TL;DR: After previously showing signs of stabilization, hiring and quits have taken another leg down, raising concerns about the health of the labor market. Layoffs still show no signs of rising.

In this recap I talk about:

The Big Picture

The Beveridge Curve

1. The Big Picture

If you know folks who are looking for work right now, you know it’s not an easy time to find a job. But unless you’re in a particularly hard-hit sector like tech or journalism, you probably don’t know a lot of people who’ve been laid off.

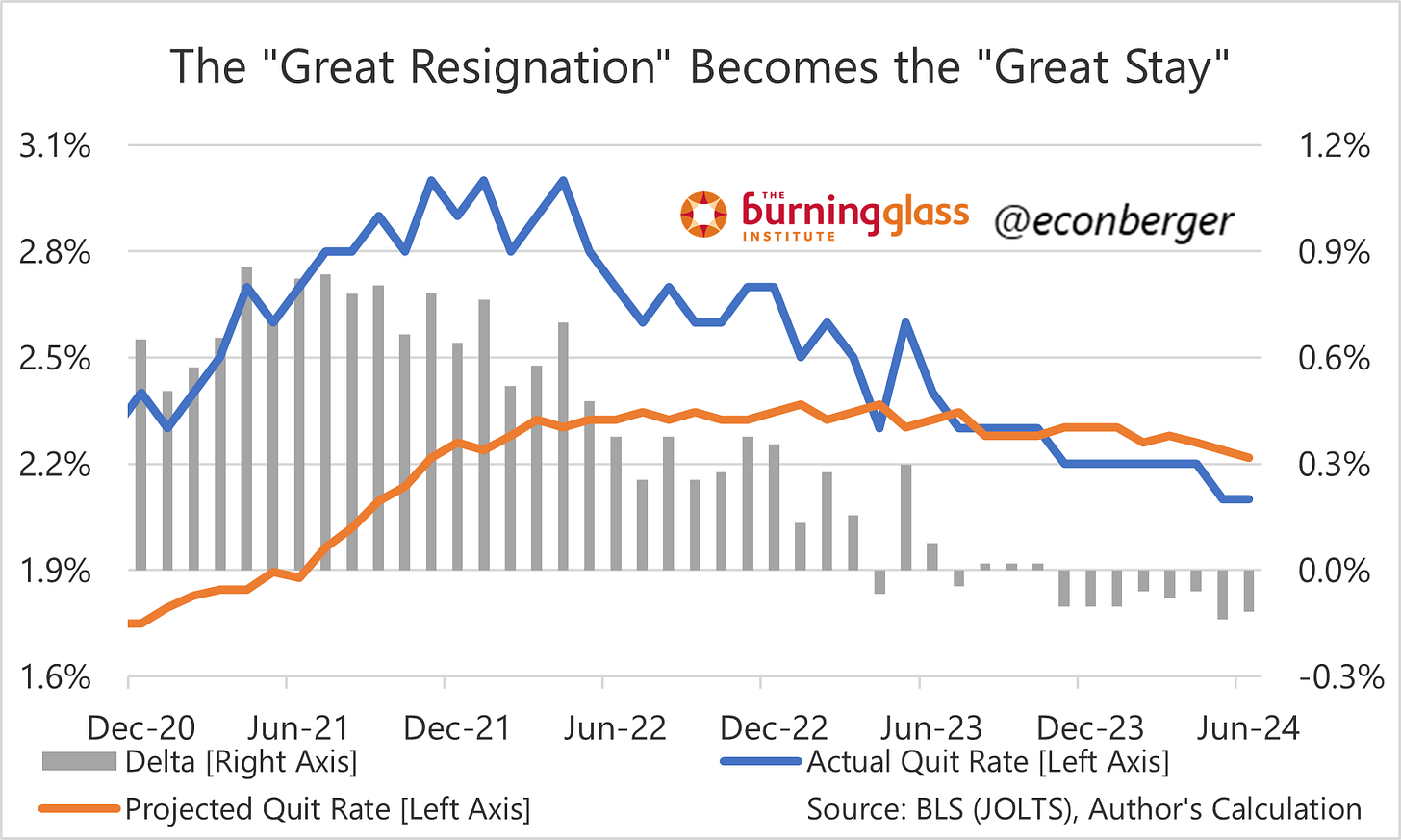

The low hiring, low layoff labor market that I like to call “The Great Stay” has been going on for over a year, but it intensified further in June.

The hiring rate fell to 3.4%, its lowest level (excluding the brief COVID recession) since early 2014, when the unemployment rate was a little below 7%. Hiring volumes are ~10% below where we would expect with an unemployment rate around 4%. This is a tough market for jobseekers!

Folks who already have a job know the truth: it’s slim pickings out there. And as a result, the quit rate is also falling. At 2.1%, it’s back at 2016 levels, when the unemployment rate was a little below 5%.

This would all be a pretty clear picture of labor market cooling, except the layoff rate also declined in June, matching its record low (0.9%). Layoffs are about 25% lower than we would expect given the current unemployment rate.

My guess is the layoff decline is noise - layoffs are just extremely low and stable, but not actually falling. And I put a lot of stock in ongoing hiring and quits declines - if these continue, at some point the job market will buckle and layoffs will increase.

One last big picture item: we’ve seen a massive decline in both hiring and quits over the past year. But net employment growth has moderated only a little.

.

2. Beveridge Curve

The Beveridge Curve is the relationship between job openings and unemployment. The Curve isn’t particularly stable over time - it’s shifted from cycle to cycle - and during the Great Resignation of 2021-22, we were far far above the 2010s Curve.

For the first year of labor market cooling, from the spring of 2022 through the spring of 2023, we experienced an “immaculate cooling” of the labor market - job openings (related metrics, like hiring, quits and wage growth) cooled significantly with no adverse effect on unemployment.

Over the past year, the cooling has become a little more “maculate” - the unemployment rate has crept up (light blue dots) and in general we’re seeing more of that traditional Beveridge Curve downward slope. Cooling the labor market has become more costly.

That said… we don’t need to repeat the large decrease in job openings we experienced in the past two years; there’s no reason we have to keep migrating down and to the right. With inflation now getting much closer to target, it may be the the labor market is close to where it needs to be. Let’s hope the Fed can stick their soft landing!