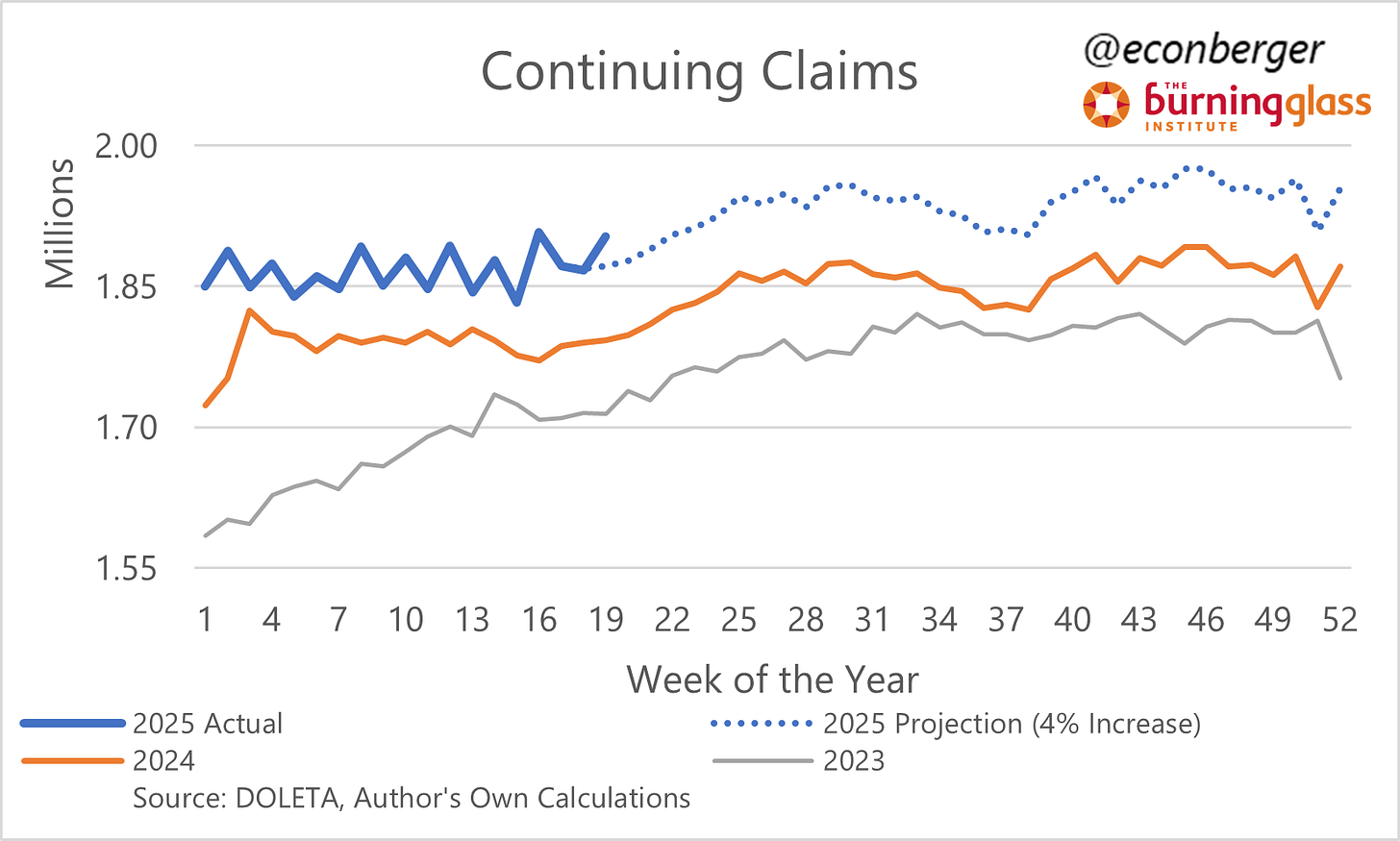

On continuing claims, there may be some evidence of a very slight further deterioration. I’m assuming they also have some residual seasonality, leading to an persistent one-time increase of about 80K from early 2025 levels, to around 1.95 million. We’re currently running 30K above my benchmark, which is not a lot (about 1.7%) but not nothing either.1

If you want to consider what I’m worried about, it’s not just a one-time acceleration from 4% annual growth in continuing claims to 5.7%, but an ongoing series of increases. Time will tell.

For what it’s worth, a sign of how small this increase is: the nowcast for the unemployment-rate-due-to-permanent-layoff (from the monthly jobs report) has barely budged. Even if we go to 2 million (past my benchmark), that’s only a small step up.

I’ll wrap up this section on claims with three additional notes. The first is that we’re seeing an increase in layoffs from year-ago levels across a wide range of data sources. There’s some disagreement across these sources about the amplitude of the increase (the Current Population Survey shows bigger increases than JOLTS or claims); it’s also not clear whether the increase is ongoing, or a one-time thing. And, as we’ll see later in this piece, it’s coupled with a stabilization in quits.

The second note is that I don’t really see any signal of additional acceleration in Google Trends searches for “file for unemployment”. There was an acceleration in February and March and maybe another one right now, but I don’t know what the precise relationship in amplitudes between searches and actual initial claims is (or even if it’s stable). The February-March acceleration in searches was a false positive prediction of an initial claims surge.

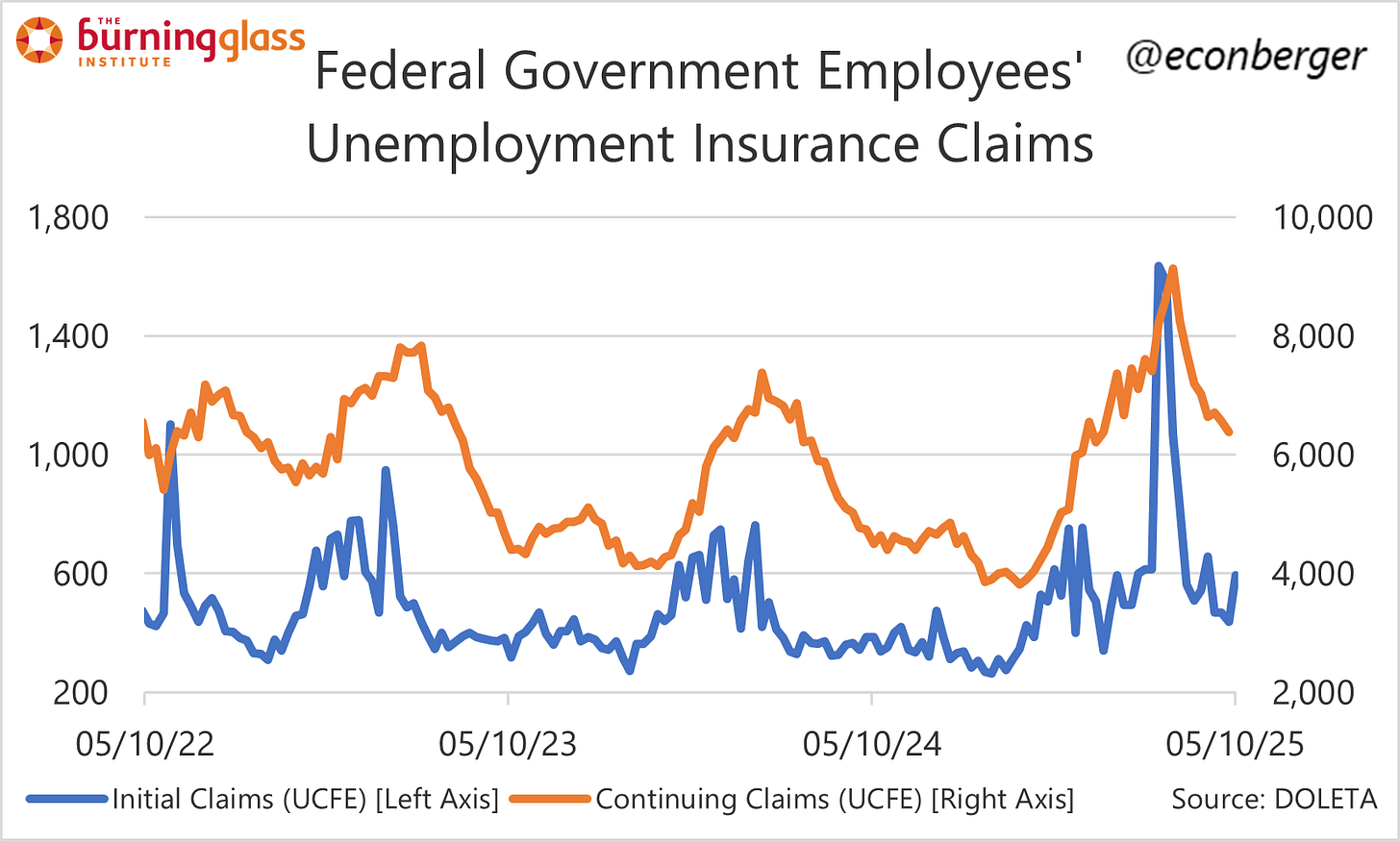

The third and final point is that claims by former federal workers (which are not included in the regular weekly claims data) remain very low.

2. Business Headcount Plans

We got the latest update from the Census Bureau’s wonderful Business Trends and Outlook Survey - our most timely survey of US businesses. I got two main takeaways from today’s data. The first is that, in the wake of the “US-China trade deal”, pessimism about future headcount (cuts planned) has moderated a little but remains substantial; the second is that we’ve seen fairly substantial fluctuations in these future headcount plans over the past 6 months and none of them have materialized into changes in actual headcount behavior (which remains modestly contractionary).

The slight improvement in future headcount sentiment has been driven by both an increase in the share of firms planning to expand and a decline in the share of firms planning to reduce employment. Both are worse than they were a year ago. Relative to 6 month ago, the increase in the share of firms expecting to cut headcount is noteworthy.

The improvement relative to 2 weeks ago was concentrated among larger firms:

I mentioned that we haven’t seen much change in actual firm behavior, even as future plans have fluctuated. What little change we have seen is mostly on the “fewer firms currently expanding” side; the share of firms presently cutting employment has not changed relative to a year ago.

Manufacturing is one of the supposed beneficiaries of tariff protection; supporters of the policy hope it will boost employment in the sector via reshoring. But like US firms overall, factory operators are telling us they expect to cut headcount in the future.

Finally, while this is a labor market newsletter, I saw a few other things in this report that caught my eye. Firms are becoming less pessimistic about future demand for their products, but their assessment of current demand is getting worse. This is a nice encapsulation of how the economy has evolved over the past two weeks!

Additionally, the supply chain crunch created by the tariffs is still getting worse… but firms’ assessments of its trajectory has improved a little:

3. Quits Stabilizing(?)

The JOLTS data has been sending some interesting signals in the last few months. Hiring stabilized earlier in the summer, followed by quits a few months later. There’s no sign of further deterioration, at least for now.

We’re starting to get the same signal from the Current Population Survey. Two sets of researchers track segments of quits from the CPS. Moscarini, Fujita, and Postel-Vinay track job-to-job transitions. These are the least risky quits, and they’ve been stable for a year.

But until recently, we saw quits into non-employment - what I call “high risk” layoffs - still falling. (The researchers who created this metric are Amanda Michaud and Kathrin Ellieroth.) Until recently… when they’ve shown very tentative signs of stabilizing. This is nice independent confirmation of the JOLTS data; I wonder how long it can persist with pressures from the policy side.

The other thing I’m wondering: how do we reconcile stabilizing quits/hiring (good) with an increase in layoffs (bad)? Maybe the Great Stay is ending and we’re headed toward a more turnover-normal labor market.

4. Farewell to Andor

This is a labor market newsletter, so feel free to disregard if you have no interest, but I can’t help going off topic and mentioning that I’m sad the Star Wars series Andor has ended after 2 seasons. It was a masterful political/espionage thriller - even people who don’t like Star Wars might enjoy it. (Also, check out Alan Furst’s novels for a similar vibe.)

Here are two of my favorite sequences from the show: